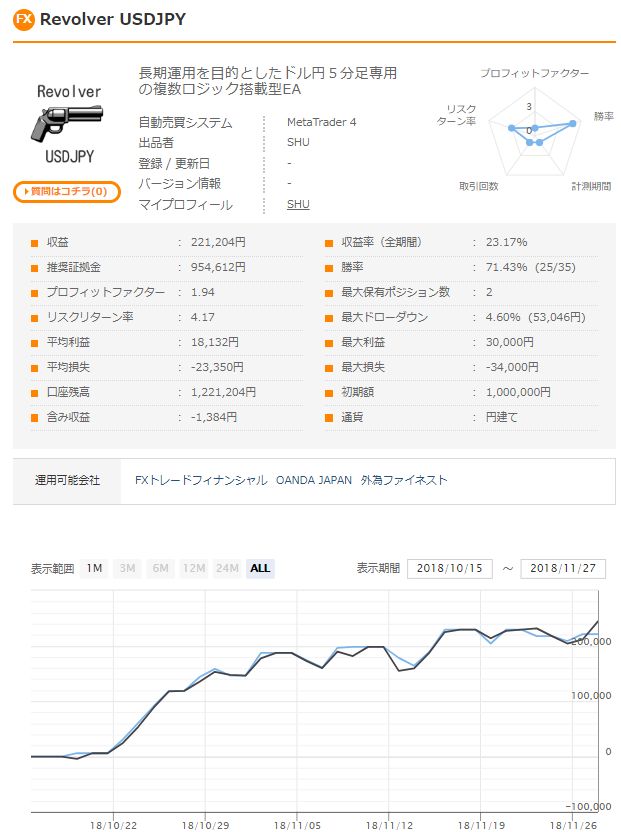

Equipped with multiple logics, there is no market it can't handle! An annual return of over 50% is expected for 'Revolver USDJPY'

Equipped with multiple logics to avoid big losses!

Stable annual pip gains

'Revolver USDJPY'

【Revolver USDJPY Overview】

Currency pair: [USD/JPY]

Trading styles: [Scalping][Day Trading][Swing Trading]

Maximum positions: 2

Timeframe: M5

Maximum stop loss: 40; others: variable per strategy

Take profit: 30; others: variable per strategy

Hedging: Enabled

Notes: internally, different stop losses and take profits are configured per logic.

The appeal is high trading frequency due to multiple logics.

Additionally, the maximum SL of 40 pips is a reassuring design.

In forward testing, with 1.0 lot operation, +220 pips per month.

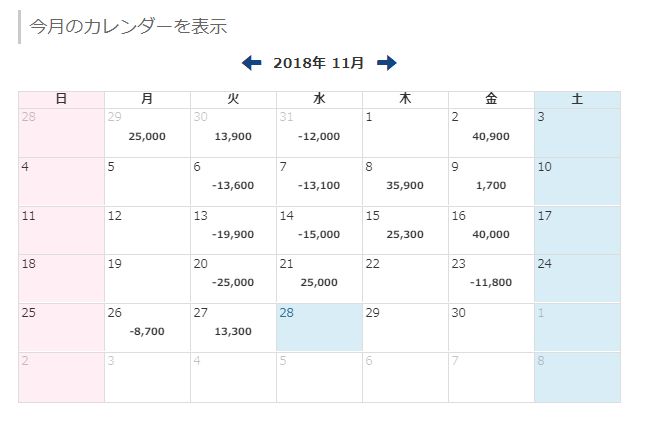

Looking at the trading calendar, you can see trades almost every day.

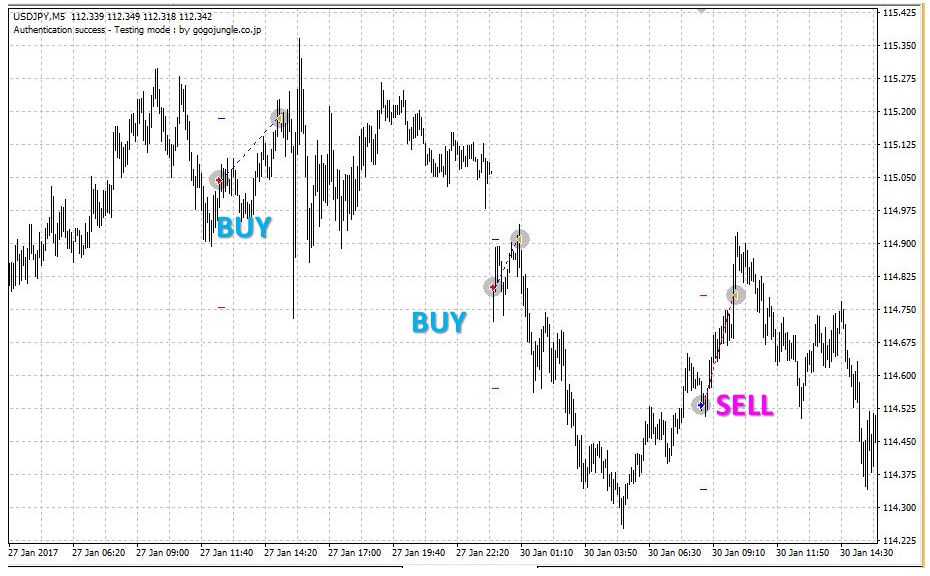

■ Trade Image

Blue arrows: SELL

Red arrows: BUY

Entries place TP and SL at the same time. Depending on the logic, TP and SL differ; for counter-trend strategies, TP is narrower; for trend-following strategies, TP is wider.

Trading frequency is high and SL is tight, so the win rate may not be very high; however, we should verify win rate and risk-reward ratio via backtests.

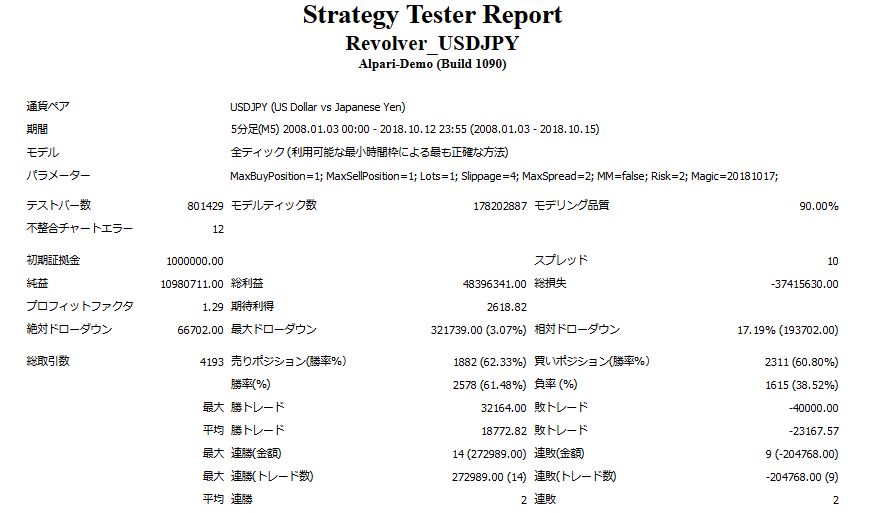

■ Backtest Analysis

2008.01.03-2018.10.15

Spread 1.0

1.0 lot (100,000 units) fixed

Net profit +10,980,000 yen

Total trades 4,193 (about 400 per year)

Maximum drawdown 320,000 yen

Win rate 62%

Average gain 18,772 yen

Average loss -23,167 yen

This was the result.

The profit factor is relatively low at 1.29, so it is a strategy that builds profit gradually by performing many trades.

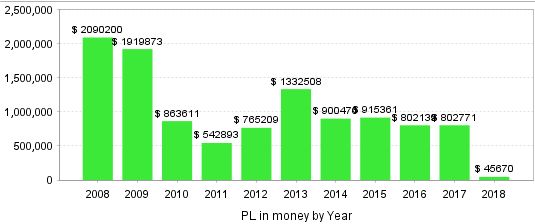

【Monthly P&L】

March and October show a tendency toward slightly more losses, but there is no annual loss overall.

【Annual P&L】

From 2014 to 2017, profits are stable, which is excellent!

The high profits in 2008 and 2009 also indicate that there is the ability to make substantial profits even when volatility increases and the market becomes one-sided.

This suggests the strategy has the capacity to generate meaningful profits in volatile or trending markets.

Looking at annual profits, there isn't a year that is extremely weak; it seems possible to profit in any market conditions.

【Recommended Margin and Expected Annual Return】

Recommended margin per 0.1 lot is

(4.5*2) + (3.2*2) = 15.4 (ten-thousand yen)

This assumes a maximum drawdown of 50%.

Even in the last five years, earning over 800 pips per year, so simplyAnnual return of 50% or moreseems feasible.

In forward testing, with 1 million yen margin at 1.0 lot, the annual return is expected to be 70-80%.

From the perspective of the equity curve, it slowly rises in a zigzag, so this is not about quick big profits but a long-term investment to monitor.