『ATS-13 RCI』 Last week's results ~2024/12/28

Good evening everyone. This is ATS BASE.

Currently, the trading style at ATS-13 is

to quietly pursue stable profits with a risk-controlled approach

by adopting a solid strategy.

Please take a look right away.

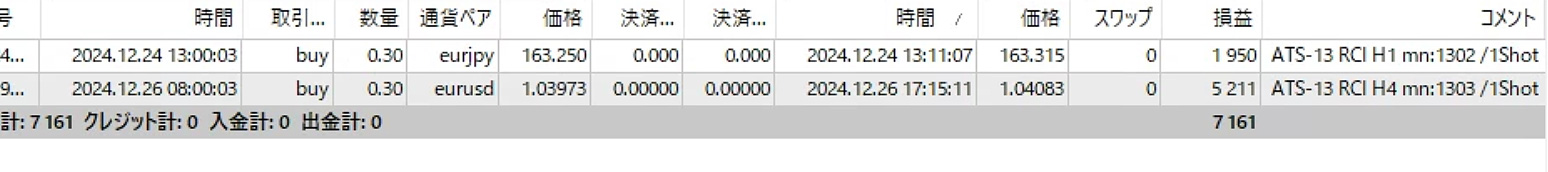

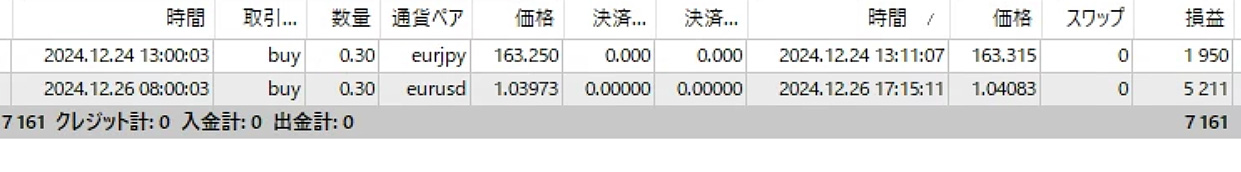

Last week's trading summary Period: 2024/12/23~12/28

(Trading with margin 1,000,000 yen / 0.3 Lots)

[Trade history image]

Self-evaluation

- High-profit stability:

- Although trade count is low, a 100% win rate secures stable profits.

- Low-risk operation while generating profit is a major merit.

Effectiveness of the RCI settings

- Features of RCI:

- Uses different currency pairs and timeframes for each setting to handle diverse market conditions.

- Efficiently extracts optimal trading conditions via auto-search.

- Effectiveness:

- Since profits have been consistently achieved, the RCI settings are effective.

- On the other hand, declines in profits depend on the setting's adaptability to market volatility.

RCI settings used:Three types (USDJPY H1, EURJPY H1, EURUSD H4)

- Each setting trades on different pairs and timeframes based on the RCI mode, period, entry level, and exit level.

Setting 1

Acquisition/exit conditions for Setting 1

USDJPY H1

Acquisition mode is Return

Number of RCI candlesticks is 28

BUY entry (Open): Enter when RCI rebounds below -80

BUY exit (Close): Exit when RCI rebounds above 30

--------------------------------------------------------------------

Sell entry (Open): Enter when RCI rebounds above 80

Sell exit (Close): Exit when RCI rebounds below -30

- Aimed at catching clear trend reversals.

- Longer RCI period of 28 helps filter short-term noise.

- Suitable for capturing mid-term trends.

- USDJPY is relatively stable; settings may align well.

Setting 2

Acquisition/exit conditions for Setting 2

EURJPY H1

Acquisition mode is Return

Number of RCI candlesticks is 16

BUY entry (Open): Enter when RCI rebounds below -80

BUY exit (Close): Exit when RCI rebounds above 0

--------------------------------------------------------------------

Sell entry (Open): Enter when RCI rebounds above 80

Sell exit (Close): Exit when RCI rebounds below 0

- Better handles shorter-term moves than Setting 1.

- Catches mid-term trend changes more quickly.

- Reacts sensitively to the volatile EURJPY.

- Exit points are centered at 0 in the RCI, allowing earlier profit-taking.

Setting 3

Acquisition/exit conditions for Setting 3

EURUSD H4

Acquisition mode is Line Out

Number of RCI candlesticks is 13

BUY entry (Open): Enter when RCI rebounds below -80

BUY exit (Close): Exit when RCI rebounds above 30

--------------------------------------------------------------------

Sell entry (Open): Enter when RCI rebounds above 80

Sell exit (Close): Exit when RCI rebounds below -30

- Focuses on long-term trends.

- Because the RCI period is short, it moves relatively quickly.

- On H4, trends tend to become clear.

- Combining short-term RCI with long timeframe tends to generate profits.

Overall trends, improvements

RCI modes and periods:

- Settings 1 and 2 use Return to target reversals.

- Setting 3 uses Line Out to chase a clear trend.

- Compare performance by mode and select the advantageous mode for specific market conditions.

Exit point adjustments:

- Setting 2's Exit at 0 leads to early profit-taking.

- Settings 1 and 3 set exits at 30/-30, which can push profits higher, but carry exit delays risk.

Choosing currency pairs and timeframes:

- Each currency pair has different volatility and trend traits; the settings are designed to match them.

- Clearly define applicable market conditions and test for each pair’s suitability.

Optimizing RCI periods:

- Periods differ, e.g., Setting 1 (28 bars) and Setting 3 (13 bars).

- Flexibly adjust periods with market changes to improve trading efficiency.

Last week'sTrade summaryLast week's trade summary

That’s all for last week!

See you all again next week!

(Trading with margin 1,000,000 yen / 0.3 lots)

| Period: 2024/12/16~12/21 (1 week) | +38,141 yen | Settings at that time |

| Period: 2024/12/9~12/14 (1 week) | +49,029 yen | Settings at that time |

| Period: 2024/12/2~12/7 (1 week) | +13,849 yen | Settings at that time |

| Period: 2024/11/25~11/30 (1 week) | +6,655 yen | Settings at that time |

| Period: 2024/11/18~2024/11/23 (1 week) | +20,637 yen | Settings at that time |

| Period: 2024/11/11~2024/11/16 (1 week) | +55,370 yen | Settings at that time |

| Period: 2024/11/4~2024/11/9 (1 week) | +15,207 yen | Settings at that time |

| Period: 2024/10/28~2024/11/2 (1 week) | +35,505 yen | Settings at that time |

| Period: 2024/10/21~2024/10/26 (1 week) | +972 yen |

Period: 2024/10/14~2024/10/21 (1 week) | +49,746 yen | |

| Period: 2024/10/07~2024/10/12 (1 week) | +49,029 yen | Settings at that time |

ATSからの3つのtrading methods

Note: Images are reused from the “ATS-12 RSI” version.

The specifications are the same.

1. Beginner: One-shot trade

【Trading Method 1】A high-win-rate, solid day-trade mode too!

Acquisition is at the first signal, exit at the scalping mode exit point. A high-win-rate, reliable trade is possible.

※ Once you get the hang of it and can win consistently, this method is recommended.

This method trades only once between the start flag and the end flag. Points gained are few, but it is the most win-rate and solid among the three. First, set the parameter “ScalMode_Flag” to ON "true". A scalping-entry/exit point will be shown on the chart.

① The first flag is the acquisition point.

② Then exit at the scalping exit point.

③ If an end flag appears while holding a position, forcibly exit then.

At first, after acquiring at ①, when the ② point is displayed, it is more prudent to exit with a profit.

As you gain experience, try aiming for the second, third, and subsequent scalping exit points.

■ About the settings: The numeric values on the score panel do not have to be as high as the other two methods.

2. Intermediate: Scalping trading

【Trading Method 2】Scalping mode!

This method is a scalping approach where you place several trades between the start and end flags. Depending on the case, it can yield the most points among the three methods.

First, set the parameter “ScalMode_Flag” to ON "true". Scalping entry/exit points will be shown.

① When the scalping entry point appears, enter a position.

② Exit the position at the exit point.

③ Perform several trades until the end flag appears.

④ If an end flag appears while holding a position, forcibly exit and wait for the next opportunity.

※ For entries, we may use two main approaches among these methods.

One is to enter one position and wait for the exit point.

The other is to add positions in very small lots at each entry point and exit all at the exit point, repeatedly.

Both approaches can yield results. In any case, start with small lots until you're comfortable, and find the method that suits you.

Once you’re comfortable with this method and can profit, try applying it with higher-level settings in related systems. It should lead to even greater results.

■ About the settings: This method benefits from high-level settings. We recommend having “ATS-13 RCI AutoSearch” ready for automatic detection of high settings.

This post focuses on the section in the following table.■I'll introduce part of the data extracted from ATS to trade in line with the current trend using RSI.

We will later revisit how to read and use this data!

(Paid version) |

(All 8 sessions) (Free) |

(Free) |

(Free) |

||

| ATS-12 RSI | [From here] |

Free to public! [From here] |

Free to public [From here] |

Continuing strong [From here] |

|

| ATS-13 RCI | [From here] |

Free to public! [From here] |

! |

|

|

| ATS-11 Ma | [From here] |

Scheduled to start! |

[From here] |

Performance公開中 [From here] |