[BO攻略] Merits and demerits of discretionary trading

Hello!

This is Kaori Takada, a housewife trader with 7 years of investing experience (*´∀`*)

Usually I run a blog called “Even beginner housewives can do it! Binary options攻略 Blog,” and I also write articles here at Gogojungle and sell my攻略 methods^^

※ Thanks to everyone, the攻略 methods ranked 3rd and 4th in the “e-book 1-month ranking”!

I would be happy if I could help as many people as possible ^^

Up until now I have earned profits solely through discretionary trading (trading by evaluating the market myself and entering) ^^

There were times I relied on tool trading in the past, but“Can I continue to earn with this in the long term?”I had doubts about that, and ever since I have been polishing my own trading skills (^_^)

Now I can consistently make profits of 600,000 to 1,000,000 yen per month, and I have realized how important it is to develop my own skills to“obtain a sustainable and stable income”.

In this series, I will introduce one by one the“Knowledge and skills necessary to win in discretionary trading”that I have cultivated^^

I sincerely hope that as many people as possible become independent and able to earn steadily in binary options (*´∀`*)

This time I would like to talk about the advantages and disadvantages of discretionary trading, which I personally recommend the most ^^

As you may know, binary options are investments where you predict a binary up or down movement, and if your prediction and the market direction match, you earn a profit (^_^)

To predict that binary up or down movement, you read price movements using charts and trade with your own ideas and reasons about which direction is more likely to move in the future—.“Discretionary trading”is what that is ^^

In other words, your decision to trade or not is firmly grounded in your own reasoning.

This is extremely important when engaging in discretionary trading (^_^)

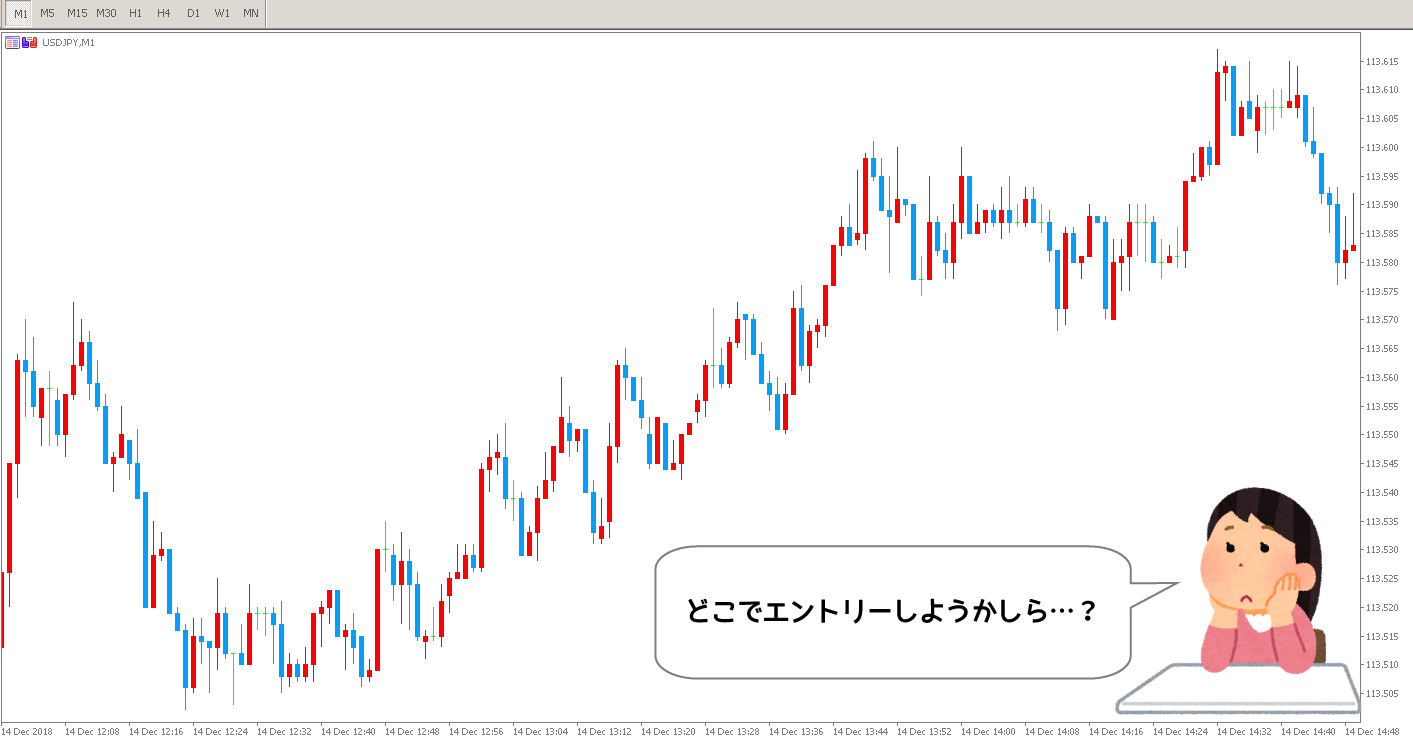

If this thinking isn’t solidified, when you actually open a chart and try to trade, you may …

↑ You can barely tell that the price is moving upward, and you end up hesitating about entering, or you may not even be able to distinguish whether you should trade at all ^^;

As a result, you may rashly enter due to vague judgments or lose without understanding why, which could increase the chance of losses (;´Д`)

Trading with vague judgments is, in a sense, gambling left to luck to decide win or lose.

As long as it’s gambling, you may win temporarily, but sustaining results is difficult, and you are very likely to eventually burn through your precious funds—don’t forget this “wasteful situation”!

Next, I will explain concretely what it means to have your own “thoughts and reasoning.”

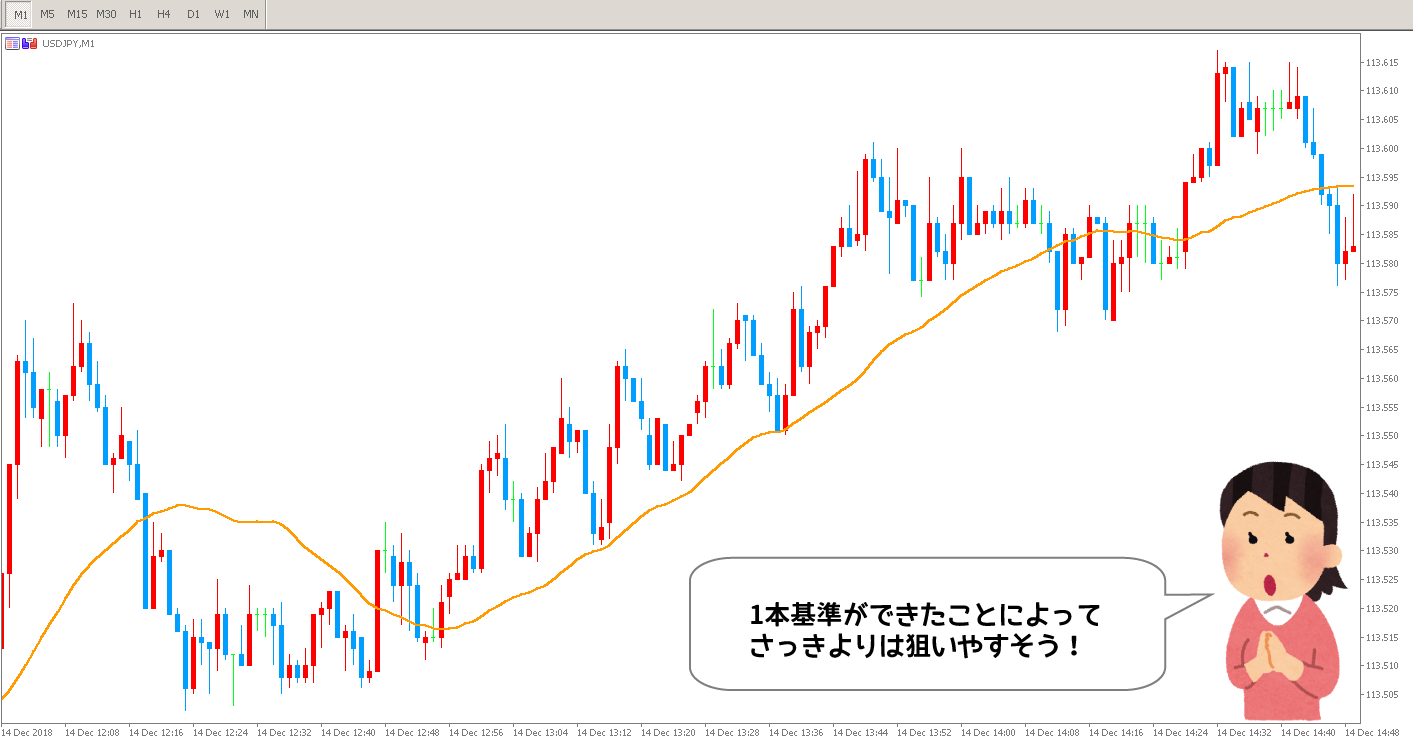

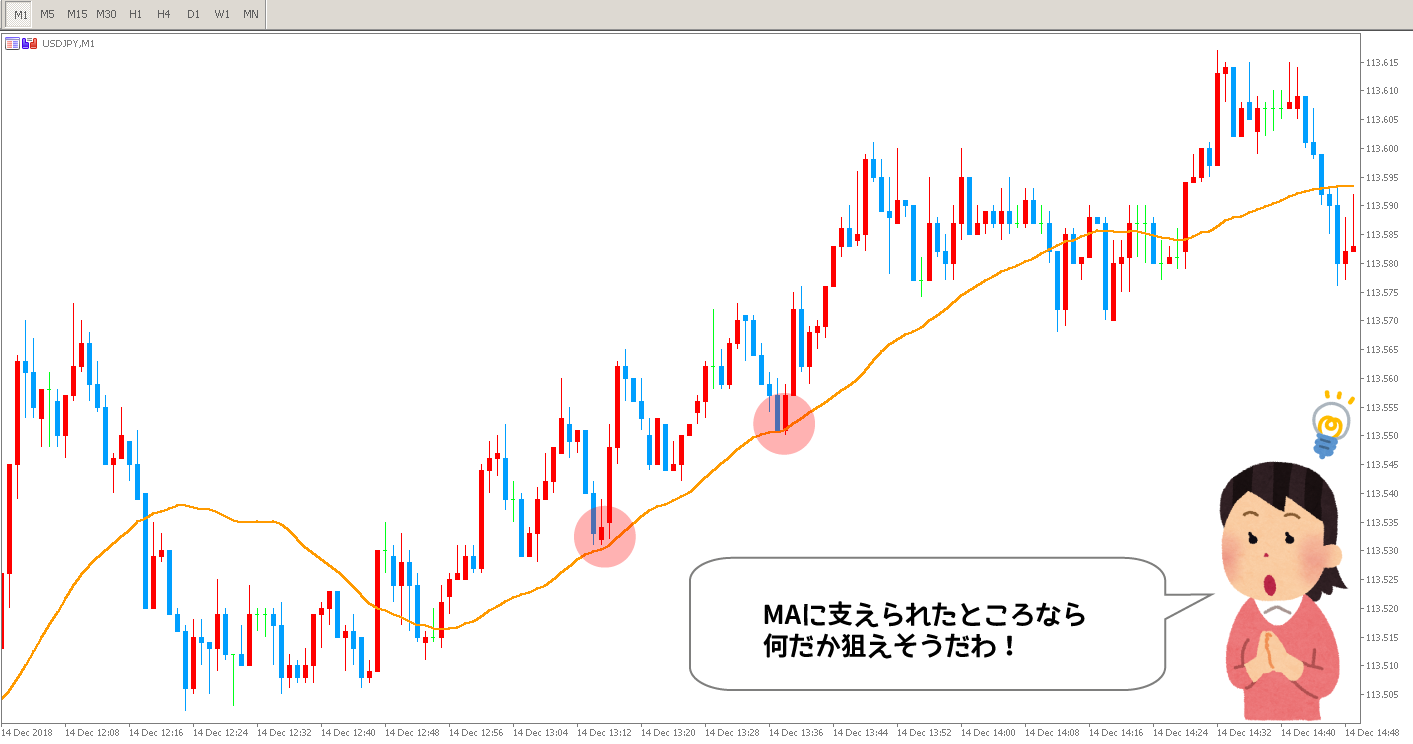

Earlier I’ll show one moving average line (SMA) that I also rely on, just one, this time

↑ Up to now you could tell only that it was moving upward roughly, but once you display a single moving average to establish a baseline, it makes it more credible that the market is moving upward, doesn’t it ^^

Next, with just a bit of knowledge about moving averages, you should naturally see what points to target in this situation ♪

In a scenario with a clear direction like this, you can increase your chances of winning by aiming for a rebound (pullback) that is supported by the MA and then resumes upward movement—one of the famousGrandville’s law!

Based on this point, to articulate my own‘thoughts and reasoning’more concretely,

When the market is read as rising by the MA, I aim to enter at a pullback where the upward momentum strengthens again.

This is (^_^)

If you have this kind of thinking, you trade when market conditions meet the criteria. If not, you do not trade.This makes it clear whether to enter or not.It becomes possible to clearly distinguish trading decisions, improving consistency ^^

Being able to tell whether you trade or not means you stop making trades based on vague feelings, and after a trade you can assess its quality with a clear standard (*´∀`*)

Being able to decide to trade or not means you understand why you entered at that point.

In other words, after reviewing the results, by comparing with your own decision materials you can identify“good points and bad points”more easily (^_^)

As a result, after finishing a trade you may think

“I don’t know the reason for the loss”

“What should I do next…?”

This kind of uncertain situation that prevents you from finding improvement can be avoided, and you can decide for yourself how to proceed in the next trade (^_^)

The more you trade and accumulate experience, the more it leads to your own growth.This isthe biggest merit of discretionary trading!

If you consistently replicate the reasons you won in the next trade and avoid repeating the reasons you lost, your loss avoidance frequency will increase and your win rate will rise, you can imagine (^_^)

However, this discretionary trading, once you master it, will undoubtedly be a skill that lasts forever, but there are also disadvantages such as (^_^;)

- It takes time to learn

- The quality of reviews and understanding affects how long it takes to master

- It’s hard to grasp the whole picture because systematically organized information is hard to come by

Thus, many people have the preconception that “discretion is difficult,” and it takes some time to acquire market analysis techniques.

That said, it’s not that beginners can’t do it or that experienced traders can do it easily! (^_^)

I believe it comes down to how seriously you want to acquire the knowledge and techniques to earn consistently in binary options and whether you can create an environment capable of supporting that goal.

It’s certainly not an easy path, but the world of investing isn’t so forgiving that you can get rich easily.

If this serves to spark even a little more interest in discretionary trading, I would be happy too ♪

To study discretionary trading in a structured way, I created a guidebook titled Binary Options攻略法【3-count Strategy】(^_^)

This攻略法 is designed for those who want to seriously acquire the knowledge and techniques to earn consistently in binary options. The PDF file not only explains trading techniques but also“the mindset to become a professional trader”without omitting details (^_^)

It covers trading techniques (trading process), money management, and the foundational knowledge, providing a guide for beginners to experienced traders, so I’d be glad if you take a look (*´∀`*)

※For details of the 3-count strategy, please check the product page description m(_ _)m

Binary Options攻略法【3-count Strategy】— download pages for each guide

●【Foundation Volume: The complete guide for investment beginners / Essential basic knowledge for BO】 2-volume set (136 pages total) →Free download page

●【Introduction Volume: Market principles / Overview of trading strategies / Survival strategies】 2-volume set (109 pages total) →Free download page

●【Intermediate Volume: Practical trading process / Growth strategies】 2-volume set (208 pages total) →Paid purchase page

●【Advanced Volume: Self-solve / Independence / Revenue strategies】 2-volume set (348 pages total) →Paid purchase page

●【Foundation to Advanced Volume】 All 8 volumes bundle (809 pages total) →Paid purchase page

245 pages combining Foundation and Intro volumes are freely available, so please start with those and consider purchasing the Intermediate and Advanced volumes next.

Also, here is the blog I run ♪

I publish information that can help those who are starting binary options or who are struggling to make profits, so feel free to drop by (*´∀`*)

● “Even beginner housewives can do it! Overseas Binary Options攻略 Blog”