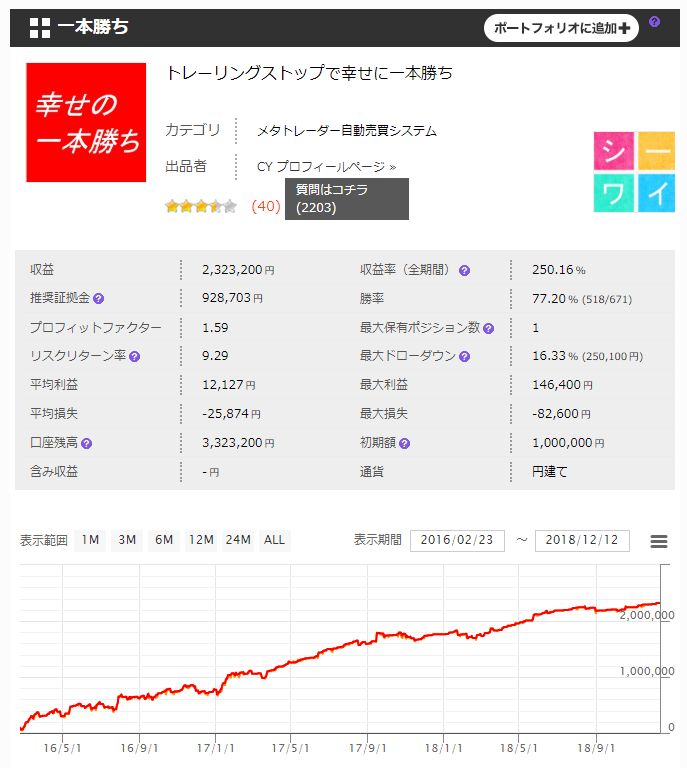

As expected, a consistently high rate of return 'Ippon-kachi' — looking back at the 2018 results!

2018 was steady as well! +250% return achieved in forward testing over two and a half years

“Ippon Kachi”

As you all know, "Ippon Kachi".

It can be regarded as the originator of the 1-position, 100k-currency EA.

With 2018 drawing to a close, I would like to review the year’s performance.

【Ippon Kachi - Overview】

Currency pair: [USD/JPY]

Trading style: [Day trading][Scalping]

Maximum positions: 1

Time frame used: M15

Maximum stop loss: 80

With a maximum stop loss of 80 pips, take-profit is a trailing-exit logic.

Average gain in pips is 12 pips, and with trailing, profits can ride up to +140 pips.

◆2018 Performance

Pips gained as of December 12, 2018: +540 pips!

Profit is 54,000 yen at 10k units, and 540,000 yen at 100k units.

Looking back at past results,

In 2017, +987 pips were gained, achieving a 100% return.

Compared with last year, the pips gained decreased, but it still earned 500 pips, so starting with 1,000,000 yen and operating at 100k units would leave the account at 1.5 million yen, a 50% return—a very good profit rate.

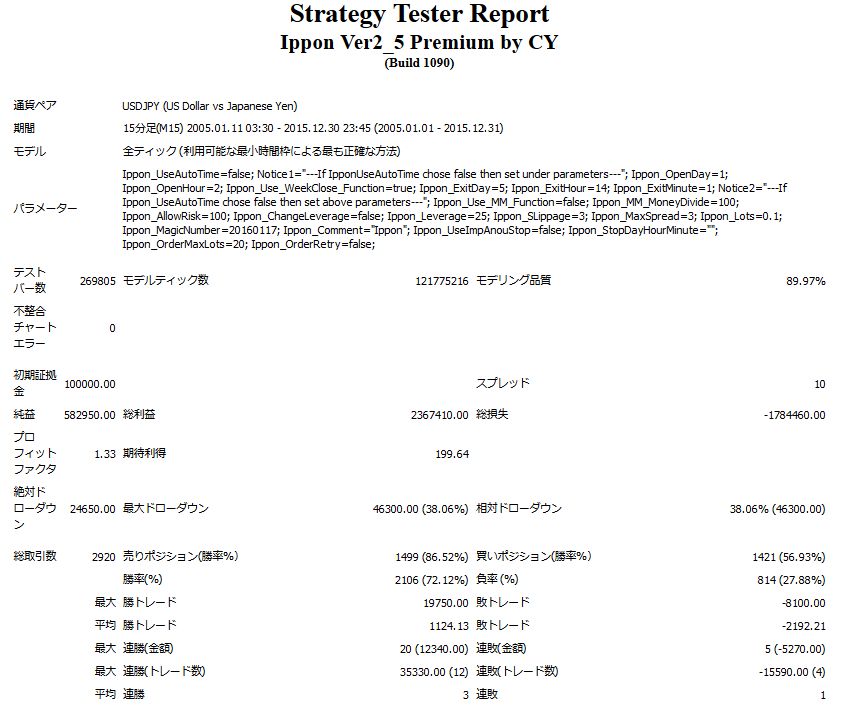

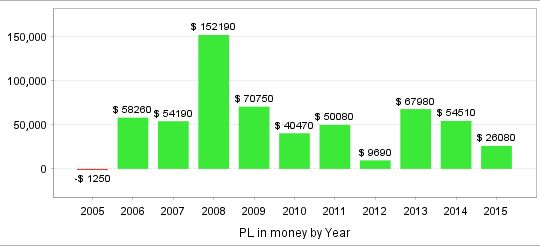

■Backtest Analysis

There are more than two years of forward performance, so backtest analysis may be unnecessary, but

it’s useful to understand what market conditions it underperforms in and in what market the maximum drawdown occurs, for safe operation.

2005.01.01-2015.12.30

Spread 1.0

Fixed 0.1 lot

Net profit +582,900 yen (annual average 58,300 yen)

Maximum drawdown -46,300 yen

Total trades 2,920 (annual average 290)

Win rate 72%

PF 1.33

Thus it stood.

Recommended margin per 0.1 lot is

(4.5) + (4.63*2) ≒ 14

It is possible to operate with about 140,000 yen margin per 0.1 lot.

In that case,the average annual return is 41%.

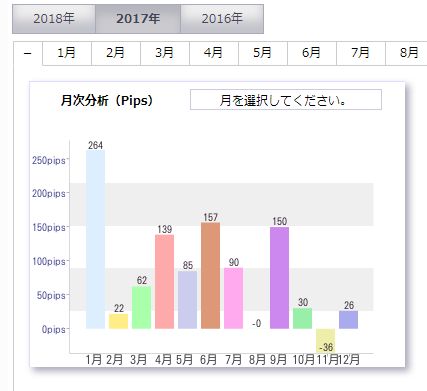

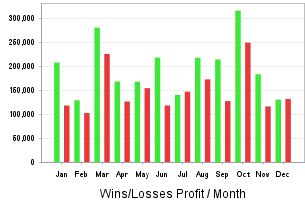

【月別・年別損益】

July and December tend to be loss-prone.

When looking at monthly profits and losses, July and December still show larger overall losses, so

reducing lot sizes or stopping trading in December is a good strategy.

Looking at yearly results, 2005 shows a small loss, while 2008 shows a large profit, indicating that it is a trend-following EA.

This is evident.

■Difference between Ippon Kachi and Ippon Kachi (Standard)

This time we introduced “Ippon Kachi” (Unbranded), and another “Ippon Kachi (Standard)” is sold at a lower price.

The Unbranded version runs with fixed 1.0-lot simple interest, but includes a compounding feature, and the maximum number of lots is up to 20.

On the other hand, “Ippon Kachi (Standard)” uses only simple (non-compounding) operation.

If you have around 1,000,000 yen in margin, Standard should be fine, but for those who want to operate with larger lots or want to use compounding, we recommend “Ippon Kachi” (Unbranded).

It is an ace-level EA that continues to deliver stable, high profits in long-term forward testing!

Compounding supported; up to 20 lots

Ippon Kachi Standard

No-compounding version