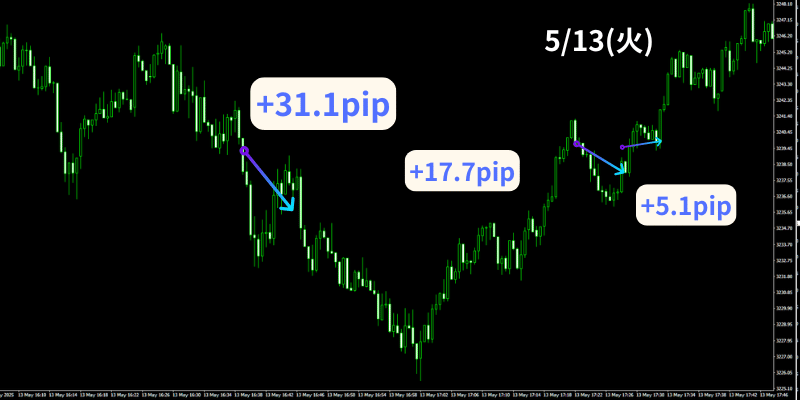

[May 13] 30-second Gold No-Discretion Scalping Trade Result

Details of 30-second GOLD No-Discretion Scalping here

+++++++++++++++++++++++++++++++++

This is the trade from May 13.

21:30

United States: Consumer Price Index (CPI) April [Year-over-year]

21:30

United States: CPI April [Excludes food and energy, core, MoM]

and other indicators are upcoming.

Both importance and volatility are high, so caution is required.

Trades are based on these considerations.

GOLD fell sharply on the 12th, and it was a question of whether it would fill the gap by rising, enter a corrective range, but there was little buying momentum.

How long this range will last seems to be the key.

With a decline in the Tokyo market, rise in the London market, forming a big zigzag into the NY market.

There was not enough momentum to break the previous high/low, and it appears to be moving within a large box range.

The movement is relatively easy to understand, and precisely the selling entries aligned with the ongoing decline allowed for solid pip gains.

The subsequent rebound did not align, and although the number of entries was fewer than usual, it unusually ended without a loss.

This is a fairly rare case and reflects the market; strategy and win rate take into account some losses.

However, this method is without discretion, so to be honest, it’s somewhat of a fluke, so you don’t need to worry too much.

Continue to trade without discretion and follow the rules.

*********************************