"ATS-11 Ma" Last week's results ~2025/1/11

Good evening, everyone! This is ATS BASE.

Starting today, we are offering a special sale for the ATS 3-pack.

The ATS series helps make your trading more efficient and reliable. Here are the benefits that come with having all three.

▼ Benefits that the ATS series brings to you ▼

Advanced analysis using RCI and moving averages

Whether in trending markets or ranging markets, this single tool handles both!Automatic optimization feature instantly extracts the best settings

No annoying adjustments needed. With one click, you can find the optimal parameters.Reliable data verification with backtesting

You can pre-check performance based on past markets, so you can trade with confidence.Trade opportunities not missed with email alerts

Real-time alerts for entry and exit signals via email. You can catch important trading moments even when you’re away from your desk.Emotion-free trading with semi-automatic exits

One-click automatic exits allow smooth profit-taking and stop-loss.

Additionally,you can flexibly build strategies that enter accurately in trending markets and target reversal points in ranging markets!

▼ Special price for a limited time ▼

Three ATS (ATS-11, 12, 13) are now available for limited time at a total price of 50,000 yen (tax included), instead of 20,000 yen, 22,000 yen, and 24,000 yen respectively!

Don’t miss this opportunity!

If you’re thinking, “I want to profit more efficiently” or “I want more precise trading,” please make use of the ATS series.

Why not take the first step that could change your trading future, today?

Now, please take a look at last week's MA battles and their results!

Last Week’s Trading Summary

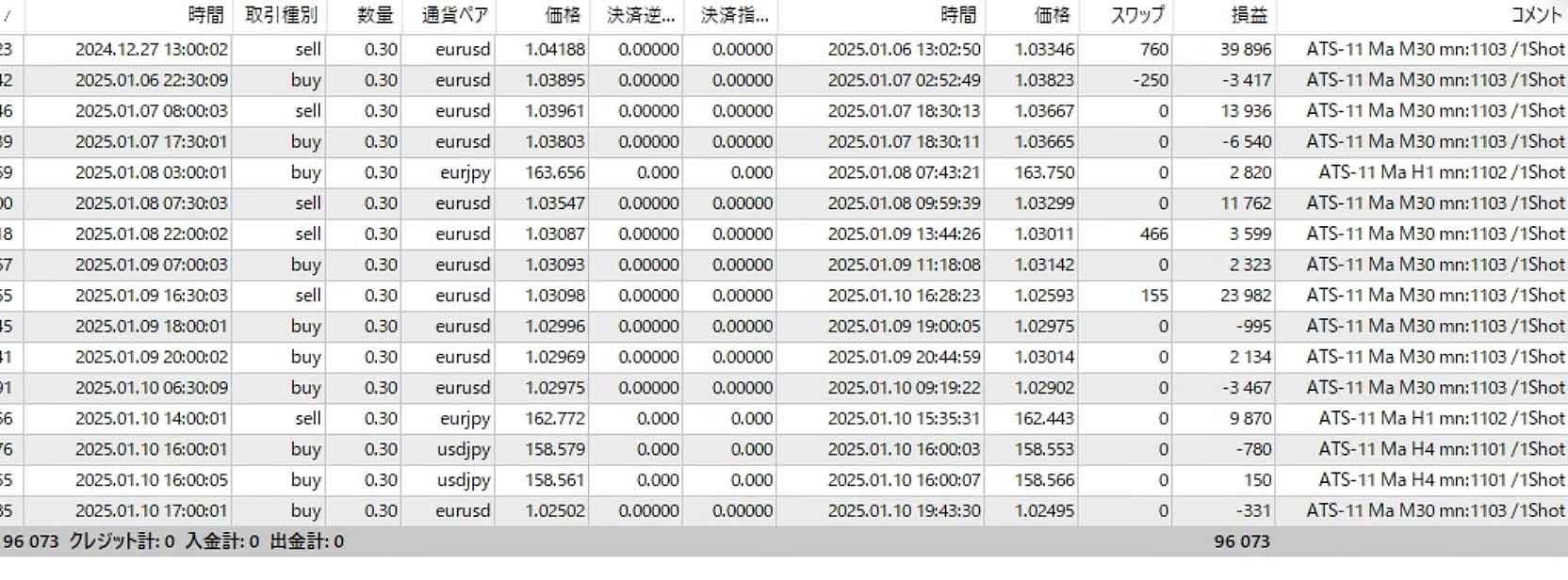

Period: 2025/01/06 to 01/11(Margin 1,000,000 yen / 0.3 Lots traded)

[Trading history image]

- Number of trades: 16

- Wins/Losses: 10 wins, 6 losses

- Win rate: 62.5%

- Profit:+96,073 yen

- Trading method: One-Shot Scalping

Self-assessment

From January 6 to January 11, 2025, we made 16 trades in total, with a win rate of 62.5% and a profit of +96,073 yen, achieving steady results. This run used “One-Shot Scalping,” managing risk while securing efficient profits.

Average profit per trade was about 6,005 yen, yielding generally high profitability. Notably, Setting 3 (EURUSD, M30) accounted for most of the profits and contributed most significantly. Despite a 58.3% win rate, a proper risk-reward ratio generated substantial profits.

Setting 2 (EURJPY, H1) recorded a 100% win rate, highlighting precise entry points and effective trading rules. Although fewer trades, the results aligned with expectations and are commendable.

Conversely, Setting 1 (USDJPY, H4) saw a 50% win rate with a small loss. With fewer trades, longer-term data accumulation will be needed for further analysis.

Overall, risk-reward management was well-handled and each setting performed appropriately. This stable performance results from adherence to trading rules and the precise parameter application by ATS. The results lay a solid foundation for future growth and profitability.

-Used MA settings-

Setting 1

USDJPY H4

Acquisition mode: counter-trend

Number of bars for MA short calculation: 11

Number of bars for MA long calculation: 17

Trading method: scalping

--------------------------------------------------------------------

Setting 2

Acquired/Exit conditions for Setting 2

EURJPY H1

Acquisition mode: counter-trend

Bars for MA short: 22

Bars for MA long: 32

Trading method: scalping

--------------------------------------------------------------------

Setting 3

Acquired/Exit conditions for Setting 3

EURUSD M30

Acquisition mode: counter-trend

Bars for MA short: 11

Bars for MA long: 23

Trading method: scalping

--------------------------------------------------------------------

Results by setting - Considerations

-Overall trends and areas for improvement-

| Setting name | Currency pair | Time frame | MA settings | Win rate | Win/Loss | Profit |

| Setting 1 | USDJPY | H4 | 11/17 | 50.0% | 1 win 1 loss | -630 yen |

| Setting 2 | EURJPY | H1 | 22/32 | 100% | 2 wins 0 losses | +12,690 yen |

| Setting 3 | EURUSD | M30 | 11/23 | 58.3% | 7 wins 5 losses | +82,792 yen |

Observations

- Setting 2’s perfect win result suggests entry points were very appropriate.

- Setting 2’s counter-trend on H1 (22/32) is an effective strategy for catching trend reversals.

- Setting 3 accounted for the majority of overall profit with excellent performance.

- Counter-trend on M30 (11/23) indicates suitability for high-frequency trading when done efficiently.

- Win rate is around 58%, somewhat low, but profitability can be maintained with a proper risk-reward ratio.

Last Week’s Trading Summary

-Overall trends and areas for improvement-

In this week's trading summary, Setting 3 showed particularly strong profitability, significantly improving overall performance. Going forward, further analyzing each setting’s performance in detail and building an efficient trading strategy should yield even higher profits.

Until next week, please look forward to it!

ATS-11MaPast trading results

-ATS-11Ma past trading results-

Period: 2024/12/30 to 2025/01/04 (1 week)

Plus 116,662 yen

Article with trading details here

Period: 2024/12/25 to 2024/12/30 (1 week)

Plus 22,996 yen

Article with trading details here

Period: 2024/12/16 to 2024/12/23 (1 week)

Plus 61,626 yen

Article with trading details here

Period: 2024/12/9 to 2024/12/14 (1 week)

Plus 38,197 yen

Article with trading details here

Period: 2024/12/2 to 2024/12/07 (1 week)

Plus 8,310 yen

Article with trading details here

Period: 2024/11/25 to 2024/11/30 (1 week)

Plus 114,524 yen

Article with trading details here

Period: 2024/11/18 to 2024/11/23 (1 week)

Plus 32,610 yen

Article with trading details here

Period: 2024/11/11 to 2024/11/16 (1 week)

Plus 32,730 yen

Article with trading details here

Period: 2024/11/04 to 2024/11/09 (1 week)

Plus 63,763 yen

Article with trading details here

Period: 2024/10/28 to 2024/11/02 (1 week)

Plus 11,734 yen

Article with trading details here

Period: 2024/10/21 to 2024/11/26 (1 week)

Plus 56,002 yen

Article with trading details here

Period: 2024/10/14 to 2024/11/19 (1 week)

Plus 17,908 yen

Article with trading details here

Plus 85,304 yen

Article with trading details here

ATS-11 MAWhy can we consistently profit?

ATS-11 MA is the optimal tool to support “profitable moving average trades.”

It solves common onboarding worries for beginners like settings and risk management,

making it possible to achieve stable profits with low risk.

If you are using moving averages for trading and feel you are not winning as you’d hoped,

ATS-11 MA might be the answer.

MA crossover: the strongest sign tool to find winning settings

ATSThree trading methods Note: the image is reused from the “ATS-12 RSI” version, but the specifications are the same.

1. Beginner: One-Shot Trade -One Shot Trade-

Also a high-win-rate solid day trading mode!

Acquisition occurs on the first signal, exit at the scalping mode exit point.

A high-win-rate, solid trade is possible.

※ We recommend this method until you get the hang of it and start winning.

This method trades only once between the start flag and the end flag.

The points you can gain are few, but it’s the highest-win-rate and most reliable among the three methods.

First, set the parameter “ScalMode_Flag” to ON “true.”

A scalping-oriented acquisition and exit points will be displayed on the chart.

1) The first flag is the acquisition point.

2) Then exit at the scalping exit point.

3) If an end flag appears while the position is held, forcibly close the position.

At first, after acquiring point 1 and when point 2 is displayed, it is more prudent to exit at a profit.

As you gain experience, try to target the second and third points and subsequent scalping exits.

About settings: The panel numbers do not need to be as high as the other two methods.

2. Intermediate: Scalping Trade -Scalping Trade-

Change settings for full-on scalping too!

This scalping method trades several times between the start and end flags.

In some cases, it can yield the most points among the three methods.

First, set the parameter “ScalMode_Flag” to ON “true.” The scalping acquisition and exit points will be displayed.

① When scalping acquisition points are displayed, open a position.

② Close the position at the exit point.

③ Trade several times until the end flag is displayed.

④ If an end flag appears while you hold a position, forcibly close it and wait for the next opportunity.

※ There are two main approaches to acquisitions among us.

One: after acquiring one position, wait for the exit point and close at that point.

Another: with very small lots, add positions at each acquisition point and exit all at the exit point, repeating.

Either approach can work. Until you’re comfortable, start with small lots and find the method that suits you.

As you become more comfortable and profits accumulate, try higher-level settings using related systems. This should yield even greater results.

■ About settings: high-level settings are recommended for this method. It’s advisable to have the bundled “ATS-11 Ma AutoSearch.”

This post continues in the following table.■Here, we will share a portion of the data extracted from “ATS” to trade in line with the current trend using RSI.

We will revisit how to read and use this data at the end!

(Paid version) |

(All 8 sessions) (Free) |

(Free) |

(Free) |

||

| ATS-12 RSI | [Click here] |

Publicly available for free! [Click here] |

to view! [Click here] |

Continuing strong [Click here] |

|

| ATS-13 RCI | [Click here] |

Publicly available for free! [Click here] |

and available! [Click here] |

helped me win! [Click here] |

|

| ATS-11 Ma | [Click here] |

to commence! |

Available here [Click here] |

|