"ATS-12 RSI" Last week performance ~2025/1/5

Good evening, everyone! This is ATS BASE.

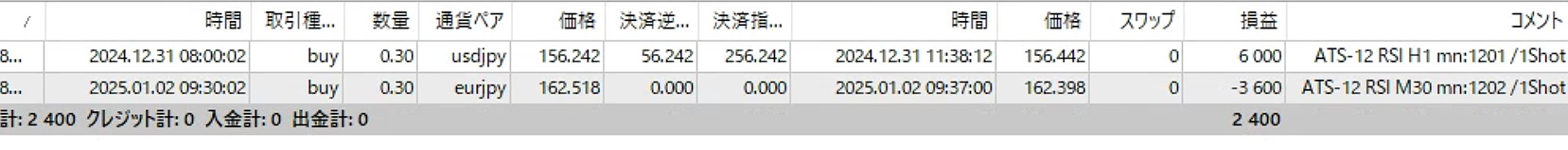

Last week's trading was only two times.

However, the result was a small but definite success: a profit of +2,400 yen. The key to the success was not just a standard RSI setting, but the high-quality RSI setting value extracted by ATS-12 AutoSearch tailored to market characteristics.

With this setting, we accurately captured a big rebound in USDJPY to achieve winning trades.

We will specifically analyze how ATS's setting values were helpful and

provide tips for the next success.

Please stay with us until the end!

Last week's trading summary

Period: 2024/12/30~2025/1/4(Trading with margin 1,000,000 yen / 0.3 Lots)

RSI settings used-Used RSI settings-

RSI Setting ❶

Setting 1 entry/exit conditions

USDJPY H1

Entry mode is Return

Number of candles for RSI calculation is 12

BUY entry (Open): Enter when RSI dips below 30 and turns upward

BUY exit (Close): Exit when RCI turns downward from above 60

--------------------------------------------------------------------

Sell entry (Open): Enter when RCI turns downward from above 70

Sell exit (Close): Exit when RCI turns upward from below 40

The RSI value of 12, extracted by ATS-12 AutoSearch, is a short-term setting that matches USDJPY's current characteristics very well and provided highly accurate signals. As a result, we could enter at appropriate turning points and secure profits from the large rebound. Also, the timing of exits using RCI was excellent, helping avoid unnecessary holding risk.

RSI Setting ❷

Setting 2 entry/exit conditions

EURJPY M30

Entry mode is Return

Number of candles for RSI calculation is 12

BUY entry (Open): Enter when RSI dips below 30 and turns upward

BUY exit (Close): Exit when RCI turns downward from above 60

--------------------------------------------------------------------

Sell entry (Open): Enter when RCI turns downward from above 70

Sell exit (Close): Exit when RCI turns upward from below 40

EURJPY on M30 incurred a temporary loss due to short-term noise. However, the RSI=12 value selected by ATS-12 AutoSearch was not bad, and the timing of the rebound was accurate. As a result, the market moved against the signal briefly, but the quality of the signal is considered high.

Last week's trading summary

-Overall trends and areas for improvement-

This trading result achieved +2,400 yen profit despite a 50% win rate because the risk-reward ratio was favorable. In particular, with setting 1 (USDJPY H1), using the high-quality RSI settings extracted by ATS-12 AutoSearch allowed accurate rebound point identification and profit generation.

On the other hand, setting 2 (EURJPY H30) resulted in a loss, which is attributed to short-term footprint effects. The quality of the RSI setting itself is high, and in the future, changing timeframes to H1 or similar may have improved performance.

By continuing to use ATS-12 AutoSearch to extract optimal settings tailored to each market, stable profits can be accumulated.

Look forward to the next installment!

ATS-12 RSI Past results(Trading with margin 1,000,000 yen / 0.3 lots)

Period: 2024/12/23~12/28 (1 week)

Actual trading data and settings at that time are here

+5,820円

Period: 2024/12/16~12/21 (1 week)

Actual trading data and settings at that time are here

+74,352円

Period: 2024/12/9~12/14 (1 week)

Actual trading data and settings at that time are here

+15,366円

Period: 2024/12/2~12/7 (1 week)

Actual trading data and settings at that time are here

+35,949円

Period: 2024/11/25~11/30 (1 week)

Actual trading data and settings at that time are here

+14,813円

Period: 2024/11/18~11/23 (1 week)

Actual trading data and settings at that time are here

+72,848円

Period: 2024/11/11~11/16 (1 week)

Actual trading data and settings at that time are here

+11,144円

Period: 2024/11/4~11/9 (1 week)

Actual trading data and settings at that time are here

+17,337円

Period: 2024/10/28~11/2 (1 week)

Actual trading data and settings at that time are here

+24,694円

Period: 2024/10/21~2024/10/26 (1 week)

Actual trading data and settings at that time are here

+3,898円

Period: 2024/10/14~2024/10/19 (1 week)

Actual trading data and settings at that time are here

+62,374円

Period: 2024/10/07~2024/10/12 (1 week)

Actual trading data and settings at that time are here

+76,852円

ATS's three trading methodsThree ATS trading methods

1. Beginner: One-shot Trade

Also a high-win-rate solid day trading mode!

Enter at the first signal, exit at the scalping mode's exit point. A high-win-rate, solid trade is possible.

※ We recommend this method until you get the hang of it and start winning.

This method trades only once between the start flag and the end flag. The potential points are few, but it is the highest win-rate and most reliable among the three methods. First, set the parameter “ScalMode_Flag” to ON “true.” The chart will display entry/exit points suitable for scalping.

① The first flag is the entry point.

② Then exit at the scalping exit point.

③ If an end flag appears while holding a position, forcibly exit then.

At first, after entry ①, if the ② point is displayed, it is more prudent to exit early at a profit.

As you gain experience, aim for the second and third points and subsequent scalping exit points.

■ About the settings: The numbers on the score panel do not need to be as high as the other two methods.

2. Intermediate: Scalping Trade

Scalping mode!

This method is a scalping technique that trades several times between the start flag and the end flag.

In some cases, it can capture the most points among the three methods.

First, set the parameter “ScalMode_Flag” to ON “true.” Scalping entry/exit points will be displayed.

① When the scalping entry point is displayed, enter a position.

② Exit the position at the exit point.

③ Trade a few times until the end flag is displayed.

④ If an end flag appears while holding a position, forcibly exit and wait for the next opportunity.

※ For entry, we may use two main approaches among this method.

One: after entering one position, simply wait for the exit point.

Another: with very small lots, add positions at each entry point and exit at the exit point, repeating this process.

Either approach can yield results. Until you get used to it, start with small lots to find a method that fits you.

As you become proficient and profits accumulate, try applying the method using higher-level settings with related systems. You may achieve even greater results.

■ About settings: This method benefits from higher-level settings. It is recommended to prepare the accompanying “ATS-12 RSI AutoSearch.”

Having the high-setting value automated detection with “ATS-12 RSI AutoSearch” and one-click entry with “ATS-12 RSI 1Click” will likely help you achieve results more efficiently.

3. Intermediate- to advanced: Swing & Day Trading

Basic swing and day trading

This method buys on the start flag and sells on the end flag in a simple manner.

Set the parameter “ScalMode_Flag” to OFF “false” and hide scalping signs.

① Enter a position at the start flag.

② Exit at the end flag.

Entry and exit are very simple, but the settings values are actually very important.

Trading according to the signs yields results that match the score panel numbers.

Also, this method yields the largest profit or loss per trade.

In other words, this method is simple yet requires the highest-level settings.

■ About settings: This method requires the highest-level settings. It is recommended to have the accompanying “ATS-12 RSI AutoSearch.”

This post's next section is the■part.

Using RSI to trade in line with current trends, we would like to share some of the data extracted by “ATS.”

We will revisit how to read and use this data at the end!

(Paid version) |

(All 8 sessions) (Free) |

(Free) |

(Free) |

||

| ATS-12 RSI | [From here] |

Free public release! [From here] |

now! [From here] |

|

|

| ATS-13 RCI | [From here] |

Free public release 【From here】 |

now! [From here] |

let you win! [From here] |

|

| ATS-11 Ma | [From here] |

Start planned! |

【From here】 |

Continuing! [From here] |