An orthodox EA that embodies the user's ideals 'Angel Heart LONO'

Multi-logic EA with annual average trades exceeding 700

"Angel Heart LONO"

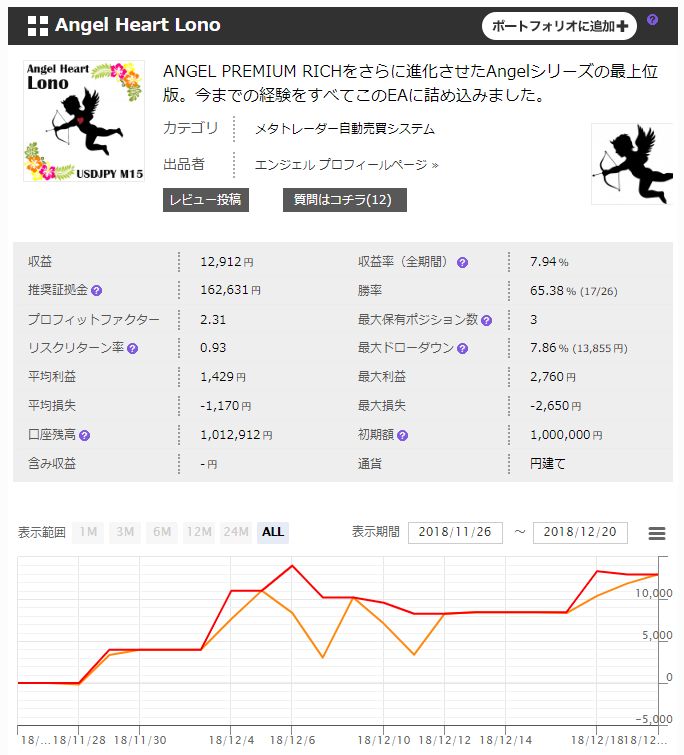

[Angel Heart LONO Overview]

Currency pair: [USD/JPY]

Trading style: [Scalping][Day trading]

Maximum number of positions: 3; Others: Lot size can be set freely

Timeframe used: M15

Maximum stop loss: 100

Take profit: 20 (configurable. Depends on the number of positions)

Packed with all features users want, and the performance is the best ever

"Angel Heart LONO"

In just two days since release, sales have surpassed 100 copies—a highly anticipated EA!

For details on the product's performance, the sales page has details, so in this article we will guide you through the backtest expected annual return and trade visuals.

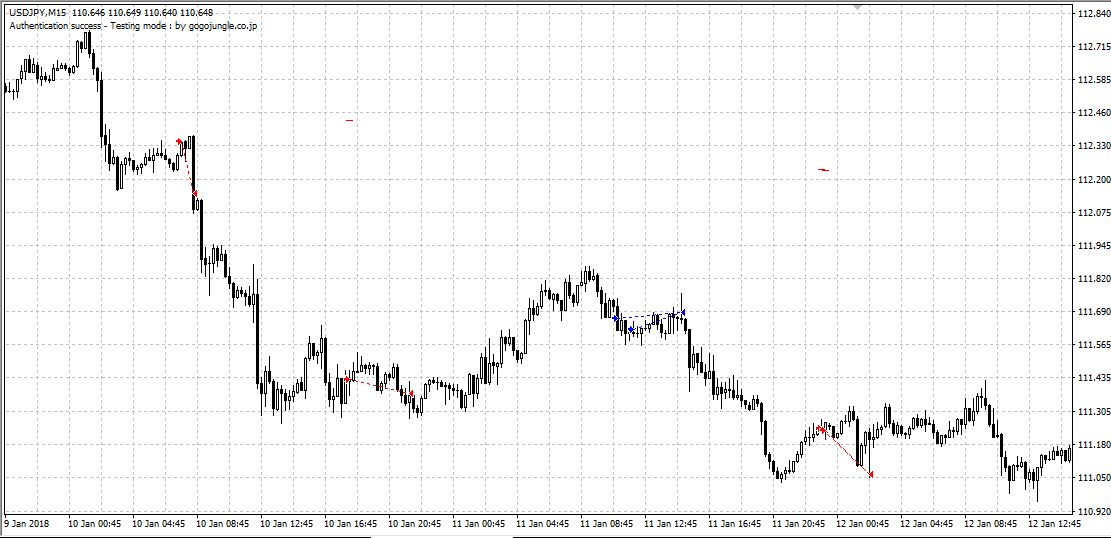

■ Trading Image

Blue: BUY

Red: SELL

We align with the 15-minute wave, buying on higher highs and selling on lower lows in a trend-following fashion. If stopped out, we promptly reverse into the opposite entry to efficiently adjust losses and ride the market wave.

There are a relatively high number of entries, and during trends we enter on favorable pullbacks and retracements and quickly take profits.

Entry timing can also be configured to suit user preferences, such as entering on candle close or Tick entry.

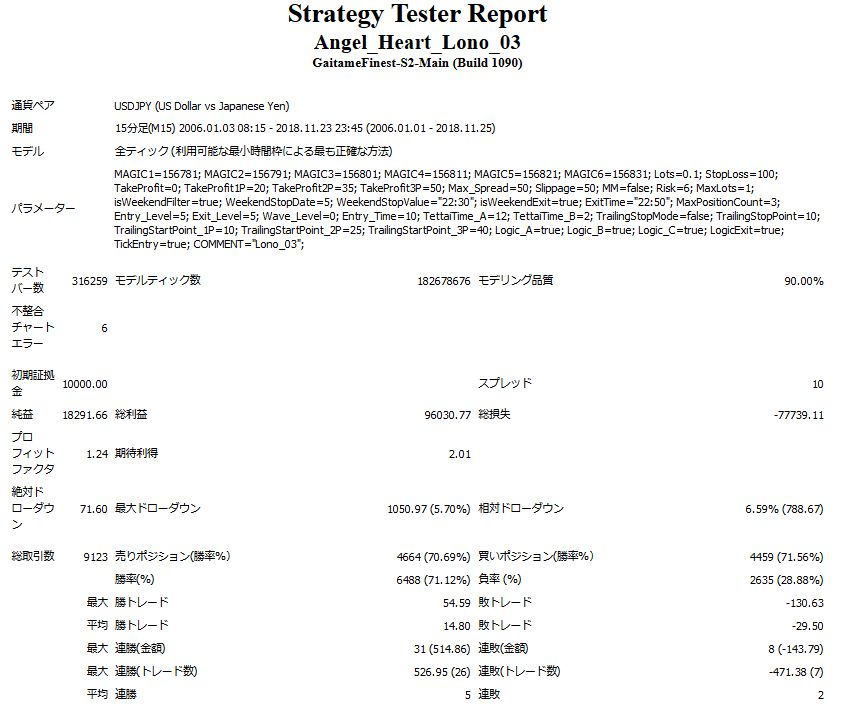

■ Backtest Analysis

2006.01.01-2018.11.25

Spread 10

Fixed 0.1 lots

Net profit +$18,291 (annual average $1,524)

Maximum drawdown -$1,050

Total trades 9,123 (annual average 760)

Win rate 71%

Average win $14.8

Average loss -$29.5

PF 1.24

This is the result. The PF is relatively low because profits and losses are aggregated across multiple positions for a single settlement; although many individual positions show losses, the total is designed to be positive.

Recommended margin is

(4.5*3) + (11*2) = 35.5 (ten-thousand-yen units)

This is.

This estimate is based on the maximum drawdown in the past 12 years, so a bit lower margin should be sufficient.

For the recommended marginThe expected annual return is about 47%approximately.

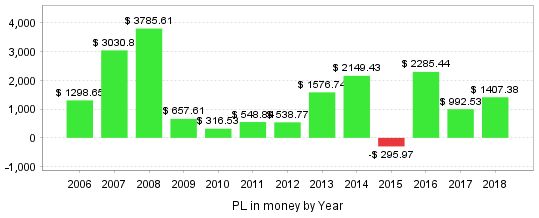

Now let's look at the monthly and yearly backtest results

Monthly results show August is challenging.

Yearly results show 2015 slightly negative, but the years around it have been strong, so it would be a pity to give up after one year. Also, 2009-2012 were weak, so volatile years tend to perform better.

If you can read the market, adjusting the Wave level parameter to match smaller waves or larger waves could improve performance.

There are many trades, and the expected annual return is over 40% even with the default settings, and features like weekend settlement, trailing, and compounding, making it a highly recommended EA with rich customization options!