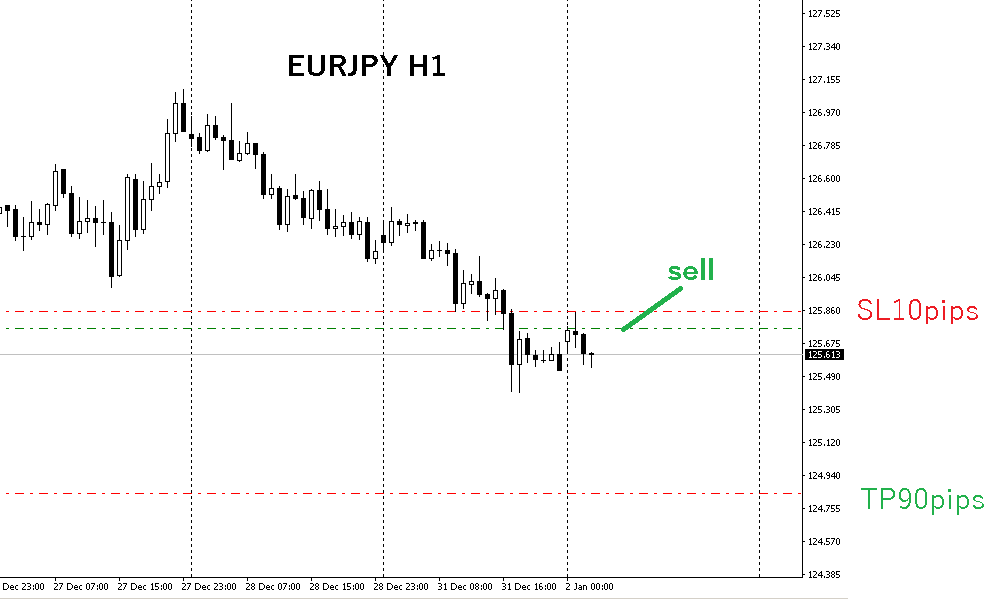

Is the first trade of the new year going as per the scenario?

First trade of the new year is a euro-yen sell entry. The stop loss (stop order against loss) is 10 pips, and the profit target is 90 pips.

Risk-reward ratio 1:9 (risk 10 pips, reward 90 pips)

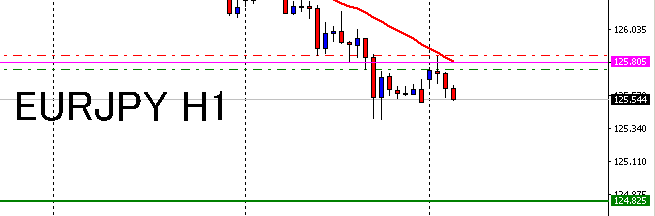

I was outlining a scenario to sell around the pink line at 125.805.

The take profit target is down to the green line below.

I pre-draft scenarios (trading plans) and post them.⇒20180102 Short-term Scenario

Planning in advance is very effective to prevent emotional trading.

Don’t waver over short-term price movements.

For this euro-yen, you would plan to sell around the pink line in advance.

That becomes the scenario.

After that, you just enter when the market moves as per the scenario.

And the important thing is

to think in terms of probability

It doesn’t always mean you will make a profit exactly as planned.

It’s common to incur a stop loss when things don’t go as planned.

In the scenario, we also consider risk-reward.

For this euro-yen, if it hits the stop, you lose 10 pips; if it hits the target, you gain 90 pips.

This trade is just one of hundreds or thousands of trades to come.

I don’t think of it as one single win. Therefore, it’s okay to take a loss.

If you do 10 trades and only 1 nets a profit, that’s 1 win and 9 losses.

Losses are 10 pips × 9 losses = 90 pips

Profit is 90 pips × 1 win = 90 pips

If you win even once in 10 attempts, you’re not overall losing; your money doesn’t decrease.

Of course, there aren’t always opportunities to target 90 pips every time.

The ideal is a risk-reward ratio of 1:3 or betterthey say.

For example, a stop of 10 pips with a take-profit of 30 pips (1:3)

There are many cases where you can aim for this.

Even with a 20-pip stop and a take-profit of 60 pips, the 1:3 ratio is acceptable.

With a 1:3 risk-reward, if you have 4 trades and 1 of them is a take profit, you won’t lose.

Win rate 25%

1 win × 30 pips = 30 pips

3 losses × 10 pips = 30 pips

With a 25% win rate, you don’t incur a loss.

If the win rate is slightly higher, you can win more.

Thinking this way, you don’t need to push to hit every time or force a high win rate.

By pre-calculating like this and outlining a scenario, considering probability, you plan to win overall.

And then, you simply trade calmly according to the plan.

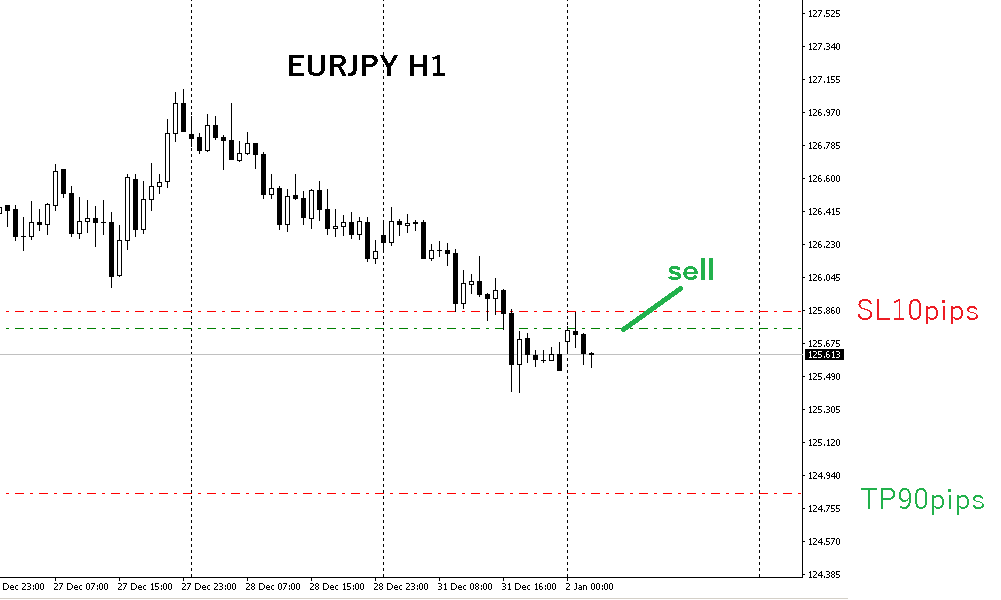

The first trade of the new year.

What the outcome will be is unknown. No one knows. Price movement cannot be predicted by anyone.

The result is uncertain, but if you plan in advance and trade as planned, that’s a nice trade.

Even if this trade ends in a stop loss, since you followed the plan, it’s a win.

Individual outcomes aren’t known, but if you continue this, there is a calculation that you can win overall.

You win because you were meant to win!

I’m on Twitter:https://twitter.com/takashipyo

I post trading videos:Trading that turned 100,000 yen into 1,000,000 yen