Considerations of a Simple Method Using Currency Strength Index

Hello!

This is Nobushi!

This year is also almost over, isn’t it?

Since my clinic is closed, I am slowly recovering from daily fatigue...

Now, this time I will discuss a simple method using Nobushi's original currency strength tool "CP_strength".

I have introduced it in several past articles, but I will visualize it for clarity.

First,

① Find the timing when either currency of a currency pair reaches a strength value of +50 or -50

② Enter on pullbacks or retracements during the period that satisfies that condition

For example,

In the case of AUD/USD, when the AUD currency strength value exceeds +50, AUD is a fairly strong currency in the market.

Obviously on the AUD/USD chart, AUD should have strong power against USD, so it should rise in an uptrend.

The theory is to enter on pullbacks during that period.

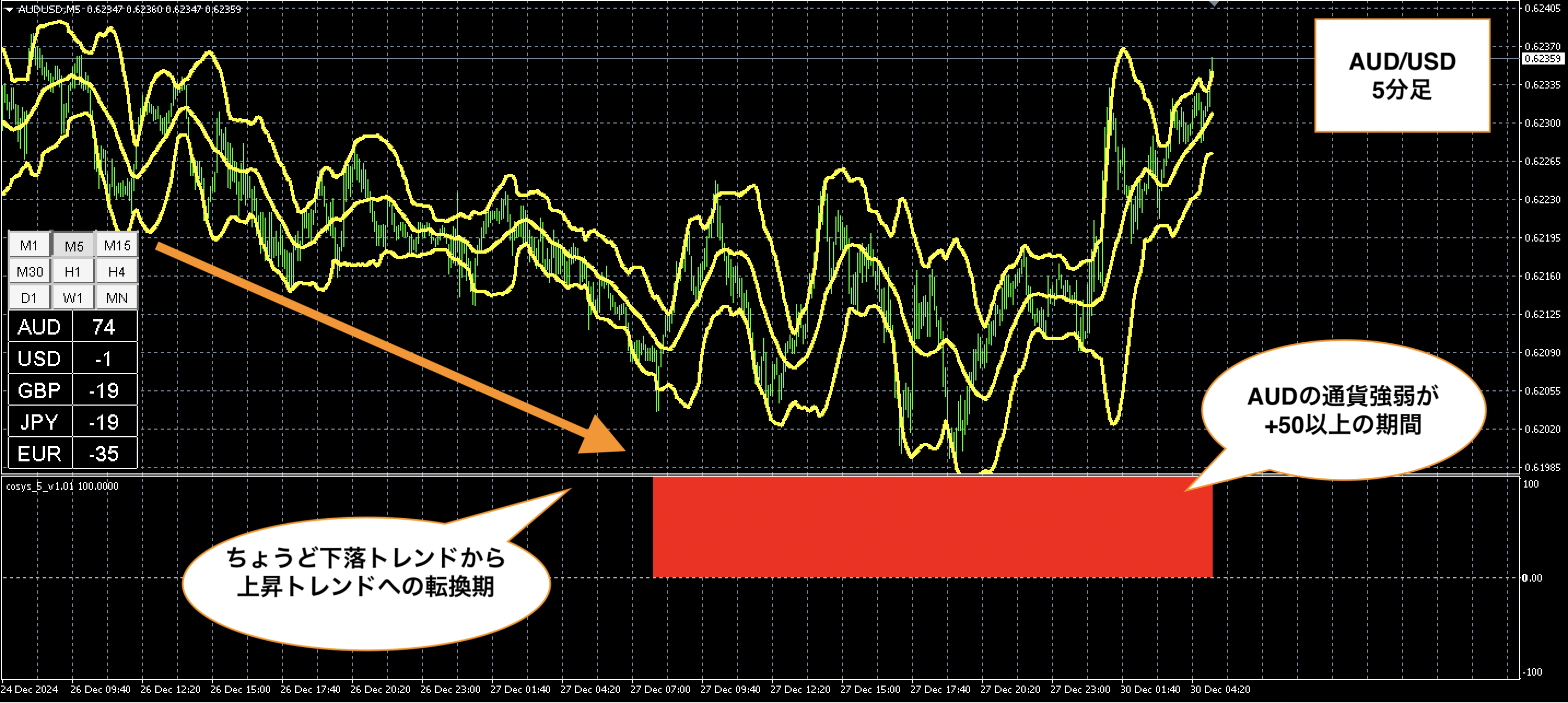

This is the AUD/USD 5-minute chart from just a moment ago.

To make it easy to understand, the period when the AUD value was +50 is shown as a red band on the lower part of the chart.

It remarkably shows the switch from a downtrend to an uptrend.

During this time, we will perform scalping by buying on dips and taking profits immediately, repeatedly.

The recommended timeframe is the 5-minute chart.

Longer timeframes have fewer false signals, but

longer timeframes offer far fewer opportunities, so I do not recommend them for part-time traders.

If you are using the currency strength judging tool CP_strength, please try incorporating this as one of your methods!

Details here →Currency Strength Judging Tool CP_strength