"ATS-12 RSI" Last week's performance ~ 2024/12/28

Good evening everyone! This is ATS BASE.

Last week, although the number of trades was small,

we were able to secure definite profits.

Behind this successlies the settings values extracted by ATSwhich played a major role.

Thanks to the settings, we could avoid unnecessary trades that don’t fit the current market, and

we achieved risk-limited trading.

This strategy, which generates profits while maintaining trading stability, will likely be a key to future success.

In this article, we will closely review last week’s trading activities,

explain the characteristics and effects of the RSI settings used, and discuss points for improvement.

We will analyze specifically how ATS’s setting values helped, and

provide hints for the next success.

Please stay with us until the end!

Last Week’s Trading Summary

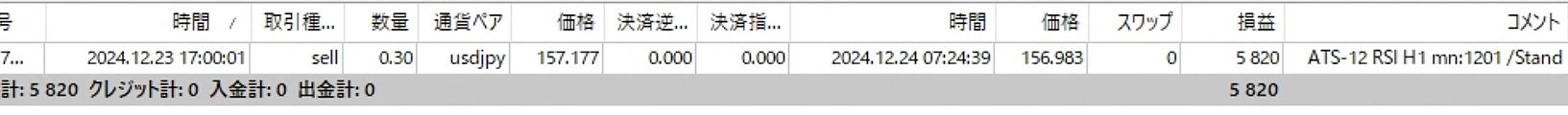

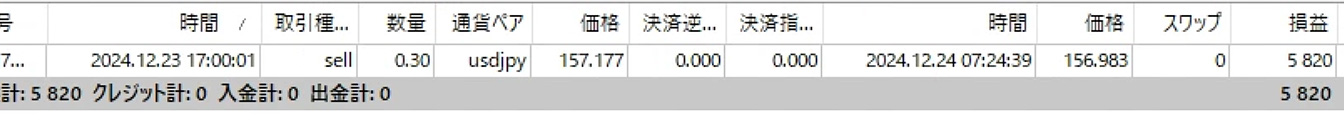

Period: 2024/12/23~12/28(Margin 1,000,000 JPY / 0.3 Lots traded)

[Trading history image]

- Number of trades: 1

- Result: 1 win, 0 losses

- Win rate: 100%

- Profit: +5,820 JPY

- Trading method: Swing & Day trading

Positive points:

- Did not incur losses.

- Ended trades with profits, even if small.

Effect of RSI settings

Effect:

- High accuracy on the short-term timeframe (H1); reversals below RSI 30 were effective

- Entries and exits at trend reversal points were executed appropriately.

- The given exit conditions may be leaning toward quicker profit realization.

Used RSI settings-Used RSI settings-

Setting 1

Acquisition/Exit Conditions for Setting 1

USDJPY H1

Acquisition mode: Return

Number of RSI calculation bars: 10

BUY Open: Acquire when RSI dips below 30 and reverses

BUY Close: Exit when RSI reverses above 60

--------------------------------------------------------------------

Sell Open: Acquire when RSI reverses above 70

Sell Close: Exit when RSI reverses below 40

Characteristics:

RSI calculation period is slightly longer (12 bars) to emphasize stability.

An approach focusing on short-term entries.

Advantages:

Flexible with a short-term trend-following approach.

Suitable for day trading with quick profit realization.

Setting 2

Acquisition/Exit Conditions for Setting 2

USDJPY M30

Acquisition mode: Return

RSI calculation bars: 12

BUY Open: Acquire when RSI dips below 35 and reverses

BUY Close: Exit when RSI reverses above 70

--------------------------------------------------------------------

Sell Open: Acquire when RSI reverses above 65

Sell Close: Exit when RSI reverses below 30

Characteristics:

RSI calculation period is slightly longer (12 bars) to emphasize stability.

An approach focused on short-term entries.

Advantages:

Flexible with a short-term trend-following approach.

Suitable for day trading with quick profit realization.

Overall trends and areas for improvement

-Overall trends and areas for improvement-

- Current methods are cautious and emphasize safety.

- Effectiveness of the settings has been confirmed.

- Trading frequency was low; overall profit efficiency is limited.

Last Week’s Trading Summary

-Overall trends and areas for improvement-

Even in last week’s trades, we were able to profit. This shows the trading strategy base is solid, and I believe we can move forward with even more confidence.

Meanwhile, the low number of trades is because ATS’s extracted settings effectively excluded entries that did not fit the current market, meaning we avoided wasteful trades. This helped reduce risk.

Going forward, we plan to fine-tune settings according to market conditions and optimize trade frequency while evolving the strategy further. We will maximize the use of ATS-provided settings to pursue efficient and sustainable trading!

ATS-12RSI

Past results(Margin 1,000,000 JPY / 0.3 lots traded)

Period: 2024/12/16~12/21 (1 week)

Actual trading data and settings at that time are here

+74,352 JPY

Period: 2024/12/9~12/14 (1 week)

Actual trading data and settings at that time are here

+15,366 JPY

Period: 2024/12/2~12/7 (1 week)

Actual trading data and settings at that time are here

+35,949 JPY

Period: 2024/11/25~11/30 (1 week)

Actual trading data and settings at that time are here

+14,813 JPY

Period: 2024/11/18~11/23 (1 week)

Actual trading data and settings at that time are here

+72,848 JPY

Period: 2024/11/11~11/16 (1 week)

Actual trading data and settings at that time are here

+11,144 JPY

Period: 2024/11/4~11/9 (1 week)

Actual trading data and settings at that time are here

+17,337 JPY

Period: 2024/10/28~11/2 (1 week)

Actual trading data and settings at that time are here

+24,694 JPY

Period: 2024/10/21~2024/10/26 (1 week)

Actual trading data and settings at that time are here

+3,898 JPY

Actual trading data and settings at that time are here

+62,374 JPY

Period: 2024/10/07~2024/10/12 (1 week)

Actual trading data and settings at that time are here

+76,852 JPY

Stay tuned for the next time as well!

‘ATS-12 RSI’ is a low-risk tool that has succeeded in steadily accumulating profits.

The key lies in selecting settings and correctly judging trends, maintaining high performance.

In particular, it can be an ideal choice for traders aiming for stable income!

ATS’s

Three trading methodsThree ATS trading methods

1. Beginner: One-shot Trade

【Trading Method 1】A highly reliable day-trading mode with high win rate too!

Acquisition is at the first signal, exit at the scalping mode’s exit point. A high-win-rate and solid trade is possible.

*We recommend this method until you get the hang of it and start winning.

This method trades only once between the start flag and the end flag. The points you can gain are few, but it is the most profitable and steady of the three. First, set the parameter “ScalMode_Flag” to ON “true.” The chart will display acquisition and exit points suitable for scalping.

① The first flag is the acquisition point.

② Then exit at the scalping exit point.

③ If an end flag appears while holding a position, forcibly exit.

At first, after acquiring at ①, when the ② point is displayed, it is more prudent to exit at the positive stage.

As you gain experience, aim for the second and third points, and then the subsequent scalping exit points.

■ About settings: The score panel values do not need to be as high as the other two methods.

2. Intermediate: Scalping Trade

【Trading Method 2】Scalping mode!

This method involves multiple trades between the start and end flags—an actual scalping approach. Depending on the case, you can accumulate more points than the other methods.

First, set the parameter “ScalMode_Flag” to ON “true.” Scalping acquisition and exit points will be displayed.

① When the scalping acquisition point is displayed, acquire the position.

② Exit at the exit point.

③ Trade a few times until the end flag is shown.

④ If an end flag appears while holding a position, forcibly exit and wait for the next opportunity.

※ For acquisitions, we use two main approaches among these methods.

The first is to acquire one position and then wait for the exit point.

The other is to add positions in very small lots at each acquisition point, and exit all at the exit point, repeating this process.

Either approach can produce results. Until you’re accustomed, start with small lots and find the method that suits you best.

Once you’re comfortable with this method and profits are possible, try implementing with higher-level settings using a related system. I believe you can achieve even greater results.

■ About settings: This method recommends preparing high-level settings.

Using “ATS-12 RSI AutoSearch” to automatically detect high settings and “ATS-12 RSI 1Click” for one-click acquisition will likely yield more efficient results.

3. Intermediate & Advanced: Swing & Day Trade

【Trading Method 3】Basic swing and day trading

This method acquires at the start flag and exits at the end flag in a simple manner.

Set the parameter “ScalMode_Flag” to OFF “false,” and hide scalping signals. 1) Acquire at the start flag.

2) Exit at the end flag.

Acquisition and exit are very straightforward, but the settings themselves are very important.

If you trade as signaled, the score panel numbers will reflect the results exactly.

Also, profit and loss per trade tends to be the largest with this method.

In other words, this method is simple and requires the highest level of settings.

■ About settings: This method requires the highest level of settings. We recommend having the included “ATS-12 RSI AutoSearch.”

This post’s next section is in the table below.■Here we introduce part of the ATS data extracted to trade in line with the current trend using RSI.

We will later revisit how to read and use this data!

(Paid version) |

(All 8 sessions) (Free) |

(Free) |

(Free) |

||

| ATS-12 RSI | [From here] |

Publicly available now! [From here] |

From here [From here] |

|

|

| ATS-13 RCI | [From here] |

Publicly available 【From here】 |

From here [From here] |

[From here] |

|

| ATS-11 Ma | [From here] |

Upcoming start! |

From here [From here] |

Continuing! [From here] |