Profits greatly outweigh losses! A 『山紫水明』 with a good risk-return ratio

There is no difference between TP and SL, and profits overwhelmingly exceed losses!

RiskHigh-turnover 'Sansui Suimei'

[Sansui Suimei - Overview]

Currency pair: [EUR/JPY]

Style: [Scalping][Day Trading]

Maximum number of positions: 4; others: adjustable within the range 4 (1–8)

Timeframe used: M5

Stop loss: 130

Take profit: 120

【エントリロジックについて】

Using MT4's standard technical indicators, check the trend direction on higher timeframes, and enter when oscillators move in the opposite direction; this simple pullback buy / retracement sell method entries at the candlestick open and exits.

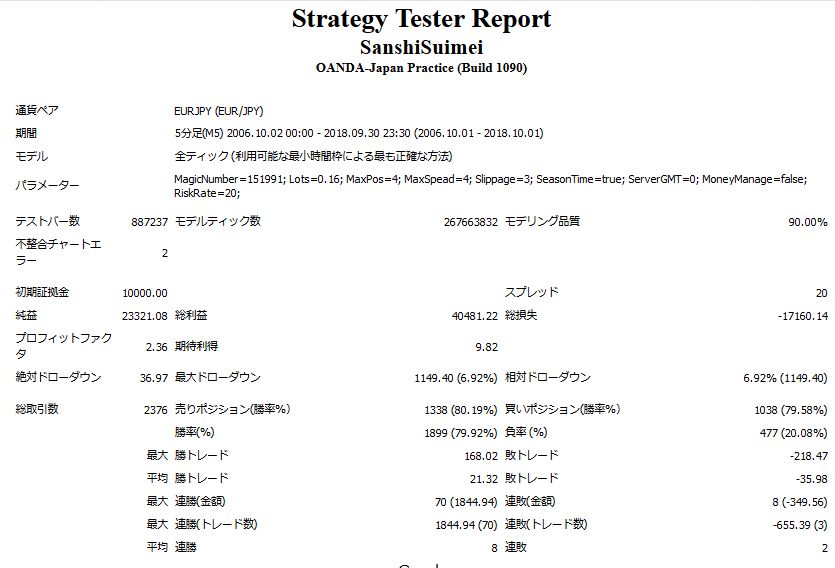

【バックテスト分析】

2006.10.01-2018.09.30

Fixed 0.16 lots

Maximum held positions: 4

Net profit +$23,321

Maximum drawdown: $1,149

Total trades: 2,376 (average about 200 per year)

Win rate: 79%

This is what it turned out.

There it is.

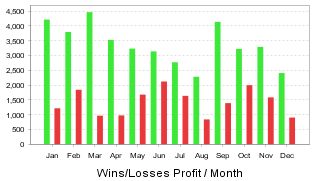

【月別・年別損益】

There are few negative months on a monthly basis.

By year, 2008 and 2009 stand out.

Over the past five years, profits have been relatively modest, but 2018 has been performing well.

(All profits are based on 0.16 lots.)

Let's take a closer look

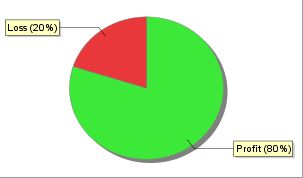

This is the monthly average profit-to-loss graph. Profits are larger than losses.

Overall, the profit-to-loss ratio is 80:20!

This is because there is no difference between TP and SL (TP 120 pips: SL 130 pips), and the win rate is about 80%, making it quite favorable.

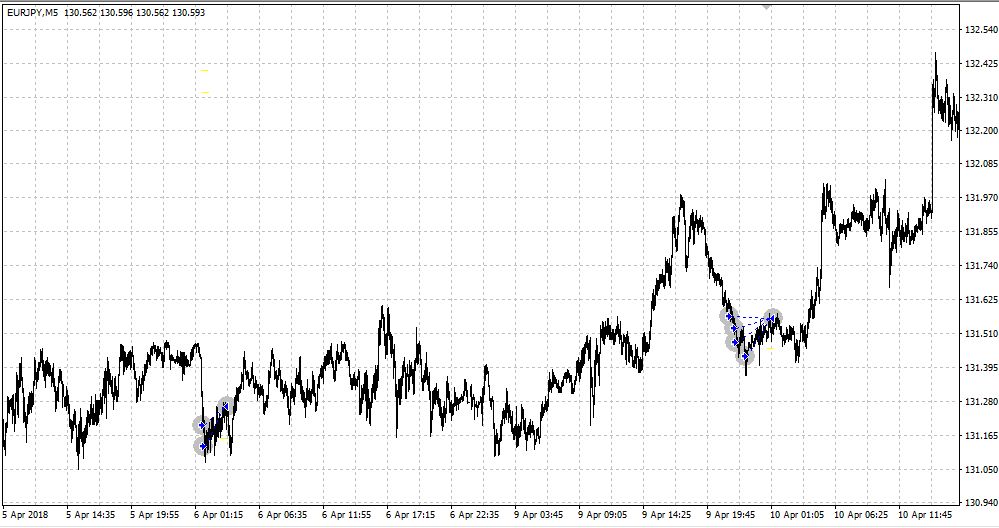

【トレードイメージ】

Blue: BUY

Red: SELL

With up to 4 positions, we perform pullback buying and retracement selling.

If losses occur, we perform partial closes to minimize overall loss.

For profits, trailing is used, so you may sometimes obtain unexpected profits.

【推奨証拠金について】

If you refer to the maximum drawdown by lot size described on the sales page,

The maximum drawdown per 0.1 lot is $590, so at 110 JPY per USD, calculation yields

(5.1*4) + (6.5×2) = 456,000 JPY

This is the result.

If you want to limit maximum drawdown to 50%, you can operate with a 0.1 lot setting per 450,000 yen.

If you operate with the default 0.16 lots,

((5.1*1.6*4) + (12.6×2)) = 33.4

With a 50% maximum drawdown risk tolerance, you can start from around 33.4万円.

【見込める期待年利・獲得pipsは?】

The figure above shows the annual return for an account of 1,000,000 yen, but with a 1,000,000 yen account you can operate at about 0.5 lots, soannual return of 50%–60%is expected.

With proper money management, aim for annual returns over 50%!

Also, since the currency pair is EURJPY, it is recommended as part of a portfolio.