『ATS-11 Ma』 Last week's performance ~2025/2/8

Hello everyone! This is ATS BASE (^○^)

We will report the results of FX trading for last week (January 27, 2025 to February 1, 2025).

As usual this time, funded at 1,000,000 yen with 0.3 lots.

We conducted one-shot scalping trades.

Because the overall results were stable, we will report the details in depth.

▼ Limited-time ▼

Three ATS (ATS-11, 12, 13) are offered for a limited time at 20,000 yen, 22,000 yen, and 24,000 yen respectively

for 50,000 yen!

Don’t miss this opportunity!

If you want to “profit efficiently” or “trade with higher accuracy,”

please make use of the ATS series.

Last week's trading summary

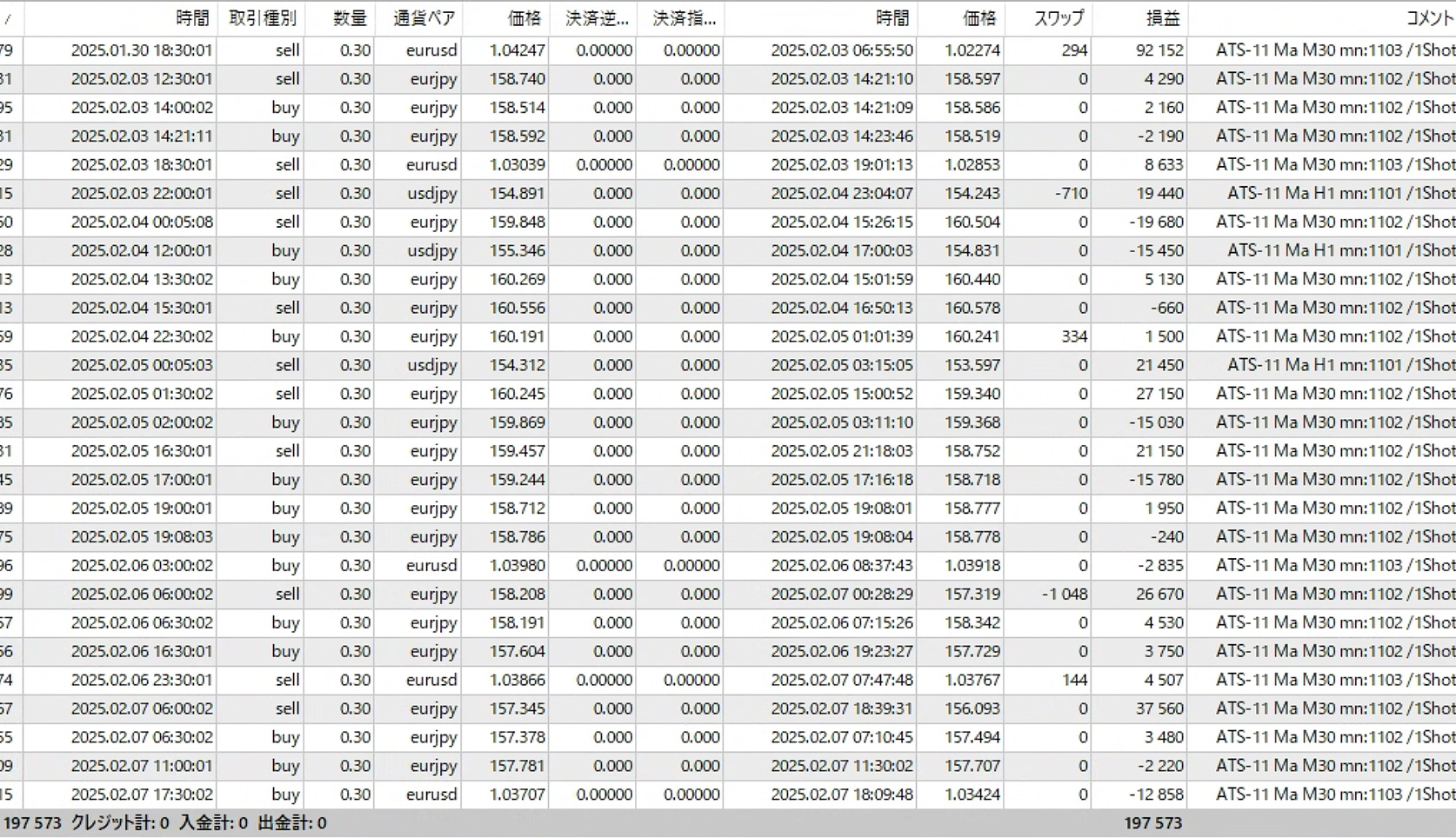

Period: 2025/02/03–02/08 (Trading with 1,000,000 yen margin / 0.3Lots)

[Trading history image]

- Number of trades: 27

- Wins/Losses: 18/9

- Win rate: 66.7%

- Profit: +197,573 yen

- Trading method: One-shot scalping trade

Self-evaluation

Last week's trades maintained a relatively high win rate of 66.7%.

Profit was about 200,000 yen in the positive, ensuring stable earnings.

With 0.3 Lot, this level of profit is excellent.

Also, the trade count was 27, a moderate number,

and from a risk management perspective it was balanced.

It can be considered that the trades were well-balanced.

Furthermore, at the top of the performance chart you can seethe positions carried over from the week before,

as many elements favored wins, I decided to hold for a while.

As a result,a big win as expected!

Incredible92,152 yen in profit was secured.

Even without that, it was a profit of 100,000 yen (^ ^)

Continuing from last week, now “MA cross” is good ♪

Last week's trading summary

-Overall trends and areas for improvement-

See you again next week!

ATS-11MaPast trading results

-ATS-11Ma past trading results-

Period: 2025/1/28–2/1 (1 week)

Plus 38,591 yen

Trading details article here

Period: 2025/1/20–1/25 (1 week)

Plus 22,512 yen

Trading details article here

Period: 2025/1/13–1/18 (1 week)

Minus 7,733 yen

Period: 2025/1/6–1/11 (1 week)

Plus 96,073 yen

Trading details article here

Period: 2024/12/30–1/4 (1 week)

Plus 116,662 yen

Trading details article here

Period: 2024/12/25–12/30 (1 week)

Plus 22,996 yen

Trading details article here

Period: 2024/12/16–12/23 (1 week)

Plus 61,626 yen

Trading details article here

Period: 2024/12/9–12/14 (1 week)

Plus 38,197 yen

Trading details article here

Period: 2024/12/2–12/7 (1 week)

Plus 8,310 yen

Trading details article here

Period: 2024/11/25–11/30 (1 week)

Plus 114,524 yen

Trading details article here

Period: 2024/11/18–11/23 (1 week)

Plus 32,610 yen

Trading details article here

Period: 2024/11/11–11/16 (1 week)

Plus 32,730 yen

Trading details article here

Period: 2024/11/4–11/9 (1 week)

Plus 63,763 yen

Trading details article here

Period: 2024/10/28–11/2 (1 week)

Plus 11,734 yen

Trading details article here

Period: 2024/10/21–11/26 (1 week)

Plus 56,002 yen

Trading details article here

Period: 2024/10/14–11/19 (1 week)

Plus 17,908 yen

Trading details article here

Plus 85,304 yen

Trading details article here

ATS-11 MAWhy can you consistently make profits?

ATS-11 MA is the optimal tool to support “profitable moving average trades.”

It solves common beginner issues with settings and risk management,

and enables stable profits with low risk.

If you are trading using moving averages and feel you aren’t winning as you’d like,

ATS-11 MA may be the answer.

ATSThree trading methods ※ Images reused from the “ATS-12 RSI” version, but the specifications are the same.

1. Beginner: One Shot Trade -One Shot Trade-

Also a high-win-rate sturdy day trading mode!

Enter on the first signal, exit at the scalping-mode exit point.

Profitable and robust trades are possible.

※ We recommend this method until you gain the knack and start winning.

This method trades only once between the start flag and the end flag.

The points you can gain are modest, but among the three it has the highest win rate and is the most reliable.

First, set the parameter “ScalMode_Flag” to ON “true.”

The chart will display scalping-oriented entry and exit points.

① The initial flag is the entry point.

② Then exit at the scalping exit point.

③ If an end flag appears while holding a position, forcibly exit then.

At first, after obtaining point ① and if point ② is displayed, it is more reliable to exit with a positive profit early.

As you get used to it, aim for the second and third points and the subsequent scalping exit points.

About settings: The numbers on the score panel don’t need to be as high as the other two methods.

2. Intermediate: Scalping Trade -Scalping Trade-

With adjusted settings, full-scale scalping is possible!

This method is a scalping technique that trades multiple times between the start flag and end flag.

In some cases, it can gain the most points among the three methods.

First, set the parameter “ScalMode_Flag” to ON “true.” Scalping entry/exit points will be shown.

① When the scalping entry point is displayed, open a position.

② Exit the position at the exit point.

③ Trade several times until the end flag is displayed.

④ If an end flag appears while holding a position, forcibly exit and wait for the next opportunity.

※ There are two main approaches to entering:

One is to hold one position and wait for the exit point.

The other is to add positions with very small lots at each entry point and exit all at the exit point, repeating this process.

Either approach can yield results. Until you’re comfortable, start with small lots and find the method that suits you.

Once you’re accustomed to this method and can realize profits, try higher-standard settings using related systems. I believe you can achieve even greater results.

■ About settings: This method benefits from high-level settings. We recommend having the included “ATS-11 Ma AutoSearch.”