[Very Important] A Beginner's Must-See! The Cloak-and-Dagger of Backtesting ~ Part ②

I will continue from the previous chapter.

This time, it is 「When to perform a backtest」.

Even with the same EA and the same settings, backtest results are not always the same.

Because…

“Because swap points are also reflected in the backtest”.

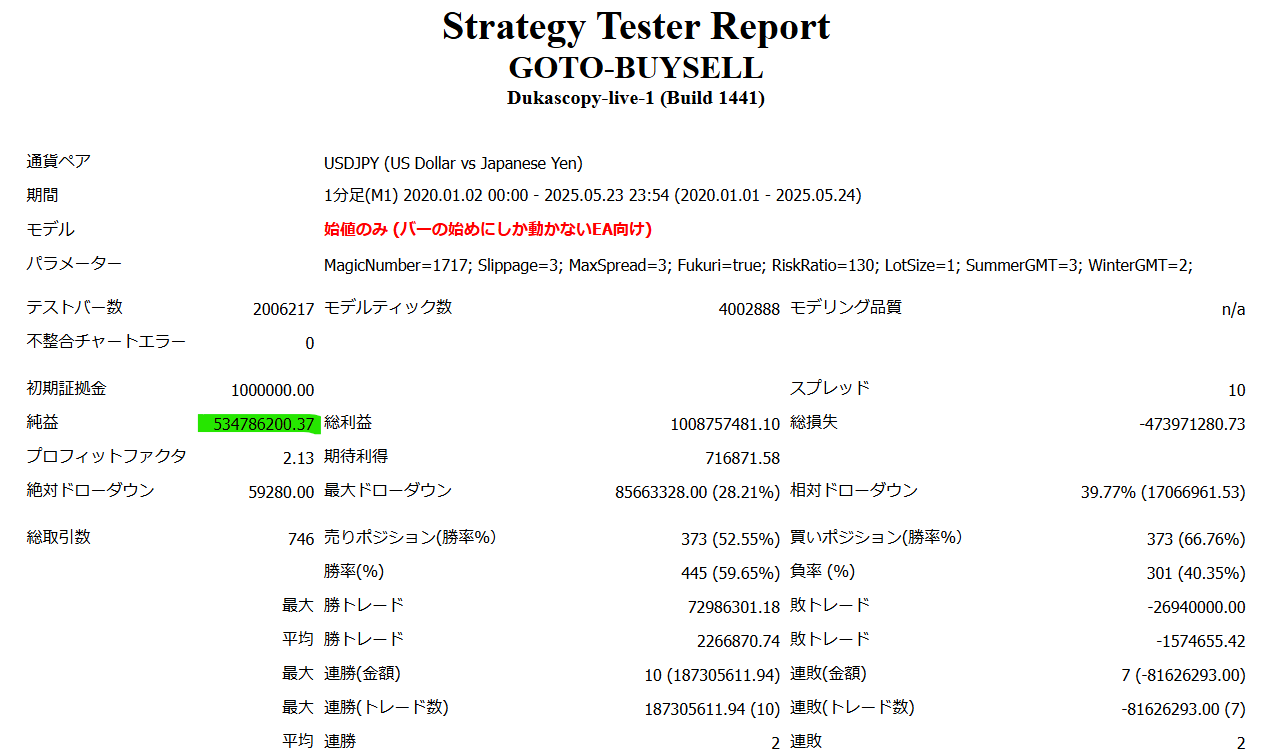

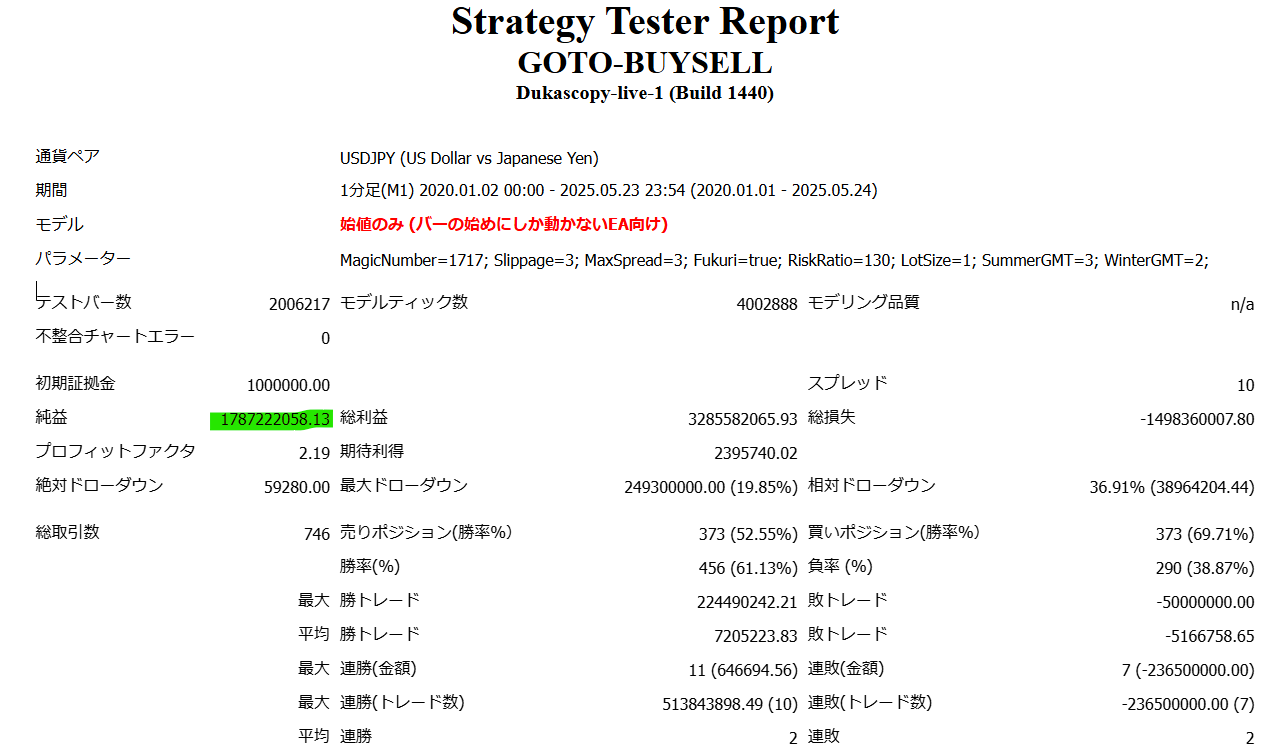

Below is「GOTO-BUYSELL (Goto-to-day EA)」backtest results laid out for you.

All EA settings are the same.

1. Result of backtesting on a day with normal swap points

Net profit → about 530 million yen

2. Result of backtesting on a day with triple swap points

Net profit → about 1.78 billion yen

Even just in net profit, there is such a large difference. In addition, important metrics such as the profit factor, maximum drawdown, and relative drawdown also show better values on the triple-day side, right?

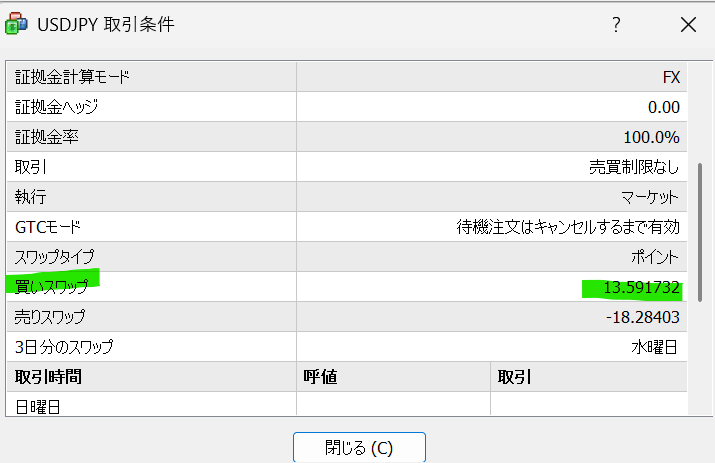

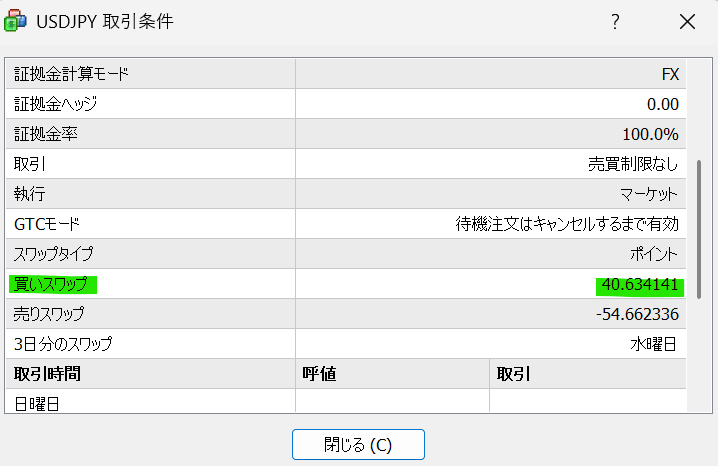

The currency pair properties are as follows, with the left side being normal time and the right side being triple-day.

What I want to say isBacktests should be conducted while avoiding triple-day!.

Also, there are cases where the backtest results are published on the EA product page, but from the surface it is hard to tell whether it uses normal swap points or triple-day swap points. This boils down to whether you can trust the EA developer or not!

To put it bluntly, it can be said that “backtesting on triple-day swaps can make the EA look better.” Please be careful when purchasing EAs!

In addition,some brokers reflect swap points and some do not, so this does not apply universally.Some brokers (especially those providing demo or low-quality data) mayset swaps to “0”, so swap is not reflected in backtests. Please be careful.

When performing backtests, it is recommended to develop a habit of checking the current swap points from the currency pair properties!

Well then, see you next time ✋ I’d like to delve deeper into the mechanics of backtesting for beginners.