『ATS-13 RCI』 Last week's results ~2025/1/11

Good evening, everyone. This is ATS BASE.

Last week's trading results reaffirmed the effectiveness of the trading method and its settings. Trades were executed based on RCI settings extracted by the auto-search function, achieving a win rate of 75% and a profit rate of 4.63% relative to the margin. This indicates stable performance even in a short period and will serve as a major guideline for future trades.

In particular, the EURUSD (H4, 13 bars) settings demonstrated standout results, generating stable profits. Meanwhile, USDJPY (H4, 14 bars) and EURJPY (H1, 17 bars) settings also hold potential, and further trading data accumulation is required. Based on these results, you should proceed to build an efficient trading strategy with controlled risk.

Below is a detailed explanation of the analysis results for each setting, the insights gained, and the future policy.

Please take a look now.

Last Week's Trading Summary Period: 2025/01/06~01/11

(Trading with margin 1,000,000 JPY / 0.3 Lots)

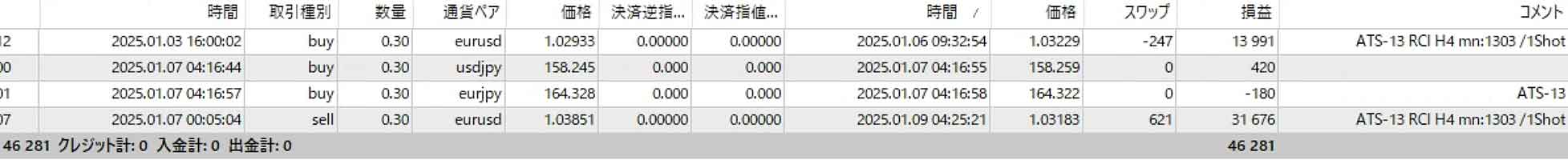

[Trading history image]

Self-evaluation

RCI Settings Used:Three types (USDJPY H4, EURJPY H1, EURUSD H4)

- RCI SettingsThat❶ -

Acquisition conditions for Setting 1

USDJPY H4

Acquisition mode is Return

Number of RCI bars is 14

BUY entry (Open): Enter when RCI rebounds below -90

BUY exit (Close): Exit when RCI rebounds above 10

--------------------------------------------------------------------

Sell entry (Open): Enter when RCI rebounds above 10

Sell exit (Close): Exit when RCI rebounds below -90

- RCI SettingsThat❷-

Acquisition conditions for Setting 2

EURJPY H1

Acquisition mode is Return

Number of RCI bars is 17

BUY entry (Open): Enter when RCI rebounds below -70

BUY exit (Close): Exit when RCI rebounds above 10

--------------------------------------------------------------------

Sell entry (Open): Enter when RCI rebounds above 70

Sell exit (Close): Exit when RCI rebounds below -10

- RCI SettingsThat❸-

Acquisition conditions for Setting 3

EURUSD H4

Acquisition mode is Return

Number of RCI bars is 13

BUY entry (Open): Enter when RCI rebounds below -80

BUY exit (Close): Exit when RCI rebounds above 0

--------------------------------------------------------------------

Sell entry (Open): Enter when RCI rebounds above 80

Sell exit (Close): Exit when RCI rebounds below 0

Results by settingDiscussion

-Overall trends and areas for improvement-

| Setting name | Currency pair | Timeframe | RCI bar count | Win rate | Result | Profit |

| Setting 1 | USDJPY | H4 | 14 bars | 100.0% | 1 win 0 losses | +420 yen |

| Setting 2 | EURJPY | H1 | 17 bars | 0% | 0 wins 1 loss | -190 yen |

| Setting 3 | EURUSD | H4 | 13 bars | 100.0% | 2 wins 0 losses | +45,667 yen |

In this analysis of the performance of the RCI settings, the settings extracted by the auto-search function showed different performance across the board. In particular, the EURUSD (H4, 13 bars) setting stood out, achieving a win rate of 100% and a large profit (+45,667 yen). This setting is currently the most reliable and is likely to become the mainstay for future trading.

On the other hand, USDJPY (H4, 14 bars)andEURJPY (H1, 17 bars) had few trades or did not show results.

Overall, the H4 timeframe settings demonstrated relatively stable results. Based on this trend, continue to use the auto-search function and identify settings that can deliver stable performance.

Last Week'sTrade SummaryLast week's trade summary

That concludes last week's results! See you all again next week!

ATS Three-Pack Special SaleSpecial sale of ATS 3-pack

(Trading with margin 1,000,000 JPY / 0.3 lots)

| Period: 2024/12/30~1/4 (1 week) | +8 yen | Settings here |

| +7,161 | Settings here |

| Period: 2024/12/16~12/21 (1 week) | +38,141 yen | Settings here |

| Period: 2024/12/9~12/14 (1 week) | +49,029 yen | Settings here |

| Period: 2024/12/2~12/7 (1 week) | +13,849 yen | Settings here |

| Period: 2024/11/25~11/30 (1 week) | +6,655 yen | Settings here |

| Period: 2024/11/18~2024/11/23 (1 week) | +20,637 yen | Settings here |

| Period: 2024/11/11~2024/11/16 (1 week) | +5 yen | Settings here |

| Period: 2024/11/4~2024/11/9 (1 week) | +15,207 yen | Settings here |

| Period: 2024/10/28~2024/11/2 (1 week) | +35,505 yen | Settings here |

| Period: 2024/10/21~2024/10/26 (1 week) | +972 |

Period: 2024/10/14~2024/10/21 (1 week) | +49,746 | |

| Period: 2024/10/07~2024/10/12 (1 week) | +49 yen | Settings here |

Three trading methods using ATSTraders

Images are reused from the “ATS-12 RSI” version. The specifications are the same.

1. Beginner: One-shot Trade

【Trading Method 1】A solid high-win-rate day trading mode as well!

Acquisition occurs at the first signal, and the exit occurs at the scalping mode exit point. A high-win-rate, solid trade is possible.

※ We recommend this method until you master it and can win consistently.

This method trades only once between the start flag and end flag. The points gained are modest, but it is the method with the highest win rate among the three and is the most reliable. First, set the parameter “ScalMode_Flag” to ON “true”. The chart will display acquisition and exit points suitable for scalping.

① The first flag is the acquisition point.

② Then exit at the scalping exit point.

③ If an end flag appears while holding a position, forcibly exit then.

At first, after the ① acquisition and when the ② point is shown, it is more prudent to exit early at a profit.

As you gain familiarity, aim for the second, third points and subsequent scalping exits.

■ About the settings: The score panel values do not need to be as high as the other two methods.

2. Intermediate: Scalping Trade

【Trading Method 2】Scalping mode!

This method involves several trades between the start and end flags as a scalping technique. Depending on the case, it can yield the most points among the three methods.

First, set the parameter “ScalMode_Flag” to ON “true”. Scalping acquisition and exit points will be displayed.

① When the scalping acquisition point is displayed, enter the position.

② Exit the position at the exit point.

③ Trade several times until the end flag is displayed.

④ If the end flag appears while holding a position, forcibly exit and wait for the next opportunity.

※ For acquisition, we may use two main approaches among these methods.

One is to acquire one position and wait for the exit point.

The other is to add positions in very small lots at each acquisition point and exit fully at the exit points, repeating this process.

Any approach can yield results. Until you get used to it, start with small lots and find the method that suits you.

Once you are comfortable with this method and begin to generate profits, try applying higher-set values using related systems. You should achieve even greater results.

■ About the settings: This method benefits from high-level settings. It is recommended to use the included “ATS-13 RCI AutoSearch.”