Nikkei futures analysis 2025/5/21

Daily

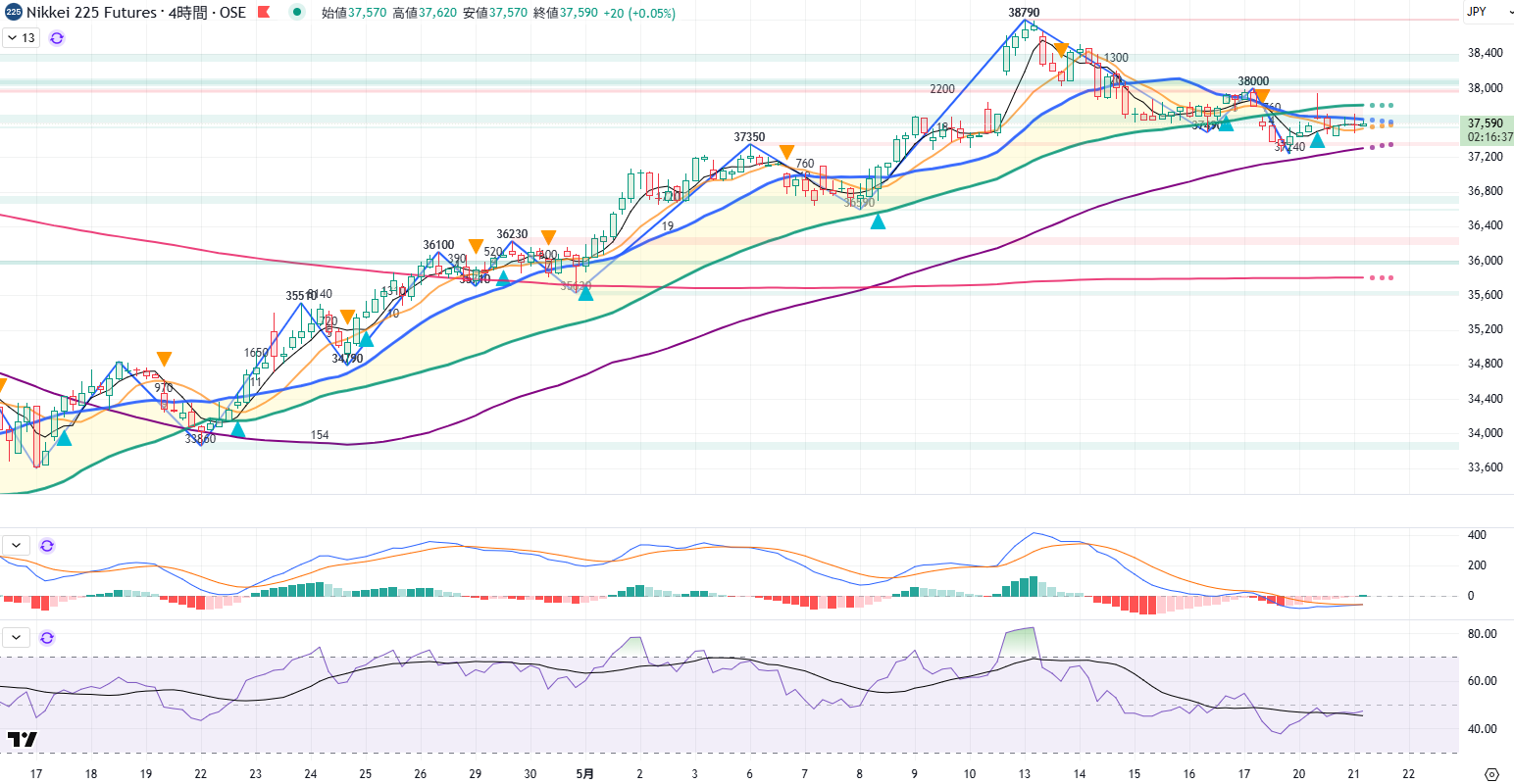

4-hour

1-hour

15-minute

Environment understanding

Daily: Trendless, downward wave, turning price at 38210 for an upward move

4-hour: Downtrend, upward wave, turning price at 37440 for a downward move

1-hour: Trendless, downward wave

15-minute: Trendless, upward wave

Overall assessment

In the night session, price moves within a range: 37440–37710; night close at 37590

On the daily chart, the 100MA at 37400 provides support, but materials are needed to test higher levels

On the 4-hour chart, price ranges between the 249MA and 20MA as it moves upward

On the 1-hour chart, highs are decreasing while lows are increasing in a triangle consolidation

Overall, the environment is not suitable for trading

Since the 15-minute and 1-hour MAs are converging, wait for a strong move in one direction and then follow the direction of that move

If there is a scenario testing around 37800, consider shorting the retrace on the 4-hour chart

Longs based on movement from the recent low around 37240–37300, or short when the 4-hour 100MA definitively breaks below (though a bounce is possible)

Think of it as an image like the above