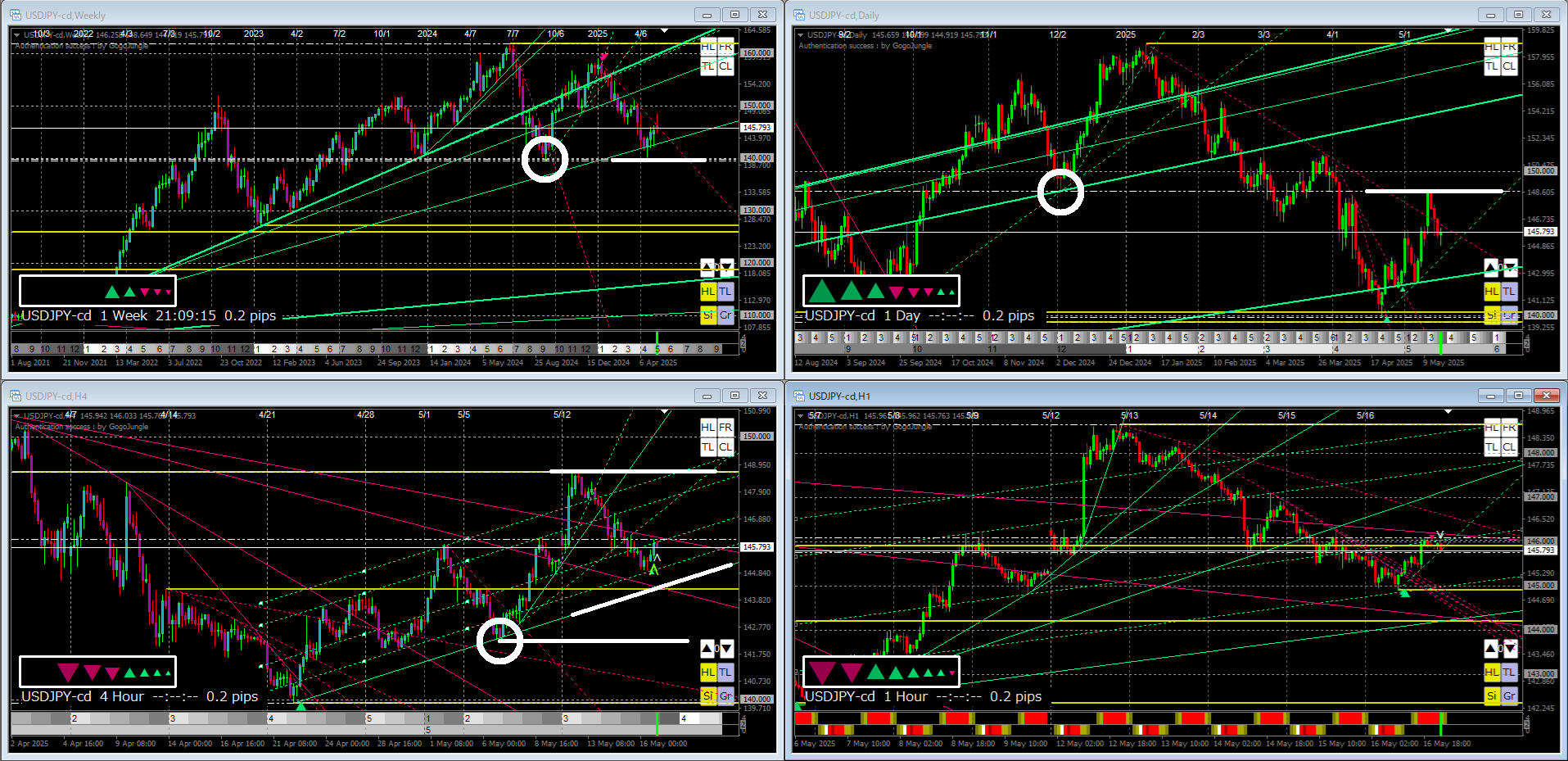

2025-5-12 > 2025-5-16 This week's USD/JPY + Next week's USD/JPY 【Trend Line Pro 2】

A quick recap of this week's USD/JPY.

We prepare a video for behavior verification every week, so first I will paste that one.

【This Week's USD/JPY】

The basic strategy this week was to buy on dips after a pullback.

I felt the upper and lower resistances were strong, so I anticipated limited price movement, but in reality the near-term resistance broke early at the start of the week due to tariff news, and it touched the next resistance without filling the gap in no time.

The precise rebound at the strong resistance area circled by the white circle on the weekly chart gave me the impression that a turning point would come, followed by a strong decline.

On the four-hour chart in the image above, the downward arrow appears, so entering at this timing is the best.

Because there were sharp surges and a gap, there was also a possibility that price would move to fill them, which was a factor suggesting shifting to a bearish view.

Sharp moves and gaps do not always fill, but since the premise was a clean rebound from strong resistance, I felt there was a higher likelihood of testing lower levels more aggressively.

The moves that most market participants notice as strongly perceived tend to directly influence price action, so it is best to ride that momentum plainly.

【Next Week's USD/JPY】

The recent trend is upward, so the basic strategy remains to buy on dips after a pullback.

This week there was a decline that filled the gap after a surge, but as for the next price movement, there is a possibility of moving again in the upward surge direction.

That said, since there is a premise of being knocked down by strong resistance, there is also not-zero chance that it will try lower levels further.

When new lows are made, one should watch for a potential test of the downside in a head-and-shoulders formation.

I have added white circles and horizontal lines at psychologically important levels according to Dow Theory, hoping this will be helpful.

Looking at the lines, it becomes clear that the channel line drawn last week was more effective than expected this week.

To reiterate, channel lines are less effective as resistance than support/resistance lines or trendlines, so do not overestimate them; however, the part currently drawn may still be useful next week.

A more noticeable line has been added with a white line, but I feel it is unlikely to anticipate smaller developments beyond this point.

If your own chart is hard to understand, please assume it would be hard for market participants worldwide to understand as well.

In such cases, price action will reflect that, so it is important not to take action until there is a clear sense of direction.

If the image is small and hard to read, right-click the image and select 'Open image in new tab' to view at actual size.

【How to Create a Channel Line】

A channel line can be easily created by duplicating a trendline drawn with Trendline Pro 2.

Hold the Ctrl key, double-click the trendline you want to duplicate, and then move it without releasing the mouse button to duplicate it.

ーーーーーーーーーーーーーーーーーーーーーーーー

If you found this article helpful, please click below『 Read more』 buttonto let me know.

ーーーーーーーーーーーーーーーーーーーーーーーー