【Note: Cumulative views surpassed 1000!!】A highly popular article currently公開中, now on a special release!

Note has been very well received. "【FX】Towards the end-of-month London Fix (London Fix): Is the Pound more likely to be bought?" I would like to publish this article here as well.

Hello, this is Sabecks. I usually trade USD/JPY with discretionary trading and automated trading to earn.

Yes, as the title says, this article will report the results of verification on the logic that the Pound tends to be bought toward the end-of-month London Fix (hereafter, the London Fix).

Reading this article will make late-night end-of-month trading more enjoyable! (probably)

First of all, a preface. This article is a paid article.

Yes, you just tried to hit the browser back button, didn’t you.

If it were me, it would be a browser-back case.

In this article, I will cover the London Fix results within the free article scope. Then, I will make the parts I have devised from the results that can earn money paid content.

Therefore, please read at least the free results. I will write to ensure the free portions provide valuable information.

If you don’t mind, please join me.

First, what is the London Fix?

I will explain from there.

London Fix isthe time to set the reference rate for clients, which in Japan is called the Nakamura-rate.

In Japan, the Nakamura-rate is at 9:55 AM, but for the London Fix, the London time is 16:00, which in Japan is0:00 during British Summer Time and 1:00 during Standard Time.

At this time, there is a tendency that the Pound is bought toward 0:00 (1:00 in winter time).

Reason:

It is said that because the base rate is high toward the end of the month when Pound buybacks tend to cluster, the banks can accept customer Pound buy orders at higher prices, so a rise in GBPUSD before the month-end London Fix occurs (various theories exist).

That seems to be the idea.

Well, I understand it as something like dollar buying toward Nakamura-rate around Goto Day in Japan.

Yes, this is a famous logic, but will it really be accurate? Can you really win?

Aren’t you curious? I am extremely curious.

So, I used MT4 to backtest past data.

This logic is about Pound being bought, but the test was done on GBPUSD. I will also discuss GBPJPY later, so please stay tuned.

The method of verification is

Summer time: enter long at 23:00 and execute at 0:00

Winter time: enter long at 0:00 and execute at 1:00

I simply tested the theory that if Pound is bought at a certain time, entering long will win.

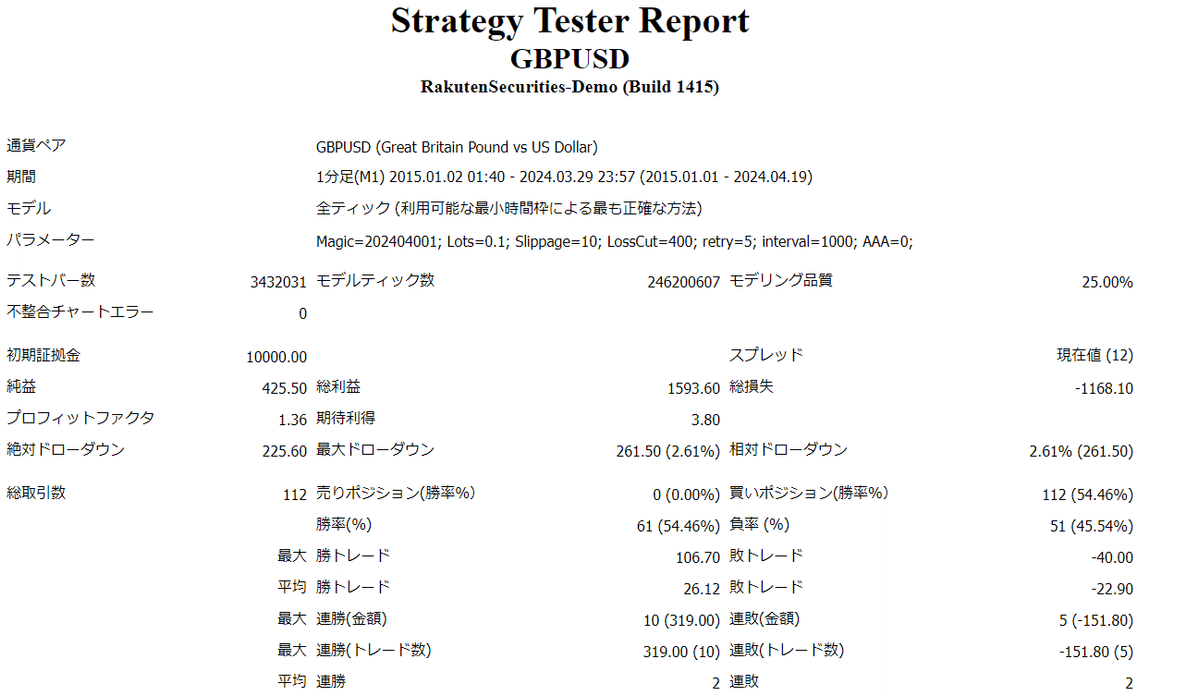

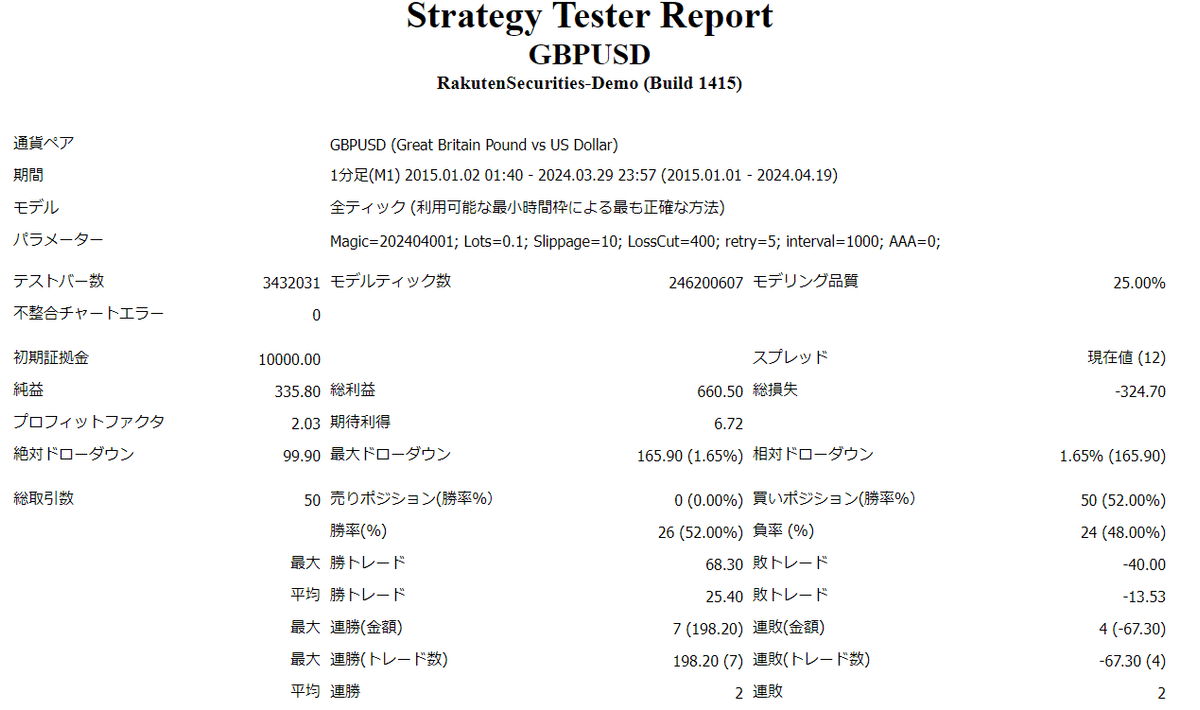

It may be hard to read, so I will excerpt.

Profit factor, i.e., how much profit per loss, is1.36

Win rate54.46%

.

I consider a practically useful EA to have a profit factor of at least 1.25 and a win rate of at least 55%, so although the win rate is slightly below, I believe it is still practically usable.

If you think about it, a win rate above 50% suggests a tendency for Pound to be bought (though it feels a bit borderline).

And a reasonably high profit factor with a decent win rate suggests that when buying at this time, there could be a wide price move upward, a hypothesis that emerges.

In other words, I thought that people would buy Pounds toward London Fix, and when buying occurs, it becomes a strong up-move.

Let’s also look at the graph.

From the graph, you can see there was no trend around 2015, but afterward, the logic was valid for a period, and now it is honestly only marginally applicable, in my reading.

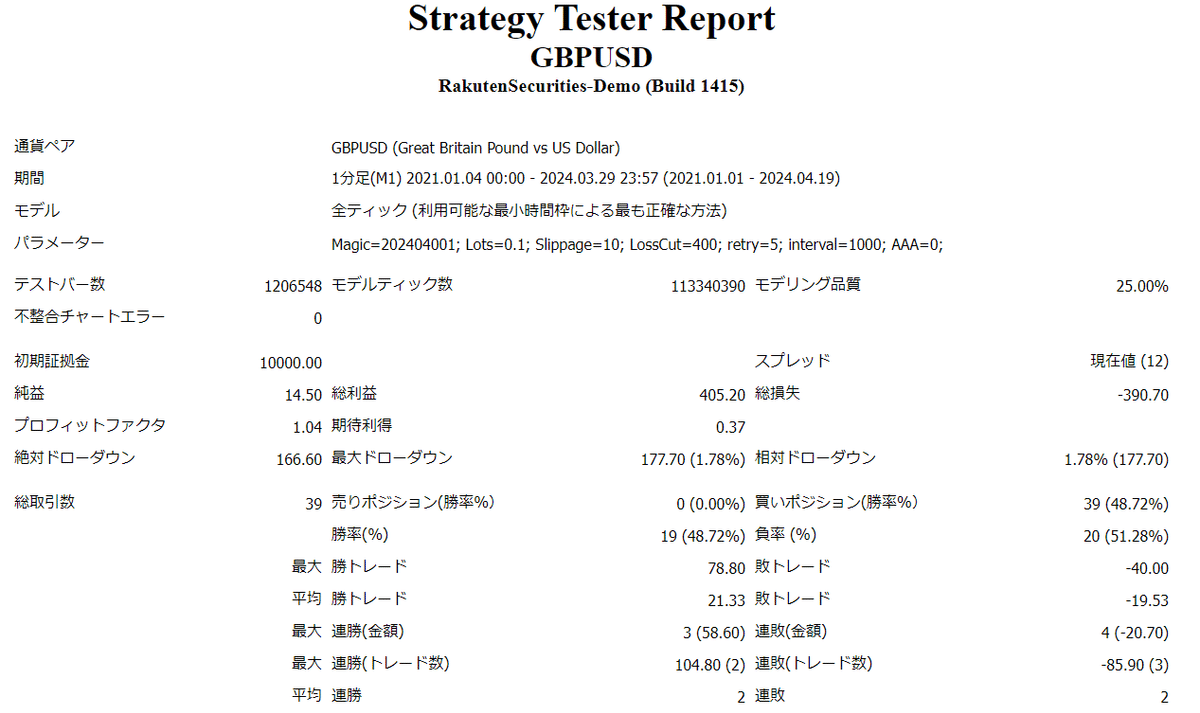

Since the current period is marginal, let’s look at data from 2021 onward rather than from 2015 for clarity.

I will excerpt.

Profit factor is1.04.

Win rate is48.72%

Here is the graph.

Yes, both the profit factor and win rate dropped sharply.

Honestly, these figures are no longer a winning logic.

In other words, the logic that Pound buys toward London Fix was valid in the past during certain periods, but now it is a logic that cannot be used.

That seems to be the conclusion, but wait a moment—

I know a similar case with USDJPY on the Goto Day.

The Goto Day logic also remains somewhat favorable but is fading.

However, if you keep digging persistently, you will find that by applying certain conditions, you can still win with the Goto Day logic.

Thus, even for end-of-month London Fix, there are cases where adding new conditions can make it a winning logic.

Why is that? This is my hypothesis: in the past, simply entering one hour before and waiting for execution would win, but as many did this, the market became more competitive, so you need to add conditions or introduce refinements. I think that’s why.

So, for this London Fix logic, what conditions should be added and what refinements should be made to still win today?

Yes, this is where, unfortunately, it becomes paid content (´∀` )

How has it been so far? I hope you found it interesting.

A little more.

I achieved the following accuracy with an EA by adding certain conditions.

I will excerpt.

Profit factor is 2.03. Win rate is 52.00%.

The graph is shown below.

Let’s consider.

By adding certain conditions, the profit factor exceeded 2. In other words, profits exceeded losses by more than double.

And the win rate. Unfortunately, the win rate is 52.00%, which is low (orz).

But look at the graph.

Around 2015 there was no clear trend and it showed losses, but recently it has been rising on the right.

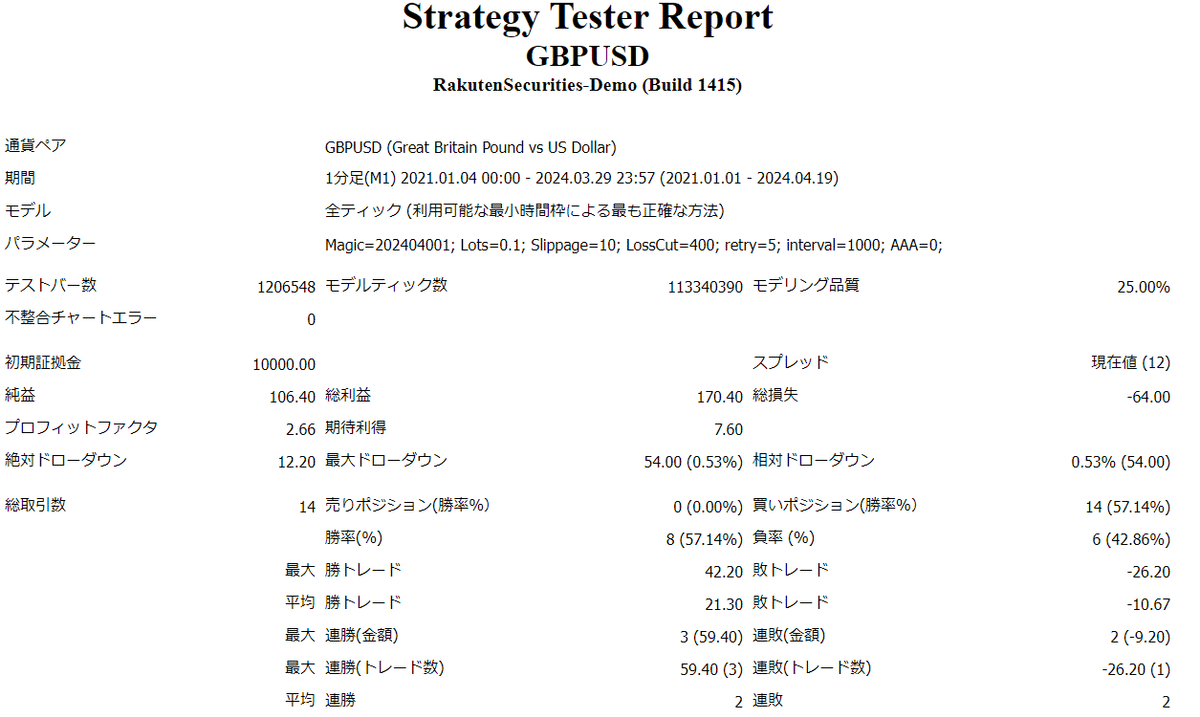

For clarity, let’s look at data from 2021 onward.

I will excerpt.

Profit factor is2.66.

Win rate is57.14%。

The graph looks like this.

Yes, the latest results look good.

In other words, by adding certain conditions, the logic can be made to win today.

Now, hmm, interesting.

But wait, data size! The data count has dropped sharply, so is it overfitting? wondered someone.

If you’ve read my article this far, thank you!

If I were the reader, I would ask that kind of question.

So, let me share my thoughts on that as well.

Overfitting is when you attach too many conditions to raw data when validating, so the accuracy increases, but in the live environment the conditions that existed in the raw data don’t exist, and you lose in tests or real trading.

Yes, overfitting is not good.

However, during my university days, while researching with a professor, I learned that attaching conditions and adjusting values to achieve high precision can sometimes yield meaningful laws or numbers in the real world.

So, overfitting does not automatically equate to bad.

It’s not as simple as saying overfitting is bad.

Well, the idea is to separate validation data from data used to obtain accuracy to avoid overfitting, but I’ll skip that here.

Yes, I’ve digressed, so let me return.

Whether my verification results have caused overfitting may or may not have done so.

I don’t know.

That’s my answer.

I believe forward testing with EA and discretionary trading will reveal this later.

However, the added conditions I used are in line with common FX thinking.

So, rather than data fitting, I think the market’s simple uptrend in Pound buying is shifting the FX trading norms (refinements).

In other words, what I proudly publish as paid content is basically common sense.

Yes, you don’t have to force yourself to buy it (´∀` )

When entering long in FX, the things a trader typically watches are.

This is the story of achieving accuracy by adding those conditions.

Therefore, if you want to check the answers, or if you find the article interesting enough to buy, please do.

Also, when reading my paid article, if you plan to build an EA, I recommend building it properly rather than a quick, simple version, and I think applying this London Fix logic more to discretionary trading would be better.

This has become long, but here is my conclusion!!

There is a tendency for Pound-dollar to be bought toward London Fix!!

However, since the market is now more sophisticated, if you trade in long positions you should pay attention to the usual prudent points to earn money (probably).

The good thing about the London Fix logic is probably that when it moves on the buy side, the price range can be reasonably wide (hence the high profit factor).

So, why not try discretionary trading GBPUSD during the London Fix to earn?

I’d like to end neatly here, but wait, isn’t Pound Yen showing the same tendency if Pound is bought?

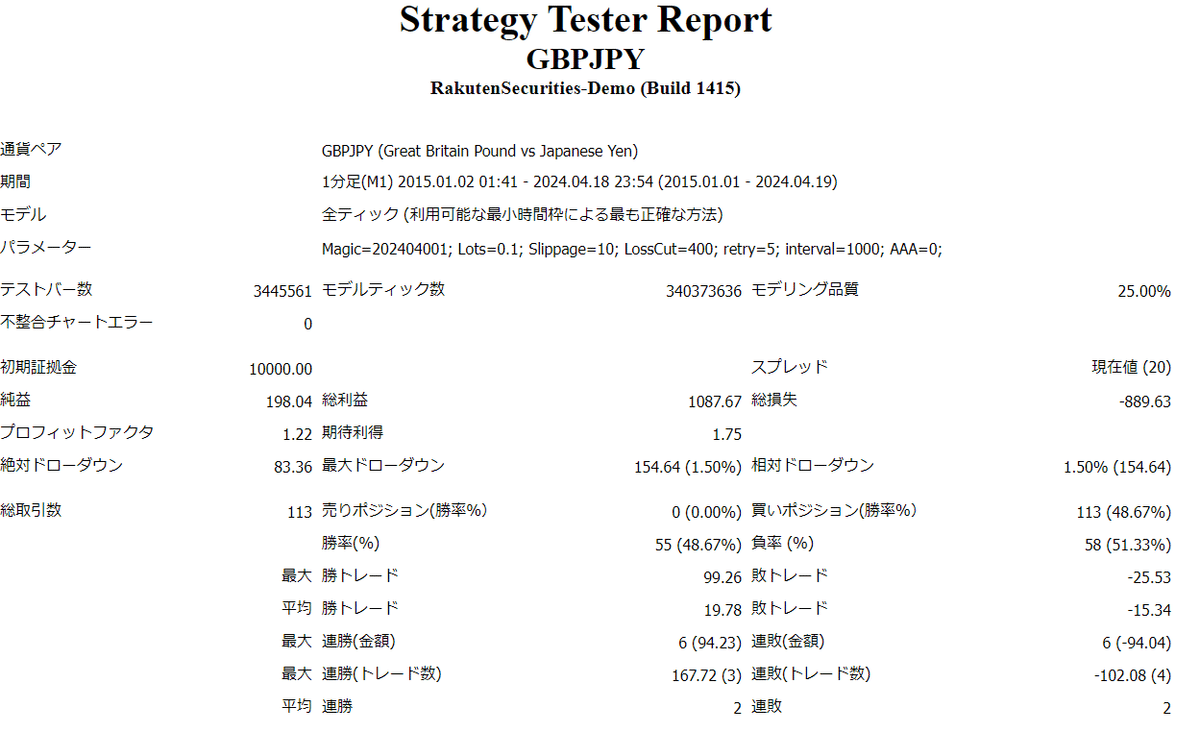

For those who are curious about Pound Yen’s tendency and find GBPJPY more appealing than GBPUSD, I’ve added GBPJPY results below as free content to end the free portion.

Thank you for reading up to here.

Profit factor: 1.22

Win rate: 48.67%

My conclusion is that if you’re going to take a risk, it’s better to trade GBPUSD rather than GBPJPY.Yes, the free portion ends here.

Thank you for reading.

The paid portion simply covers very common things, so there’s no need to force yourself to buy.

If you’re willing to pay 500 yen for this article, please purchase it.

Well, holidays are quiet, aren’t they? I hope everyone finds it enjoyable and meaningful.

Well then, I will write more articles if I find interesting topics again.

If you could like or follow, I’d be happy.

See you again