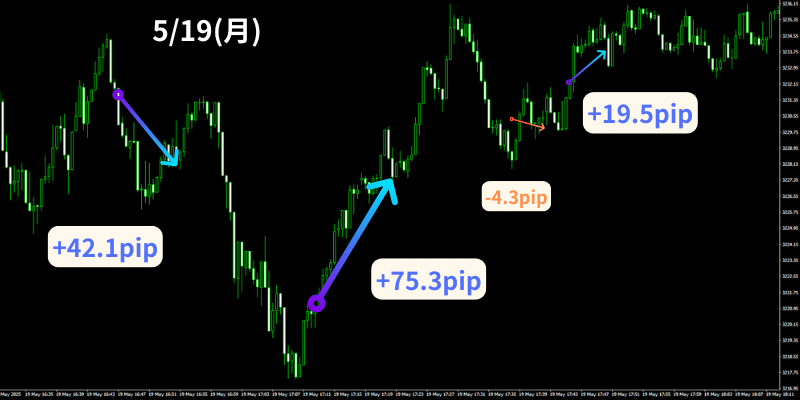

[May 19] 30-second Foot Gold Non-discretionary Scalping Trade Result

Details of 30-second GOLD non-discretionary scalping here

+++++++++++++++++++++++++++++++++

This is the trade from May 19.

There are no particularly notable indicators.

GOLD had shown a downward trend for now, but there is no selling momentum.

Prices did not make lower highs and seems to be forming a triangle consolidation.

And the market opened with a gap of nearly 100 pips at the start on the 19th.

Even in the Tokyo session, highs could not be exceeded, and near the previous high it rebounded sharply, continuing a directionless market.

Last week saw a large drop, so this should be viewed as a period of consolidation range.

In the London market, attempts were made again to push to new highs.

Buying momentum is strong, but it is clear that the resistance is quite firm.

In such a situation, entering in the NY session, the price was also met with resistance at the same point where the entry rule aligned, allowing for a large drop.

And as mentioned, where buying momentum and the buy entry rule coincide, the price rose significantly.

Compared with last week, volatility is higher, and momentum is strong, so prices rose rapidly and a large number of pips were captured.

However, resistance is firm, and after that the price formed a tighter triangle consolidation and became choppy.

Wouldn’t you say it was a pretty good entry point?

To be frank, the result exceeded what one might expect.

However, looking at the long term, it seems the triangle consolidation may break and there could be some movement, so keep vigilance.

Continue to enter according to the rules without discretion.

*********************************