Stock investment dramatically changes! Methods for selecting stocks using AI!!

"In stock investing, small-cap investing is the most efficient method to aim for the largest returns" — this is the words of the legendary office worker investor, Tatsurō Kiyohara, whom I respect the most.

Companies with small market capitalization have great room for growth, and in some cases their stock price can multiply several times within a few years.

There are many small-cap stocks that have the potential to rise by 10 times in just a few months (tenbagger), which shows the dream of small-cap stocks.

Reading this article will help you face stock investing with confidence, thinking, “This is the next promising stock!”

We will introduce in detail how to utilize AI and what methods renowned investors in the investing world use.

1. Methods of famous investors: Tatsurō Kiyohara and Toshiya Imura

● Tatsurō Kiyohara's method

A legendary office-worker investor with personal assets exceeding 80 billion yen

His book, "My Investment Techniques: Who Will Smile at the Market?" is a bestseller.

A style emphasizing small-cap stocks

Unlike investors who favor large caps like Warren Buffett, he advocates a strategy to “target small caps that are not yet drawing attention.” He believes the smaller the market cap, the greater the room for growth.

● Toshiya Imura's method

Thorough company analysis and pursuit of “alpha”

He is a legendary investor who dedicates everything to stock investing, digging into a single stock deeper than anyone else, directly contacting companies and visiting them.

By pursuing “alpha,” he hand-picks stocks that are fundamentally undervalued and irrationally cheap, investing with a one-point focus.

Recently, he has begun advising on the management of his own Japanese stock fund, drawing attention.

The methods practiced by these top-tier investors are a high hurdle for ordinary investors; attempting to imitate them requires enormous time and knowledge for research. This is where my trading method and AI-powered research come into play.

Masayan's Background

Please allow me to briefly introduce the author of this article,Masayan.

I have 16 years of experience in FX and stock investing, facing the market for a long time.

By combining stock investing and FX trading experience with programming skills, I develop my own stock-price analysis tools and FX trading algorithms (EA automated trading systems).

For example, I have built a website that accumulates IPO data to analyze post-listing stock price trends, excelling at data-driven method development.

Leveraging these investment experiences and programming skills, I have accumulated profits through data-based strategies.

In this article, I would like to share that know-how without reservation.

Benefits of Small-Cap Investing

When investing in small-cap stocks, it is important to understandlarge price fluctuations.

Here, we will organize the advantages and risks of small-cap investing.

Advantages of small caps

-

High growth potential: There are many companies in growth stages among small-cap stocks.

Therefore, there is substantial room for business expansion, and they tend to have high growth potential.growth potential is high.

Indeed, when looking at historical EPS (earnings per share) trends, small caps have shown higher growth than large caps.

From this perspective, the biggest appeal is their growth potential that large companies do not possess. -

Opportunity to discover “hidden stocks”: Small caps are often underanalyzed by institutions and analysts, so treasure stocks can be buried in the market.

In other words, many stocks are undervalued relative to their true price potential.

If you can discover and accumulate such stocks before other investors pay attention, the stock price can rise in the future. However, avoiding long-term stagnation is also important, so this article will present a logic that yields immediate results soon after.

Disadvantages of small caps

Liquidity risk (difficulty selling): Small caps have fewer outstanding shares and lower trading volumes,tending to have low liquidity. As a result, there is a risk of not being able to buy when you want to buy or not being able to sell when you want to sell. You may also face the inability to sell when you want to exit during a sudden drop in price.

- Difficulty in judging due to lack of information: Because small caps attract less attention, financial results, news, and analyst reportsmay be limited. The lack of information makes it hard to assess corporate value, and insufficient information can be a problem. However, with the advent of generative AI, these drawbacks are being addressed.

A proven investment strategy based on analysis of historical stock price data

Next,we will explain concrete stock investment strategies.

I specialize in validating methods derived from past data rather than relying on experience or intuition.

Discovering promising stock groups through historical data analysis

To succeed in small-cap investing, strategies backed by past price movements are more effective than trades based on guesswork.strategies grounded in historical price action.

Since 2011, I have meticulously analyzed time-series data for IPO stocks, searching for common patterns and advantages.common factors and advantages.

-

Common traits of listed stocks: I analyze the price behavior on the first day of listing and subsequent price trends.

By comparing the issue price and the opening price, examining subsequent price movement after listing, and examining volume trends in detail, I identify factors common to stocks that exploded in price.factors common to big winners.

For example, we explore trends such as what stock price movements look like when the initial price falls below the issue price and listing day prices stay under 800 yen, with trading volume decreasing and market attention staying low for an extended period.

-

Signals that lead to rapid price increases:on-chart signals for sharp price rises are not overlooked.

As a characteristic of small caps, there are cases where trading volume surges and prices move decisively on a certain day.

Stocks that were quiet may suddenly attract a lot of buying as a sign that material information is about to come out or speculative forces are at work.

By filtering with indicators like year-to-date highs and price gain rankings, you can efficiently identify stocks that show signs of a rapid rise.Stocks with imminent ascent signs.

-

Post-event price movement: I also analyze price movements after events such as earnings announcements, new product releases, large orders, and business partnerships.

We analyze how small-cap stocks with positive news tend to rise in the short term and how they may drop after the material news is exhausted, using AI-based analysis to identify anomalies. This provides you with material to decide whether to jump in when news breaks.

In this waythrough analyzing vast amounts of historical data, you can objectively identify future promising small caps.

I personally use analysis tools I built with programming to narrow down a list of promising stocks from hundreds of candidates daily.

From this experience, one thing I can say is, “Data does not lie.”

Removing biases and selecting stocks based on numbers is the quickest path to success.

Using a “Stock Price Analysis Site” (free information)

Free stock price information sites include Kabutan, Yahoo Finance, as well as brokerage sites like Rakuten Securities and SBI Securities, among others.

*Including YouTube and other similar sources, there is an abundance of information available on the web.

These data are integrated through AI (Deep Research) advanced searching, and investors can easily obtain reports that summarize the information they need in a ready-to-use form.

● Google's release of the “Deep Research” feature

In March 2025, Google announced that it would make its “Deep Research” feature available for free accounts.

This enables AI to automatically collect and analyze vast information on the web and create expert-level detailed reports.

An example of simulation results — strategies revealed by data analysis

Now, I will introduce some of the results from past data analysessimulation results.

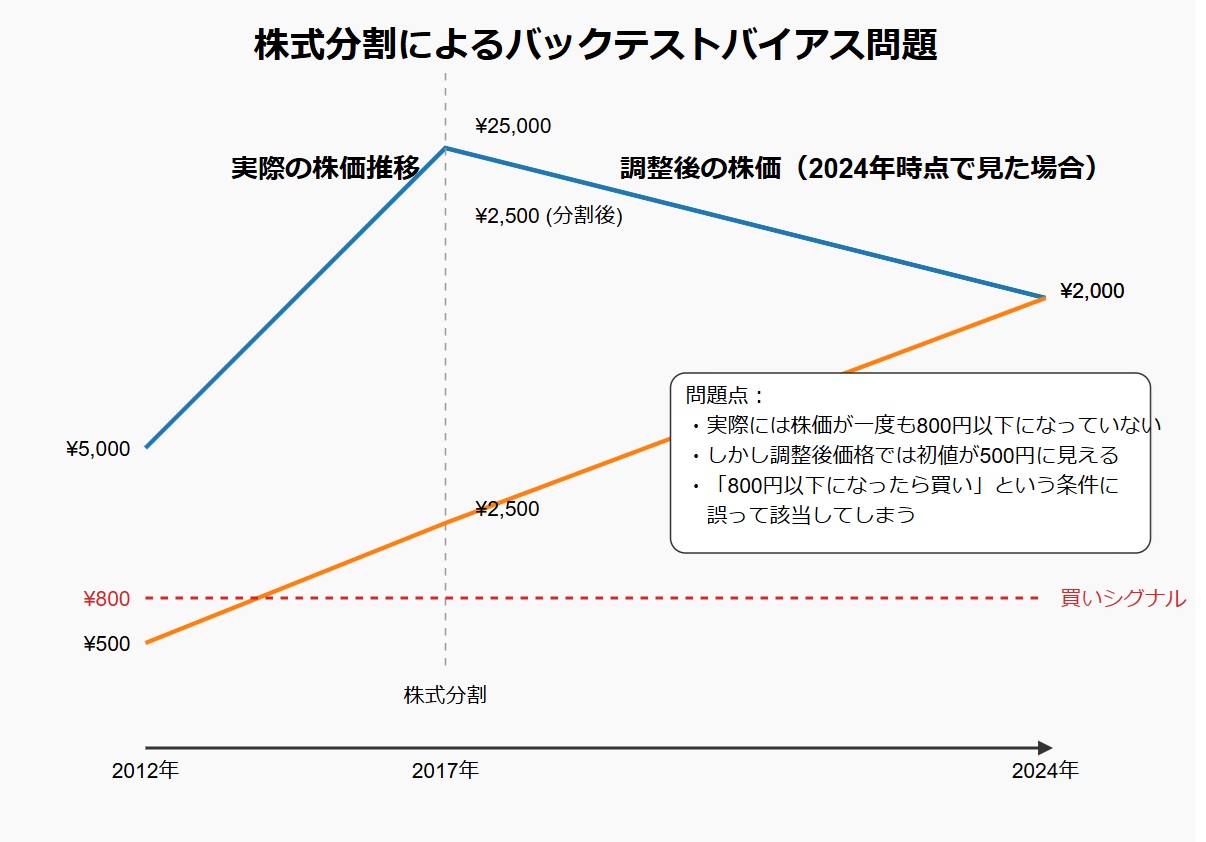

In stock investing, you must conduct backtests (validation with past data) based on hypotheses to confirm effectiveness.

The figure below shows results from simulations I conducted on IPO stocks, testing multiple patterns where after listing the price fell to a certain level, you buy, and when the target price is reached you take profit or cut losses if it falls below a set price.

The above simulations include stocks that underwent stock splits, so actual trading results may differ.

I run simulations that account for stock splits and price-limit moves, and for stocks deemed promising by past validations, I perform AI-based stock analysis to decide whether to buy.

This process is covered in detail in this article as well, includingthe detailed buy/sell rules of each strategy andwhether these strategies are applicable in the current market.

If you are interested, please take a look.

(The detailed data in the diagrams above are published in detail in the paid articles.)

Successful examples of small-cap strategies

The power of this method becomes more apparent when you see real success cases.

Here we feature two stocks that drew attention as notable performers in the recent market, from 2024 to 2025.

We will explain the points used to select these stocks and when it was most effective to invest.

Sakura Internet (3778) – AI-related themes trigger a rapid stock surge

First is Sakura Internet, a long-established internet infrastructure company.Sakura Internet was a mid-cap stock with a market cap of several tens of billions of yen, but from late 2023 to early 2024 its stock price surged dramatically, shocking the market.

The backdrop is theAI boom.

Sakura Internet provides GPU cloud services for AI processing and is involved in government cloud projects, making it one of the highlights as a “strong AI-related stock.”

Looking back at the stock price movement, the price around January 2024 was in the 2,100 yen range, but by the close on March 7, 2024, it hit an all-time high of 10,270 yen, rising about fivefold.

If you had bought this stock when it was under 1,000 yen, you would have achieved a tenbagger.

Was such a trade possible?

If you had noticed the themes like “generative AI-related” and “involvement in government projects,” you could have positioned in advance, but by February 20, 2024, the price had already surged to the 5,000 yen range.

Buying at this price range carried very high risk, and after hitting a peak of 10,270 yen on March 7, it fell to the 5,000 yen range within a few days.

For maximizing profit on this stock,early accumulationwas essential.

I analyze past surging stocks through vast amounts of data to know which price ranges to enter and at what price levels to exit, the initial momentum price band where movement begins.

In hindsight, the best timing was around November–December 2023 when the price was about 1,500 yen.

From brokerage rankings and similar sources, I identify promising stocks, and by analyzing them with AI, I can anticipate tenbagger candidates ahead of the surge.This is an example of being ahead of the curve.

note (5243) – Rapid growth from partnership with Google

The second example isNote Inc..

Note was a relatively new small-cap stock listed on the Tokyo Stock Exchange Growth Market at the end of 2022, but on January 14, 2024, the big news of a capital and business alliance with Google caused the stock price to surge.

It was a case where small caps received a spotlight.

Before the announcement on January 14, their stock price was in the 500-yen range.

The momentum continued, and from late January to February, individual investors’ popularity surged. On February 12, it rose to 2,909 yen, up about 500 yen from the previous day, hitting a stop high.It truly delivered a big bull market typical of small caps.

So, when would be the timing to buy this stock?

The answer is the day after the two consecutive stop highs, January 17, or the following Monday, January 20.

On January 17, the stock opened at 1,025 yen and quickly climbed, but by Monday after the weekend it fell to the 700 yen range; however, on January 21 it rose again and surged to nearly 3,000 yen.

Holders who bought in the 500-yen range did not achieve a tenbagger, but this was a stock that could have yielded substantial profits.

If you monitor price surges regularly, you can ride news newsworthiness quickly when it arises.

In fact, with Note, since the initial price was in the 500-yen range, buying near the time of the alliance announcement and selling around 1,000 yen would have yielded ample profit.

Key to profit-taking timing isnot being greedy at the moment of gains.

Specific price levels for selling around a certain range have been found to be optimal in historical price data analyses.

If you want to secure profits reliably, you can sell half when the price has doubled and exit the rest if the price turns downward, avoiding a sudden drop to zero profits.

This stock was a prime example of a strategy where jumping on opportunities yields profits.

For those wanting to know the next promising stocks — About paid articles

“So,which stock will be the next big winner?“I want to know which stocks could explode like Sakura Internet or Note!” — Many readers must feel this way.

Unfortunately, providing specific stock recommendations requires investment advisor registration, so I cannot teach you directly.

Therefore, in paid articles, based on the strategies and analyses discussed here,what price to buy at?Also,what price to exit would be optimal?andconditionsare disclosed.

For example,

- Buy at 800 yen and take profit at 3,000 yen, sell if it falls to 400 yen: By holding stocks meeting this condition, you can know the expected return percentage on average.

- Logic to avoid prolonged losses: If the stock price does not reach the take-profit point or stop-loss point, you would end up holding the stock for years. From a capital efficiency perspective, entering at moments of price movement allows you to profit more efficiently.

- AI prompt disclosure: I publicly disclose the prompts I use daily. AI is not all-powerful; well-directed instructions yield meaningful information and give hints for finding promising stocks yourself.

- Take-profit and stop-loss timing: I also disclose guidelines for target prices for profits and stop losses. Not only buying stocks but knowing “when to take profits” and “when to cut losses.”

These aretop-secret information only in paid articles, packed with tips to obtain a large return from a small investment.

Success in small-cap investing depends on timing and stock selection.

The paid articles provide information covering both aspects and strongly support your investment decisions.

How to subscribe to the paid articlesis as follows:Register with GogoJungle,and you can purchase and view the articles. Purchases can be made easily with credit card payments.

If you are interested, please purchase the paid articles. Together, let's maximize the appeal of small-cap investing through data analysis and strategies!

Thank you for reading to the end.

For those purchasing paid articles — From here, the paid articles begin

How much should you buy for?Also,what price is optimal to exit?andconditionsexplained sequentially.