The translated HTML content is: Let's manage our funds

Yesterday, things went smoothly as per the scenario.

【First Trade of the New Year】Trade on 20190102 (Wed) 【Celebration】

I drew the scenario in advance on the members' blog, and I received reports that they traded based on that and paid off.

The following

The above

There were also large images attached. Thank you very much.

Yesterday, it was exactly the scenario, but, as I always say, there are times when you hit the stop loss.

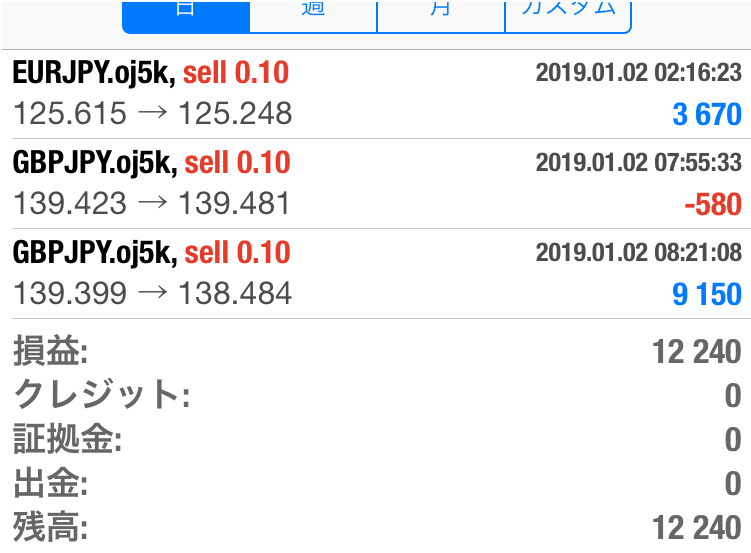

Looking at yesterday's GBP/JPY 5-minute chart, if you place the stop loss above the red line, it seems you could sell anywhere without triggering a stop loss and still make a profit, right?

Because I had already seen the scenario where you sell when it returns to this red line, doesn't it look like anyone could profit?

However, watching the chart move in real time, trading is much harder than it looks in hindsight.

If you miss the entry timing, wait until it falls somewhat, the stop loss width becomes large, and you end up with a stop loss.

Even if you cheat by pre-reading my scenario, it doesn't mean anyone can easily make money.

Practice and getting used to it are necessary.

And the important thing is money management.

Even if you enter and exit exactly the same as me using the same scenario, if you can't manage your funds, your capital can decrease.

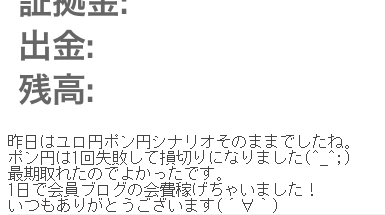

For example, for the person above, 0.1 lots means 10,000 units.

Your account balance should be around 100,000 yen or more.

If you have less capital than that and trade 10,000 units, you're overextending, overtrading.

The calculation is like this:

Trade 10,000 units with 100,000 yen.

If the stop loss is 10 pips, that's a 1,000 yen loss.

A 1,000 yen loss on 100,000 yen is 1%.

If you risk 1% per entry, that is a safe range.

If you can't set a 10-pip stop loss like me and it’s 20 pips instead, the risk is 2%.

A capital management of 2% or less should be fine.

When you hear risk of 1–2%, beginners (who cannot win) tend to think their lot size is too small and that they won't make money.

Then they raise the lot size and self-destruct.

Even if you have a winning method, you lose because you increase the lot size.

Even with a winning method, if you can't manage funds, you can't win, so prioritize money management first.

The person above was trading with 100,000 yen in capital and had a 1% risk.

Total profit was 12,240 yen.

Profit margin is about 12%.

Is it small? It’s an enormous profit margin. It’s a daily profit spike.

“I earned the membership blog fee in one day!”

Even paying one month’s subscription leaves you with change.

Even with a 1% risk, you can still make money, right?

If you think earning 12% in one day is not enough, that is a dangerous way of thinking.

Anything beyond that is gambling. Gambling may win briefly, but you will lose in the end.

Let’s do this not as gambling, but as a solid business.

Related articles:The story of money management

I am on Twitter:https://twitter.com/takashipyo

Trading videos are uploaded:Trading that turned 100,000 yen into 1,000,000 yen