Fast recovery from drawdown! "Scalping Dragon V2"

Backtested for about 20 years!

Trading 300 times per year with an average gain of 500 pips per year — scalping!

“Scalping Dragon V2”

[Scalping Dragon V2 Overview]

Currency pair: [USD/JPY]

Trading style: [Scalping]

Maximum position: 1

Trading type: 1 lot per trade

Maximum lots: 99

Timeframe used: M5

Maximum stop loss: 100 (mainly stop-out is by internal logic)

Take profit: 10 (also realized by internal logic)

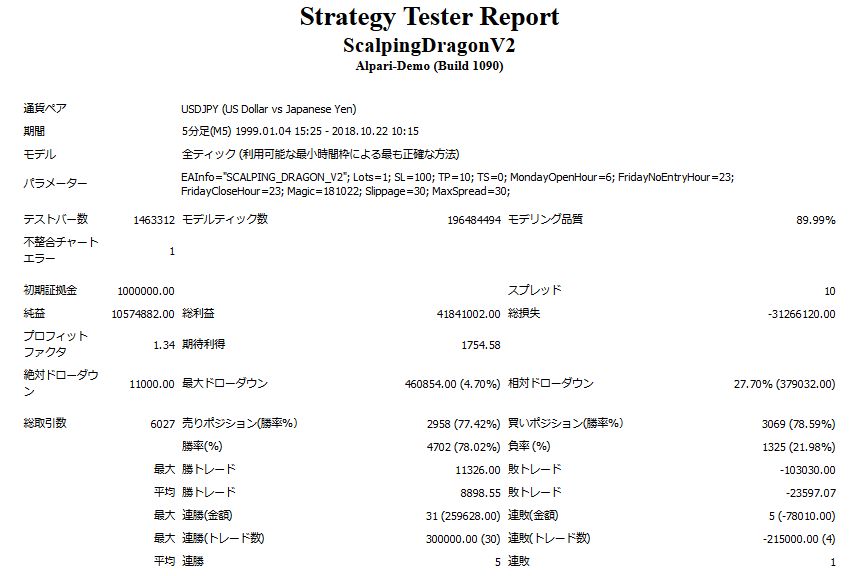

[Backtest Analysis]

1999.01.01-2018.10.22

Spread 1.0

1.0 lot fixed (100,000 currency units)

Net profit +10,570,000 yen (annual average 550,000 yen)

Maximum drawdown -460,000 yen

Total trades 6,027 (annual average 317)

Win rate 78%

Average gain 8,898 yen

Average loss -23,597 yen

The result. Profit factor is 1.37, a win rate above 70% is acceptable, but occasionally losses can be fairly large.

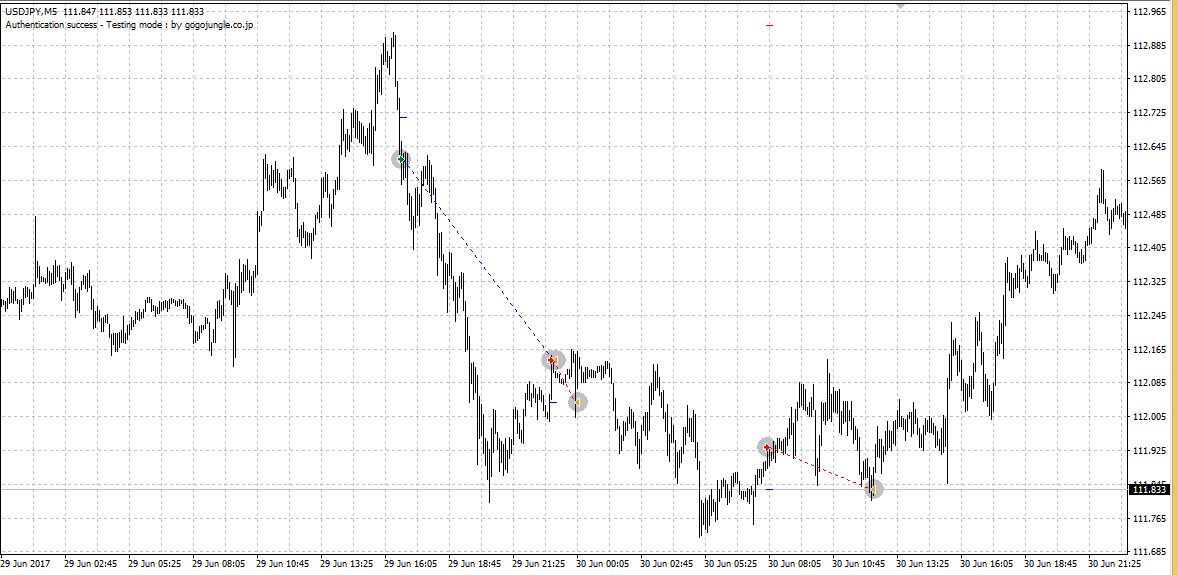

[Trade Image]

Green: BUY

Red: SELL

If the trend-following fails and a trend reversal occurs, the maximum SL is 100 pips or it exits early by logic.

After the BUY stop, it reverses nicely and takes profit on SELL.

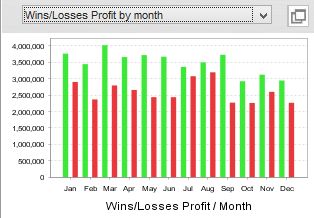

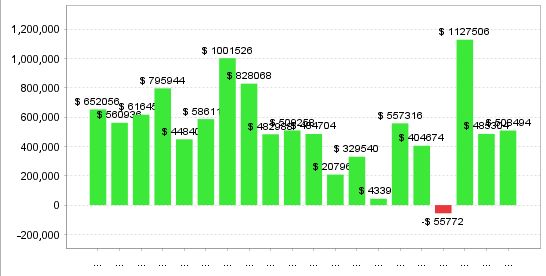

[Monthly and Annual Profit/Loss]

Although November has many negative months, in terms of amount, July and August are often the larger losses.

Looking at the year as a whole, 2015 shows a slight negative.

The following year 2016 became the highest profit amount in the backtest market,two years' worth recovered in one year.

In the most recent five years, annual profit averages 490,000 yen.

If you pursue annual profits, combining with EAs that performed well in 2012 and 2015 would further improve performance.

Recommended margin per 0.1 lot is

(4.5) + (4.6*2) = 13.7 (ten-thousand yen)

.

If operating with the recommended margin ratio, the expected annual return within a maximum drawdown of 50% would be around +36% based on the last 5 years' performance.

It also has about 300 trades per year, andquick recovery from drawdown is a feature.

Could it become a new powerhouse for USDJPY scalping? Looking forward to what's ahead!