An EA for safe trend-following with around 1000 pips per year, "Trend Sommelier USDJPY Edition"

Annual 1000-pips level! Focus on the favorable balance of low risk and high profits

『Trend Sommelier USDJPY Edition』

【Trend Sommelier Overview】

Currency pair:[USD/JPY]

Trading style:[Scalping]

Maximum number of positions:2; up to 1 position on one side (hedging allowed)

Operation type:multi-lot

Time frame used:M5

Maximum stop loss:216( trailing stop included)

Take profit:39( adjustable TP feature according to market conditions)

Hedging:enabled

Others:open-price action EA, weekend close and compounding features

Forward testing is only about one month so far,

but with a default operation of 0.3 lots, it has yielded a profit of ¥25,000.

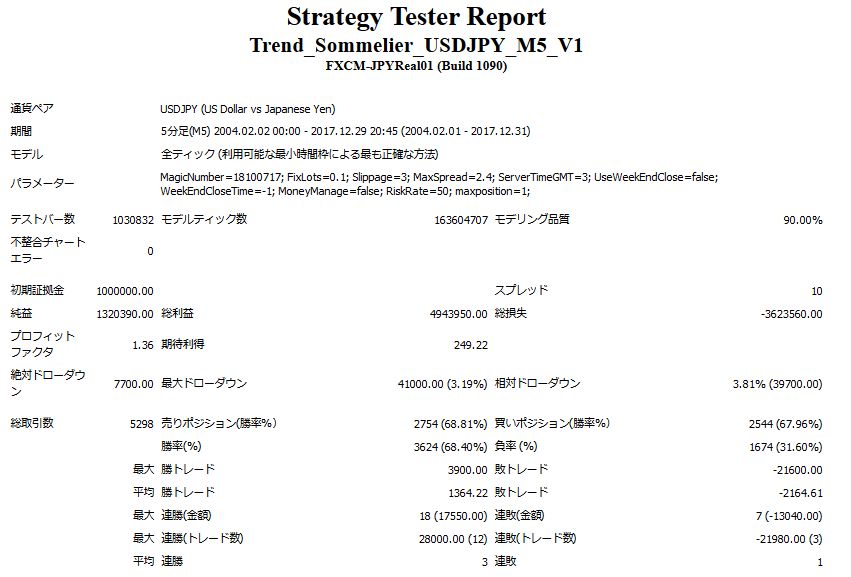

【Backtesting Analysis】

2004.02.02-2017.12.29

Spread 1.0

0.1 lots fixed

Net profit +¥1,320,000 (annual average ¥94,000)

Maximum drawdown -¥41,000

Total trades 5,298 (annual average 378)

Win rate 68%

Average gain ¥1,364

Average loss -¥2,164

Maximum loss -¥21,600

【Monthly P/L】

Typically there are about 3–4 negative months per year. This is a type designed to operate with annual profit in mind.

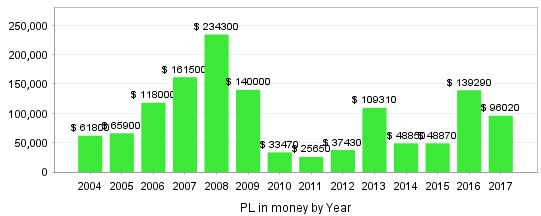

【Annual P/L】

Apart from 2008 which stands out, the last couple of years have also shown high profits.

From 200414 years without losses and profits remaining stable, which is wonderful.

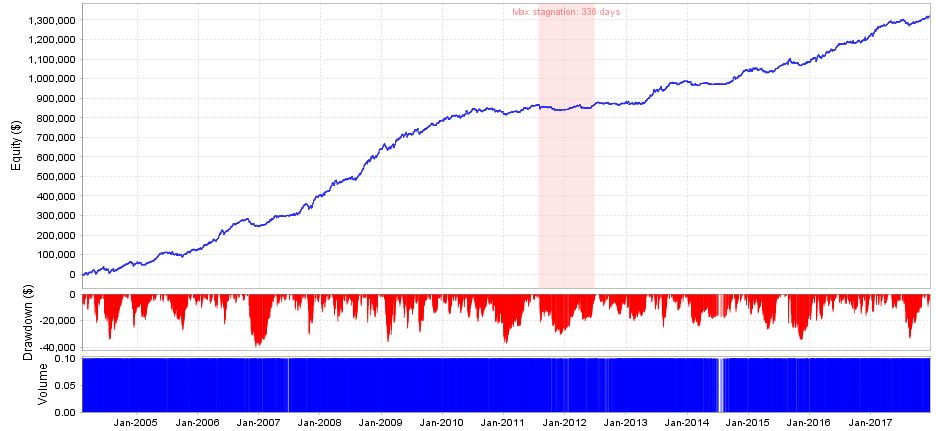

Looking at the profit-and-loss curve, there are no extreme drawdowns, and the maximum drawdown is within -¥40,000 per 0.1 lot.

There can be up to 2 positions (hedging allowed), but they do not seem to be held simultaneously.

【Trading Image】

Blue: BUY Red: SELL

Basically, it is a trend-following strategy in the direction of the trend. The direction is determined by higher highs and higher lows, and entry is made with one position.

Even in an uptrend, buying may not yield profit and the trade may close by the logic (stop loss).

The maximum SL is 210 pips, but since the judgment for cutting losses is good, it is安心できる点です—it is less likely to result in a big loss.

The developer, Daburuieru-san, was originally a discretionary trader, so in the EA as well, it uses orthodox trend-following trades,

letting profits run when possible and cutting losses early when needed—that trading philosophy is evident.

【Regarding Recommended Margin】

The product description mentions a maximum of two positions, but since they are not held simultaneously, you can consider the maximum as one position.

Recommended margin per 0.1 lot is,

(4.5)+(4.1×2)=12.7万円

Thus, on a ¥1,000,000 account you can increase to about 0.7 lots.

In backtests over the past 14 years,the annual average expected return exceeds 70%!

Even in the most recent 5 years it is 69%.

In that case the maximum drawdown risk stays within 15%, making it quite a safe operation.

Because it includes useful core features for users, such as compounding settings, weekend closes, and entry at opening prices,

it is an EA recommended for beginners and safe to operate!