The market is thin during the Christmas season. Beware of European currencies!

Trump’s market rally is taking a breather for the year-end session

The big levels for U.S. and Japanese stock prices seem likely to be put on hold for now.

Speaking of Christmas, it is a period when trading volume is among the lowest in the year

and generally investors take a slow, restful holiday.

Domestic brokers will hardly be able to trade.

This year, trading will be unavailable from around the afternoon of the 26th, but

some overseas brokers will still allow trading, especially overseas brokers that handle MT4

where, though becoming rarer in recent years, there are still places open for trading

In particular, be careful about currency moves of European currencies (the pound) late on the 26th midnight.

Surprisingly, every year during the Christmas break the pound moves about 500 points and there is a back-and-forth motion, and this year especially

in the currency market, since exiting the EU made the forex market the protagonist

for domestic brokers, rates won’t move, so it’s safe, but

if you are using overseas brokers with Christmas-trading-enabled accounts, just watching the rates can be

very entertaining!

From the 12/20 blog post

From after Christmas, overseas players will have free rein! With a 1-minute chart, trades are OK regardless of market conditions!

Dollar buying continues.

Japanese and U.S. stock prices won’t reach the big level and will likely

head into Christmas like this.

Since passing the U.S. presidential election, the market has moved into a one-sided trend toward year-end

and it seems the overseas players will bring a stormy market after Christmas.

However, this year’s year-end and New Year’s holidays will see relatively few Tokyo traders

so the post-Christmas start will be a take-off-from-now-then situation.

Now, many fund players are not participating in this Trump rally

so for this to become a truly genuine market, these aspects are the focus for the future.

Even in year-end markets, if you mainly scalp, you can surprisingly

capture gains in such conditions!

The Shadow Man released this month is already signaling on the 1-minute chart!

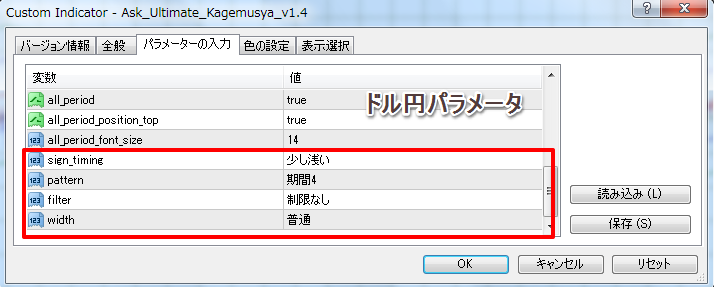

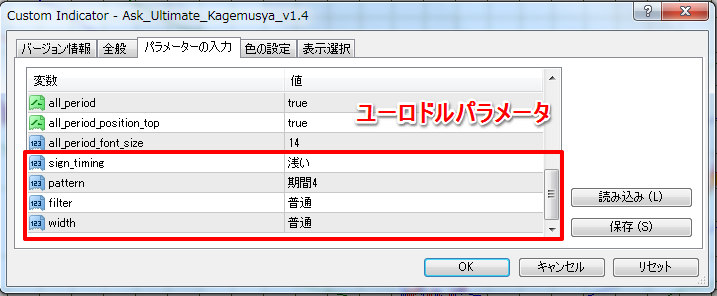

Shadow Man requires careful parameter settings, but

mastering this will allow you to handle any market

it will turn into a full-fledged indicator!

Tomorrow, I would like to update the Japanese and U.S. stock outlook, but

there is an enormous signal......

On 12/19 the European and NY markets. By adding RSI to the Askometer

it becomes even easier to catch the timing.

From the 12/21 blog post

Are the Japanese and U.S. stocks at 20,000? Dollar/Yen at 120? Will it happen? A huge signal for the Shadow Man that supports CFDs!

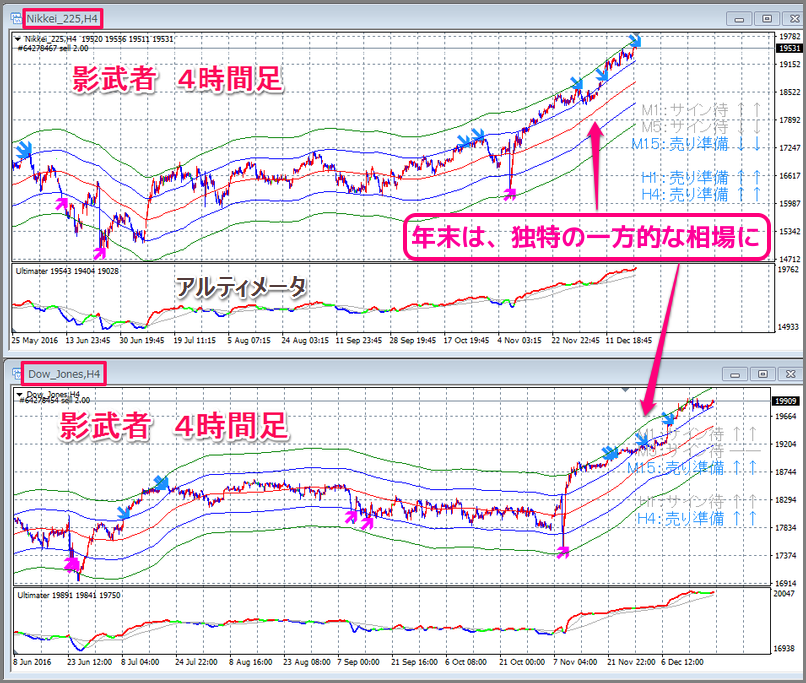

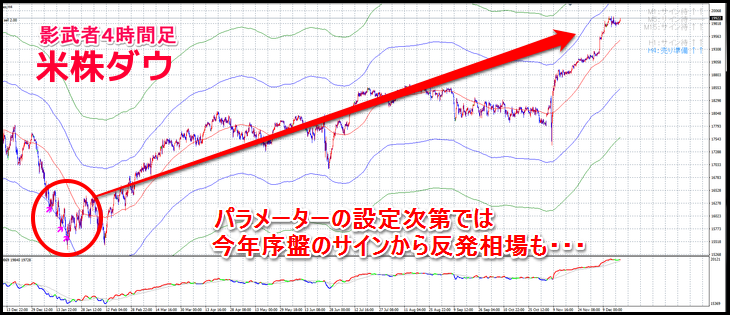

Continuing from yesterday, today we chart the Nikkei stock average and Dow using

the Shadow Man to push up the charts!

In CFDs, price movements tend to be more volatile, so trading on a 15-minute chart will likely be the main method rather than the 1-minute chart shown yesterday.

However today I opened up the most recent price movements on a 4-hour chart.

Here, the trick is to use a wider original band for the five moving lines!

Also, the original algo developed this time, the Ultimeter, is thriving in this major market,

and it can be set with up to eight levels of parameters.

We’ll discuss this in more detail next time,

and both the Nikkei and Dow have signals at best points up to the U.S. presidential election.

This month, of course, the market is one-way at year-end

and ultimately we’re waiting for changes in the Ultimeter.

For purchasers, rather than limiting yourself to one currency and tuning parameters

you can set parameters in advance and enjoy finding currencies that produce timely signals,

and if the currencies can be displayed in MT4, that would be ideal,

as Shadow Man’s strengths would be showcased for those currencies.

If you widen the bands further with parameter settings, you may encounter an extraordinary market...

Ask Ultemate MAX promptly signaled a major crash of the Pound-Yen!

★ Campaign price 22,800 yen until 1/4! (Regular price 34,600 yen)

Ultimate strength-weakness market sensing and perfect timing for exits!

★ Campaign price 14,800 yen until 1/4! (Regular price 19,800 yen)

The strongest version of the Ask series!

★ Campaign price 22,600 yen until 1/4! (Regular price 29,800 yen)

Detects signs of a major market reversal and teaches you precise exit timing!

★ Campaign price 12,800 yen until 1/4! (Regular price 14,800 yen)