[April 23] 30-second GOLD non-discretionary scalping trading result

Details of 30-second GOLD discretionary-free scalping

+++++++++++++++++++++++++++++++++

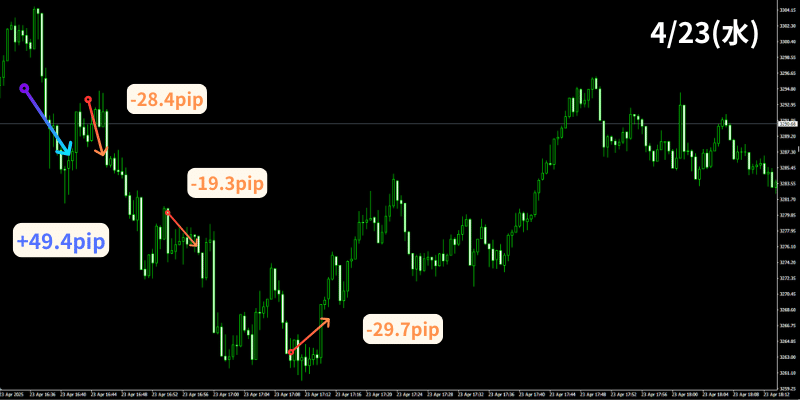

This is the trade on April 23.

22:45

US PMI (Purchasing Managers' Index - Flash) April [Manufacturing PMI - Flash]

US PMI (Purchasing Managers' Index - Flash) April [Non-Manufacturing PMI - Flash]

US PMI (Purchasing Managers' Index - Flash) April [Composite PMI - Flash]

23:30

US Weekly Petroleum Status Report 04/12 - 04/18 [Crude oil stock - Week over week]

US Weekly Petroleum Status Report 04/12 - 04/18 [Gasoline stock - Week over week]

etc., there are indicators with high volatility and importance, so caution is needed during this time period.

Trades were made with that in mind.

The 23rd began with nearly a 300-pip gap opening.

It rose once to fill the gap, but then quickly fell.

It initially found support at the previous low, but the downward momentum was strong and it fell further, entering the NY market.

Among the big drop, long bearish candles stood out.

Even one 30-second bar yielded several tens of pips.

However, several counter-trend attempts led to a losing streak, with back-to-back losses afterward.

Losses exceeded the gains from the earlier pips, resulting in a net loss.

I had feared this would happen someday, but the volatility remains high; wins are large, but losses are large as well.

.

This trade underscored the importance of risk management and proper lot sizing.

Although the price pulled back, it is unclear whether a trend reversal will occur from here or if it will rise during a pullback, so let's monitor future movements.

From now on, we will continue to enter trades in a disciplined, dispassionate way.

*********************************