Will there be profits from volatility? 'Range Against the Machine AUD/CAD Edition'

【System Trade Overview】

Currency pair: [AUD/CAD]

Trading style: [Swing trading]

Maximum number of positions: 1

Timeframe used: M1

Maximum stop loss: 220 (trailing stop enabled)

Take profit: 200 (variable TP depending on market movement)

Notes: Opening price action, weekend close feature, compounding feature available

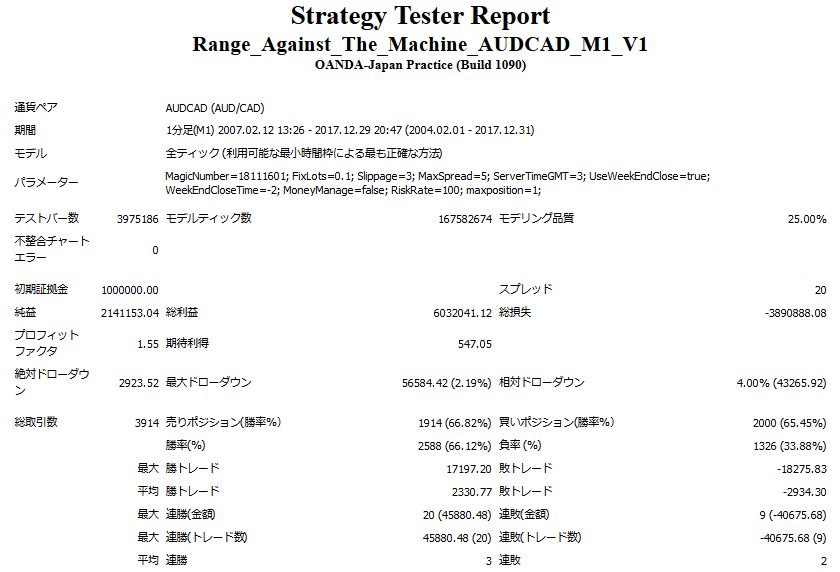

【Backtest Analysis】

2007.02.12-2017.12.31

Spread: 20

Fixed at 0.1 lot

Net profit: +2,140,000 yen (annual average 214,000 yen)

Maximum drawdown: -56,000 yen

Total trades: 3,914 (annual average 390 trades)

Win rate: 66%

Average gain: 2,330 yen

Average loss: -2,934 yen

This is the result.

Recommended margin per 0.1 lot is,

Since the AUD/CAD margin is 33,000 yen per 10,000 units,

(3.3) + (5.6*2) = 14.5 (ten-thousand yen)Thus it is.

As you can imagine, since the annual average gain per 0.1 lot is 214,000 yen,the annual average rate of return exceeds 100%!

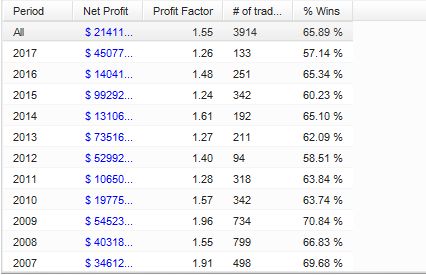

Now, let's look at the annual profits in the backtest.

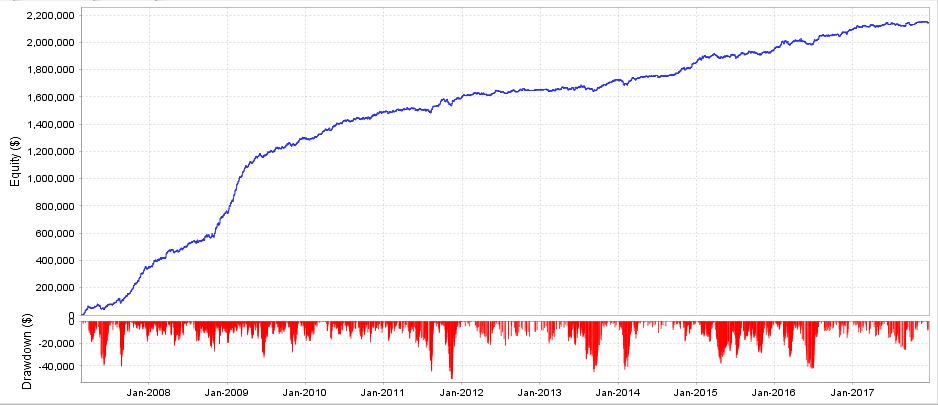

(Backtest P/L chart)

There was a maximum drawdown of nearly 50,000 yen in 2012. Since 2014 volatility has been lower, and

there is a gentle upward trend.

Looking at the number of trades, year-to-year variation is large. The low-profit year 2012 had 94 trades, reflecting volatility.

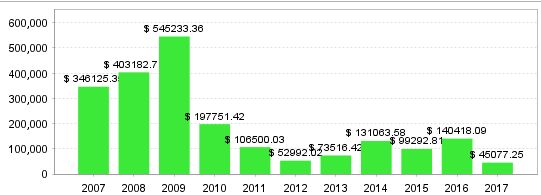

(Annual profits)

By year, profits for 2007-2009 stand out.

Since 2012, profits have been in the range of about 50,000–140,000 yen and stable.

The five-year average annual profit is 97,000 yen, so the return rate is about 66%That’s about it.

With an average monthly profit of around 80 pips, the annual profit would be 97,000 yen,

forward testing shows +70 pips in under a month, indicating results on par with the last five years.

Compared with the explosive profits up to 2008, it may seem lacking, but if the annual return exceeds 50%, it’s still quite excellent.

Although the forward period is still short, this is an EA that effectively leverages the characteristics of the AUD/CAD pair, so it is portfolio-friendly to operate alongside the main currency. Most notably, low volatility doesn’t have to be negative; conversely, if AUD/CAD volatility rises in the future and the market becomes volatile, past performance shows it has generated large profits in volatile conditions, so further upside is expected!