Salamander USDJPY with a win rate of 90% and PF3 or higher

【Salamander USDJPY Overview】

Currency pair: [USD/JPY]

Trade style: [Scalping]

Maximum positions: 2

Used timeframe: M5

Maximum stop loss: 120

Take profit: 30 ( 10 pips or 30 pips)

Since the June 2018 update, it has been trading forward with a 1.0 lot.

Approximately +160 pips gained in about six months.

【Trading image】

Blue: BUY

Red: SELL

Buying on dips and selling on rallies is the basic approach.

Although the maximum is two positions, sometimes two positions in the same area are held and closed separately.

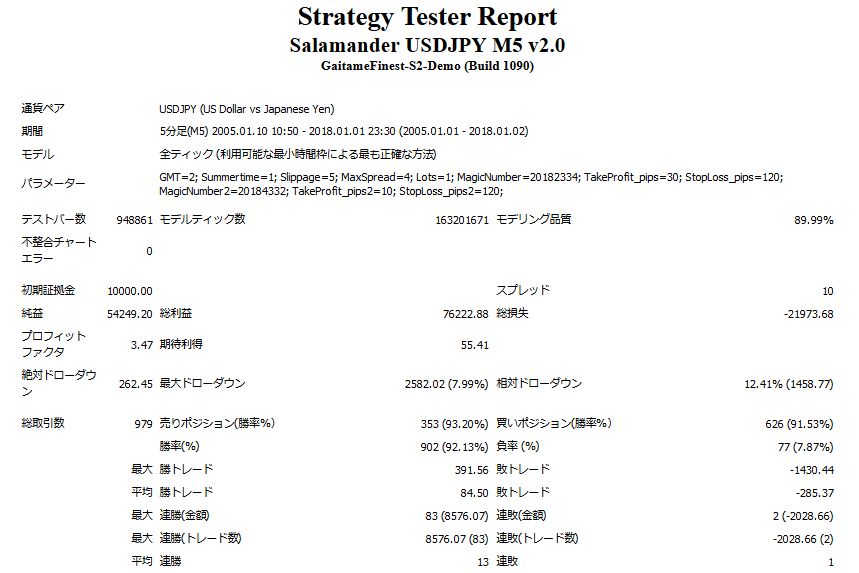

【Backtest Analysis】

2005.01.01-2018.01.01

1.0 lot fixed (100,000 units)

Spread 1.0

Net profit +$54,249

Maximum drawdown $2,582

Total trades 979

Win rate 92%

This is how it is.

The average annual number of trades is around 80, relatively low, but the yearly average gained pips is about 450 pips, with a good win rate, and a Profit Factor (total profits ÷ total losses) of 3.47, which is a very good characteristic of this EA.

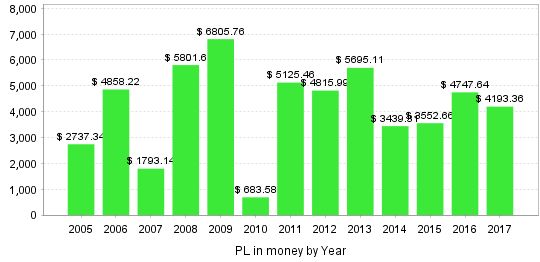

【Monthly and Yearly Profit/Loss】

Although the number of trades is small, the win rate is over 90%, so there are few losing months.

On a yearly basis, 2010 was low, but otherwise it tends to earn around 400-600 pips per year.

※All profits are based on 1.0 lot

【Recommended Margin and Expected Average Annual Return】

The recommended margin per 0.1 lot is, for two positions,

(4.5*2)+(2.6*2)=14.2(万円)

Therefore, you can start with a small amount.

The average annual profit per 0.1 lot is 46,000 yen, with expected annual return around 32%!

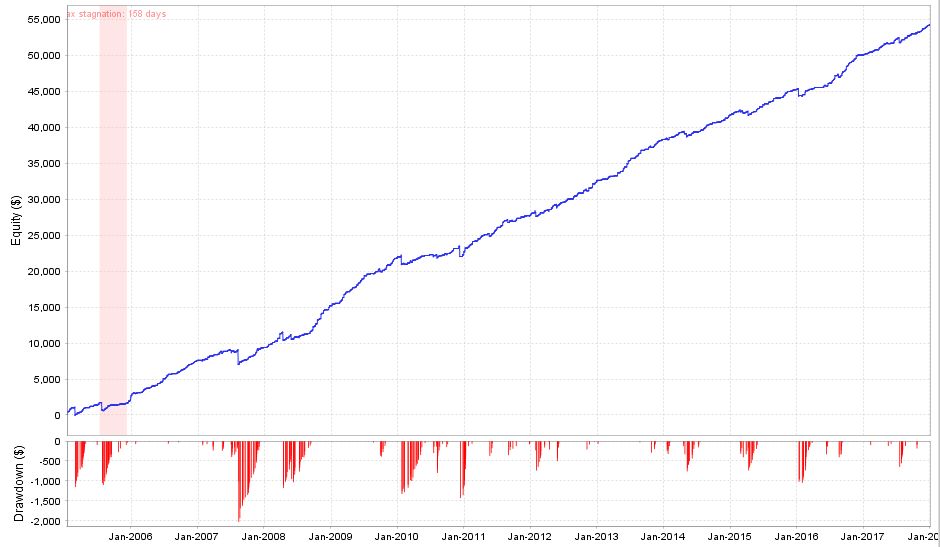

Looking at the profit/loss graph from backtests since 2005, the maximum drawdown occurred in 2007-2008,

in other years it stays around $1,000-$1,500, so under normal circumstances the recommended margin per 0.1 lot would be even smaller.