『ATS-12 RSI』 Last week's results ~2025/1/18

Hello everyone! This is ATS BASE.

Starting today, we are offering a special sale on the ATS3 three-pack.

Make your trading more efficient...

And

The ATS series helps you make things certain.

We will introduce the benefits that come from owning three.

▼ Benefits the ATS series brings to you ▼

Advanced analysis using RCI and moving averages

Whether in trending or ranging markets, you can handle both with this single tool!Automatic optimization features instantly extract the best settings

No tedious tuning required. Find the optimal parameters with one click.Reliable data verification with backtesting

You can pre-check performance based on past markets, so you can trade with confidence.Trading email notifications so you won't miss opportunities

Real-time entry and exit alerts by email. Catch important trade timings even when you're away from the screen.Emotion-free trading with semi-automatic exit

One-click automatic exits allow smooth profit-taking and stop losses.

Furthermore,

in trend markets, you won’t miss precise entries,

and in range markets, a strategy targeting reversal points

can be flexibly built!

▼ Special price ▼

ATS-11MA is 20,000 yen.

ATS-12RSI is 22,000 yen.

ATS-13RCI is 24,000 yen.

These three are available for 50,000 yen (tax included)!

Because this is a limited-time offer,

be sure not to miss this chance!

“I want to increase profits efficiently”

“I want more accurate trading”

“I want high profits with small lots!”

If so, please try the ATS series(^^)

Now, back to the main topic...

Please take a look at last week's RSI battle and its results (^_^)

Last Week’s Trading Summary

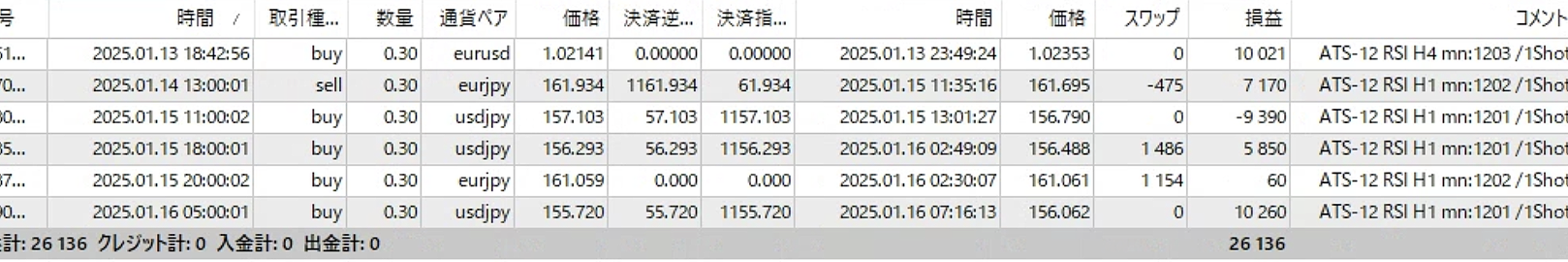

Period: 2024/1/13 to 1/18(Margin 1,000,000 yen / traded at 0.3 Lots)

AutoSearch extracted RSI settings-Used RSI settings-

RSI settings❶

Acquisition/Exit condition for Setup 1

USDJPY H1

Acquisition mode: Return

Number of RSI bars: 10

BUY entry (Open): Enter when RSI dips below 30 and turns up

BUY exit (Close): Exit when RSI turns up above 60

--------------------------------------------------------------------

Sell entry (Open): Enter when RSI turns down after RCI exceeds 70

Sell exit (Close): Exit when RSI turns down below 40

Result:

- Win rate: 66.7% (2 wins, 1 loss)

- Profit: +6,720 yen

- Win rate 66.7% with acceptable stability.

RSI setting ❷

Acquisition/Exit condition for Setup 2

EURJPY H1

Acquisition mode: Return

Number of RSI bars: 12

BUY entry (Open): Enter when RSI dips below 30 and turns up

BUY exit (Close): Exit when RCI turns up above 50

--------------------------------------------------------------------

Sell entry (Open): Enter when RCI exceeds 70 and turns down

Sell exit (Close): Exit when RCI falls below 50 and turns down

Result:

- Win rate: 100.0% (2 wins, 0 losses)

- Profit: +7,230 yen

- Win rate 100.0% with excellent results. We recommend continued monitoring while maintaining the current conditions.

RSI setting ❸

Acquisition/Exit condition for Setup 3

--------------------------------------------------------------------

Result:

- Win rate: 100.0% (1 win, 0 losses)

- Profit: +10,021 yen

- High accuracy achieved in M30.

Results by settingConsiderations

-Overall trends and areas for improvement

The results of this round show generally stable profitability. In particular, RSI settings 2 (EURJPY, H1) and 3 (EURUSD, M30) achieved 100% win rate, delivering efficient trades in short-term trades. Meanwhile, RSI setting 1 (USDJPY, H1) had a 66.7% win rate but still yielded profits. These results indicate each setting suits different market environments, reaffirming the importance of operating under appropriate conditions.

By using AutoSearch while adjusting lot size, there is room to further reduce risk and improve win rate.

Look forward to the next time!

ATS-12RSIPast results(Margin 1,000,000 yen / traded at 0.3 lots)

Period: 2024/12/30–1/4 (one week)

Actual trading data and settings at that time

+2,400 yen

Period: 2024/12/23–12/28 (one week)

Actual trading data and settings at that time

+5,820 yen

Period: 2024/12/16–12/21 (one week)

Actual trading data and settings at that time

+74,352 yen

Period: 2024/12/9–12/14 (one week)

Actual trading data and settings at that time

+15,366 yen

Period: 2024/12/2–12/7 (one week)

Actual trading data and settings at that time

+35,949 yen

Period: 2024/11/25–11/30 (one week)

Actual trading data and settings at that time

+14,813 yen

Period: 2024/11/18–11/23 (one week)

Actual trading data and settings at that time

+72,848 yen

Period: 2024/11/11–11/16 (one week)

Actual trading data and settings at that time

+11,144 yen

Period: 2024/11/4–11/9 (one week)

Actual trading data and settings at that time

+17,337 yen

Period: 2024/10/28–11/2 (one week)

Actual trading data and settings at that time

+24,694 yen

Period: 2024/10/21–2024/10/26 (one week)Period: 2024/10/14–2024/10/19 (one week)

Actual trading data and settings at that time

+3,898 yen

Actual trading data and settings at that time

+62,374 yen

Period: 2024/10/07–2024/10/12 (one week)

Actual trading data and settings at that time

+76,852 yen

ATS’ three trading methodsThree ATS trading methods

1. Beginner: One-shot Trading

Also a high-win-rate solid day-trading mode!

Acquire at the first signal, exit at the scalper mode’s exit point. This enables high-win-rate, reliable trading.

※We recommend this method while you get the hang of it and until you start winning consistently.

This method trades only once between the start flag and the end flag. The points gained are fewer, but it is the highest-win-rate, most reliable of the three. First, set the parameter “ScalMode_Flag” to ON “true.” The chart will display scalping-oriented acquisition and exit points.

① The first flag is the acquisition point.

② Then exit at the scalper exit point.

③ If an end flag appears while holding a position, forcibly exit.

At first, after acquiring point ①, if point ② is displayed, it is safer to exit while in positive territory.

As you gain experience, try aiming for the second and third points and subsequent scalper exits.

■ About settings: The scores on the score panel don’t need to be as high as the other two methods.

2. Intermediate: Scalping Trading

Scalping mode!

This method is a scalping approach that trades several times between the start and end flags.

In some cases, it can collect the most points among the three methods.

First, set the parameter “ScalMode_Flag” to ON “true.” Scalping buy/sell points will be displayed.

① When scalping buy points are displayed, acquire a position.

② Close the position at the exit point.

③ Trade a few times until the end flag appears.

④ If an end flag appears while holding, forcibly exit and wait for the next opportunity.

※ For acquisitions, we may use two main approaches.

One is to acquire one position and wait for the exit point.

The other is to add positions in very small lots at each acquisition point and exit all at the exit point, repeating this cycle.

Either approach can yield results. Start with small lots until you find what works best for you.

Once you’re comfortable with this method and profits are possible, try applying high-standard settings via related systems to achieve even greater results.

■ About settings: This method benefits from high-standard settings. We recommend having the included “ATS-12 RSI AutoSearch.”

We think it’s more efficient to have “ATS-12 RSI AutoSearch” that detects high settings automatically and “ATS-12 RSI 1Click” for one-click acquisition.

3. Intermediate/Advanced: Swing & Day Trading

Basic swing and day trading

This method acquires at the start flag and exits at the end flag in a simple approach.

Set the parameter “ScalMode_Flag” to OFF “false” and hide scalping signs.

① Acquire a position at the start flag.

② Exit at the end flag.

Acquisition/exit is simple, but the settings are actually very important.

Following the signs and trading steadily yields results that match the score panel values exactly.

Also, this method yields the largest profit per trade.

In other words, this method is simple yet demands the highest standard of settings.

■ About settings: This method requires the highest-level settings. We recommend having the included “ATS-12 RSI AutoSearch.”

This post is the part of the table below■that we would like to introduce some of the data extracted from ATS to trade in line with current trends using RSI.

We will introduce how to read and use this data at the end!

(Paid version) |

(All 8 sessions) (Free) |

(Free) |

(Free) |

||

| ATS-12 RSI | [From here] |

Now publicly available for free! [From here] |

to view! [From here] |

|

|

| ATS-13 RCI | [From here] |

Now publicly available for free [From here] |

to view [From here] |

helped me win! [From here] |

|

| ATS-11 Ma | [From here] |

Start planned! |

Please [From here] |

Continuing! [From here] |