Important Risk Management Learnings from White Bear V3 ~ Part 2

Continuing from last time, we introduce risk management by learning from the drawdown of WhiteBearV3 (Part 2).

The article for Part 1 is here↓↓↓

https://fx-on.com/navi/detail/?id=793

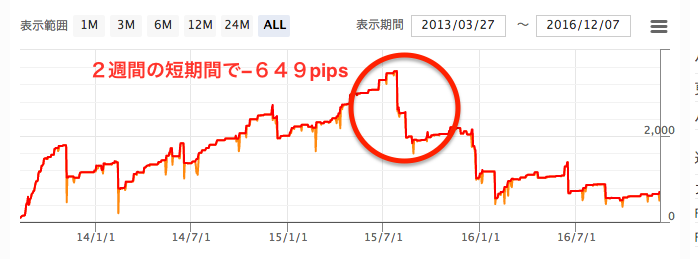

In 2014, the market favored WhiteBearV3, but in 2015 it suffered a drawdown large enough to wipe out the previous profits.

From July 2015, I started operating V3, and I began trading right at the moment where the losses in the above image started.

Naturally, the performance was negative. However,in actual trading, the losses were reduced to about 1/3 of 2015’s total loss.

That is simply because “I had stopped the EA.”

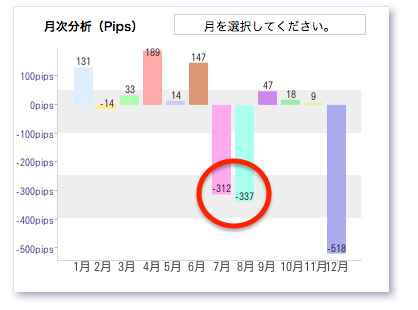

The image above shows V3’s forward-test results, and2015 saw large drawdowns in July, August, and December.

And a total loss of 1167 pipswas incurred.

In fact, I only endured 312 pips of that loss.

When the drawdown hit at the end of July, there was the yuan issue in China, and although there was not any major market movement at that moment (Did China manipulate its own currency’s price??), I felt something “unusual” about market movement due to this drawdown.

I stopped the EA afterward. (After the end of July drawdown)

Two weeks later in August, there was another major drawdown according to the official results, but since I had stopped the EA, I did not incur that loss.

And the maximum drawdown for 2015 occurred in December at year-end.Normally, scalping EAs are prone to drawdowns at year-end, so I stopped the EA from early December.

In 2015, I felt that the euro-dollar market movement was particularly strange, so I decided to stop V3 early.

(Reference) Reasons to stop trading at the year-end↓↓↓

http://サラリーマン投資自動売買.com/fx-beginner/trade-dec-stop/

So, in the endV3 updated its maximum drawdown in July, August, and December, but I managed to limit it to only July’s drawdown.

In this way,even for scalping EAs that show large drawdowns in official results, if you respond to market fluctuations appropriately,you can ultimately turn the results into profit.

However, in this case, since I started operating V3 in July 2015, the result could not be positive….If I had started operating it from 2014, I think I could have ended 2015 with a positive overall result.

The lessons learned from this include

・No matter how good an EA has performed so far, do not become overconfident.

・Consider whether your funds can endure during consecutive maximum drawdowns.

・Check what kind of risk management design the EA has.

・Operate multiple different-types of EAs to manage risk.

etc.

If you found this article helpful, please try learning automated trading from my site’s free e-mail course via the newsletter^^↓↓

⇒http://サラリーマン投資自動売買.com/landingpage/

PS:The newsletter by the active professional trader “Rikio Shima” is very rich in content.I knew him from a investment program,but paid newsletters are of a higher quality.

By the way, I’m subscribed via a three-month free trial campaign, and I’m providing excerpts from the newsletter here

⇒http://fx-newstart.com/rikio-shima

*Campaign details are at the bottom of the article.

━━━━━━━━━━━━━━━━━━━━━━━━━

My site’s strongest EA ‘Beatrice-07’

━━━━━━━━━━━━━━━━━━━━━━━━━

A site leader that has shown results through long-term operation

Because it is a swing trading EA, it is less affected by market fluctuations and easy to operate.

Profit rate 250%, a regular in the top ranks of popular EAs

*Now, there is a limited-time campaign offering free

account openings, so it’s highly recommended.

⇒http://サラリーマン投資自動売買.com/ea/beatrice-07/post-1365/

━━━━━━━━━━━━━━━━━━━━━━━━━

FX automated trading exclusive free newsletter

━━━━━━━━━━━━━━━━━━━━━━━━━

This is my site’s free newsletter. It covers winning FX automated trading strategies and introduces EAs I’m watching in real time.

Also now, a free FX automated trading strategy report is a gift!

⇒http://サラリーマン投資自動売買.com/landingpage/

━━━━━━━━━━━━━━━━━━━━━━━━━

Long-term operation maintaining 90%+ win rate: "Breakout Scalping"

━━━━━━━━━━━━━━━━━━━━━━━━━

Since starting in November 2014, it has remarkably maintained a win rate above 90% as a scalping EA

There are no flashy profits, but it reliably preserves profits

and is the quintessential investment style of trading.

It remains a regular top seller in EA rankings↓↓

http://サラリーマン投資自動売買.com/ea/breakscalsystem/breakscalsystem/

━━━━━━━━━━━━━━━━━━━━━━

Long-term profitable EA: WhiteBearZ USDJPY

━━━━━━━━━━━━━━━━━━━━━━

All monthly results since inception have been positive

This is the site’s most recommended EA.

(Price is a bit high…)

⇒http://サラリーマン投資自動売買.com/ea/white-bear-z-usdjpy/post-488/

━━━━━━━━━━━━━━━━━━━━━━

Brokerages offering MT4 and running a campaign

━━━━━━━━━━━━━━━━━━━━━━

Open a new account and get a free automated trading EA

Introducing MT4-capable brokerages. A must-see!!

⇒http://サラリーマン投資自動売買.com/fx-campaign/fxcampaign/

━━━━━━━━━━━━━━━━━━━━━━

If you use VPS, choose ABLENET

━━━━━━━━━━━━━━━━━━━━━━

A virtual desktop VPS necessary for automated trading

The top recommended VPS I use is here

⇒http://サラリーマン投資自動売買.com/mt4-ea/mt4-vps-比較/post-1470/

━━━━━━━━━━━━━━━━━━━━━━

[Recommended] Rikio Shima’s Practical Real Trades

━━━━━━━━━━━━━━━━━━━━━━

A current professional trader I also subscribe to

Rikio Shima’s practical email magazine

You can learn market analysis and trading methods from it

An innovative and high-quality newsletter.

⇒http://fx-newstart.com/rikio-shima