In 2018, the return rate surpassed 60%. The 'last 3 furlongs' are, as expected, a stable strength!

Forward testing for about a year yielded a return of over 60%!

An astonishing EA with a risk-reward ratio of 7.53 and a profit factor of 28.

‘Last 3 Furlongs’

【Last 3 Furlongs Overview】

Currency pair: [USD/JPY]

Trading style: [Scalping]

Maximum number of positions: 1

Timeframe used: M5

Maximum stop loss: 90

Take profit: 10

Forward operation for 11 months, profit of ¥320,000 with 1 lot

Profit rate reached 63%!

Although the number of trades is relatively low at 41, the maximum drawdown is as small as ¥40,000 and the win rate is 97%, making it very profitable,

and the profit factor (gross profit ÷ gross loss) is 28!

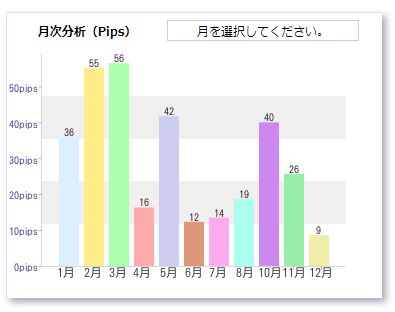

Although monthly pip gains are modest, the absence of any large negative months makes it reassuring to operate.

Now, let's look at the expected annual return from backtests and cautions for operation.

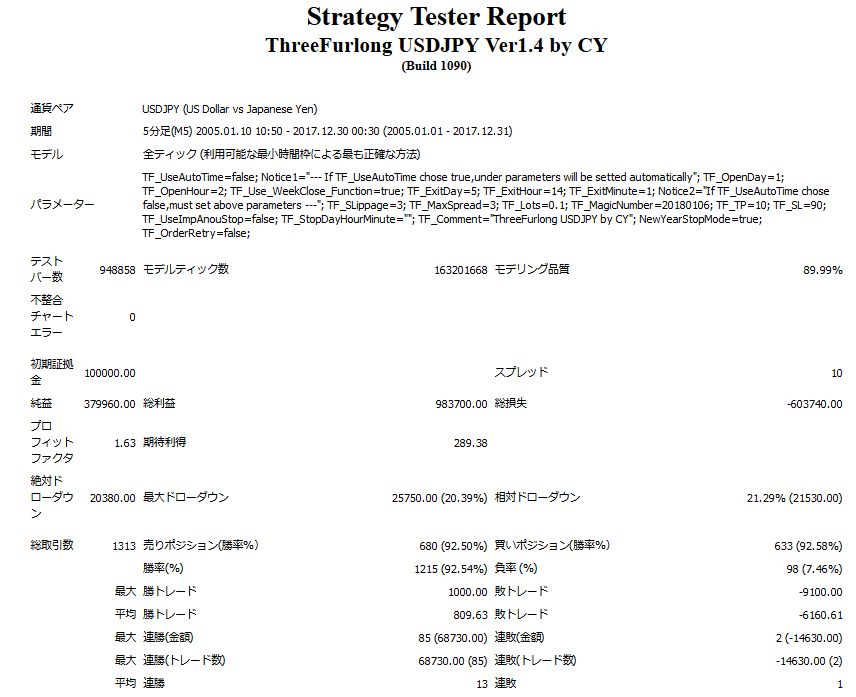

【Backtest】

2005.01.10-2017.12.30

Fixed at 0.1 lot

Spread 1.0

Net profit + ¥379,000 (annual average ¥31,000)

Maximum drawdown ¥26,000

Total trades 1,313 (annual average 109)

Win rate 92%

PF 1.63

That is the result.

0.1 lot per margin requirement is

(4.5)+(2.6*2)=97,000円

Approximately 100,000 yen allows operation of 0.1 lot.

Since the average annual profit is ¥31,000,the expected annual return is about +30%and that is about right.

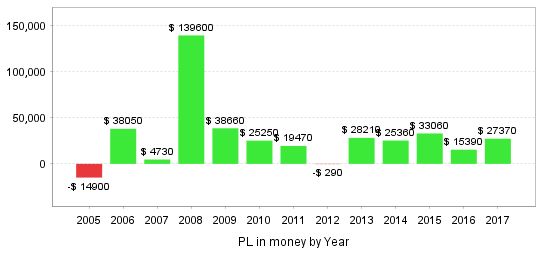

(Monthly and yearly P/L)

Looking at monthly data, 2014 had three months with no entries at all, so the number of trades remains relatively low. There are a few months per year where you can harvest substantial profits.

In the span of a year, 2008 stands out, so in years with big trends the number of trades increases and earnings grow significantly.

Looking at the last five years, the average gain is about ¥25,000, so it seems to consistently capture 200–300 pips per year. Reviewing 2018’s forward performance shows +320 pips, indicating a market that aligned well with Last 3 Furlongs more than in typical years.

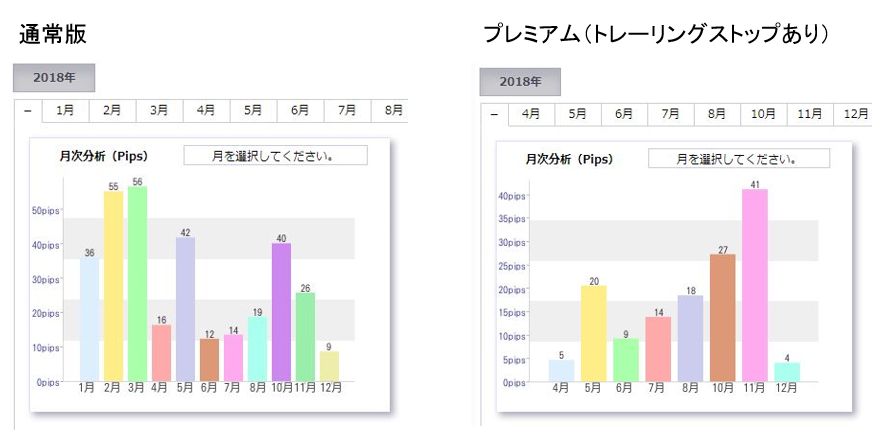

【Difference from the Premium version of Last 3 Furlongs】

The Last 3 Furlongs Premium version includes trailing and compounding features.

When you compare the forward performance, there are cases where trailing stops expand profits, and cases where profits are less than a fixed TP; it’s not easy to say which is better.

In terms of gained Pips, the differences look like this.

However, when considering long-term operation, over 2–3 years there will be a significant difference in profit amounts.

Because the win rate is high and the profit factor is high.

Results of a 3-year compounding backtest are here

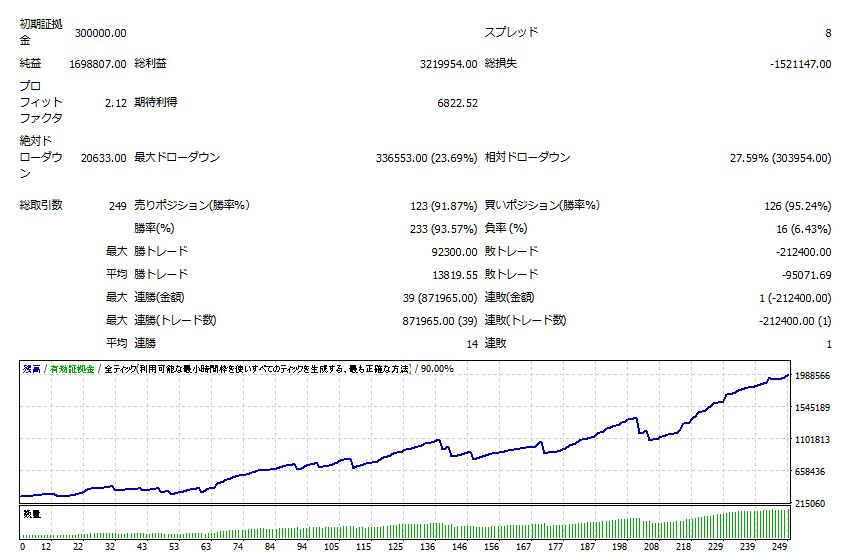

¥300,000 → ¥2,000,000! Net profit is +¥1,690,000, an increase of over 500%.

With the default compounding setting, relative drawdown is less than 30%, so risk is not a problem.

【Summary】

As noted in product reviews, the monthly average number of trades is about 3–4 because it doesn’t run often.

There are months with no entries, so those who want to check daily results might feel anxious.

Therefore, after understanding each EA’s characteristics well, accept that “Last 3 Furlongs has good win rate and PF but few trades” and operate on a semi-annual to annual basis.

Also, since it performs well in trending markets, it should shine in markets with big moves, those considered dangerous.

It would be suitable for including in a fixed-lot portfolio or for compounding from tens of thousands of yen.

Premium version of Last 3 Furlongs (with compounding feature)