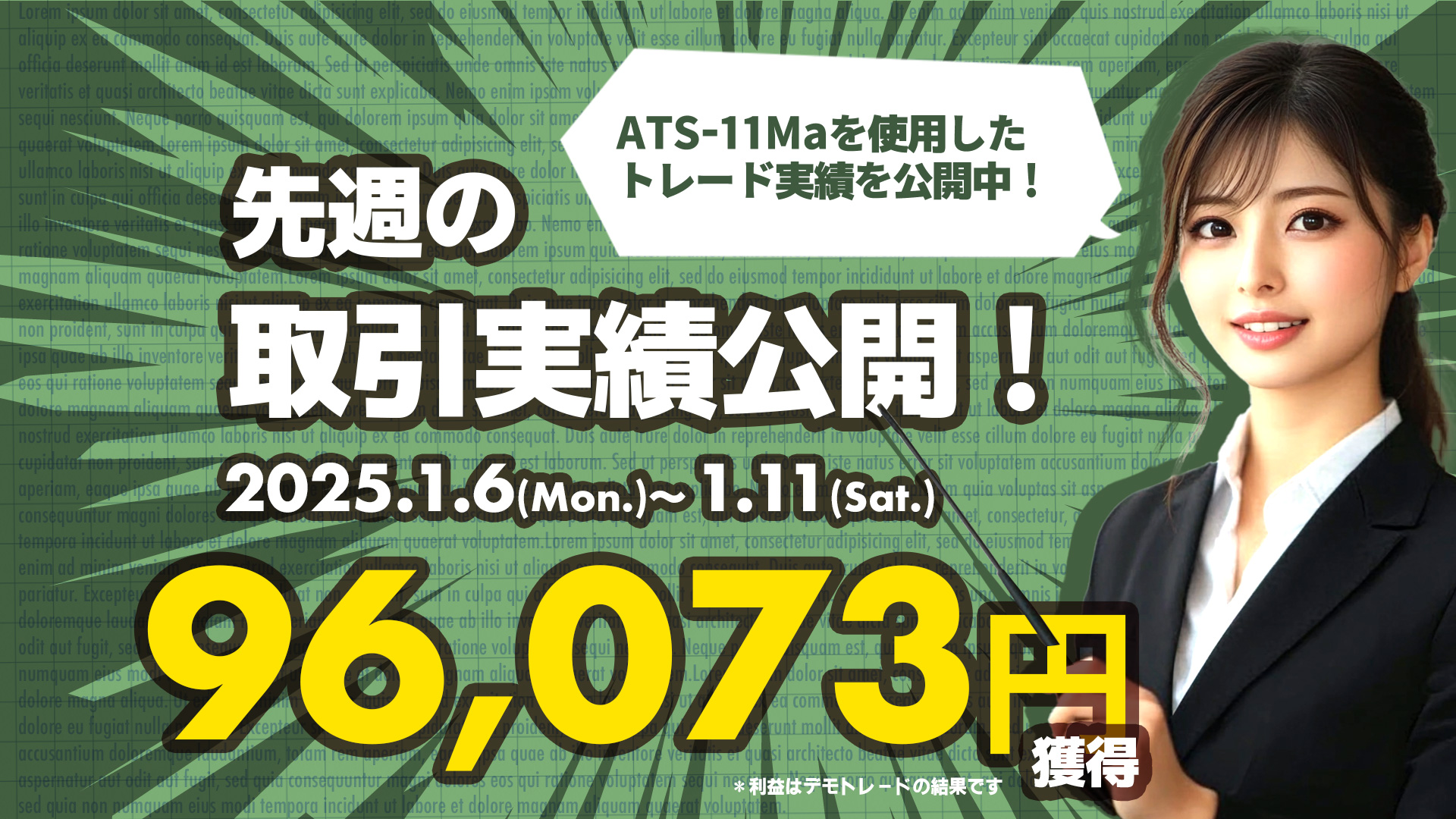

'ATS-11 Ma' Last week's results ~ 2024/12/14

Good evening, everyone! This is ATS BASE.

We will also introduce trade results using the ATS-11Ma this time.

We will share them with you.

Last week, there was a profit of 38,193 yen.

Last week's trading summary

(Trading with 1,000,000 yen margin / 0.3 lots)Period: 2024/12/9~12/14

[Trading history image]

[Trading history image / partial zoom]

The result is in one week, 38,193 yen profit.

Number of trades: 13

Wins: 8, Losses: 5

Performance in the last month

2024/12/2~/12/7 +8,310 yen2024/11/25~/11/30 +114,524 yen2024/11/18~/11/23 +32,610 yen2024/11/11~/11/16 +32,730 yen

This is a fairly excellent performance, isn’t it? (^ ^)

Now, from here, using 'ATS-11 Ma',

we will explain at what timing we acquired and closed positions.

We will also publish what settings were used.

Additionally, we will include the settings adopted.

ATS-11 MAWhy can it consistently generate profits?

With moving average trading,

it’s not easy to consistently generate profits, is it? (^^;

ATS-11 MA's AutoSearch feature

enables optimal settings and low-risk operation,

making solid trading possible without relying on experience.

Last week's settings【December 9】

[Settings image 1]

The first MA setting is,

USDJPY H4 contrarian

MA Short positions: 10

MA Long positions: 17

This is the setting.

Win rate for the past 20 days: 85%.

A very high win rate, as you can see.

[Settings image 2]

The second setting is,

EURJPY M30 contrarian

MA Short positions: 21

MA Long positions: 29

This is the setting.

In the last 20 days (Sector 1),

gained 45.01 points

an uptrend setting.

[Settings image 3]

EURJPY M30 contrarian

MA Short positions: 22

MA Long positions: 34

This is the setting.

Include EURUSD as well for diversification.

Using these settings, in the following pattern

1. Beginner: One-shot trade

I tried trading!

By the way, the MA cross data used here are

extracted with the AutoSearch included with ATS-11.

The MA settings in the second image proved to be a good fit, didn’t they? (^^)

The three trading methods are described at the end of this article.

ATS-11 MA is the optimal tool to support “profitable moving average trading.”

It resolves common beginner concerns about settings and risk management,

and enables stable earnings even with low risk.

If you are trading using moving averages but feel

you aren’t winning as you hoped,

ATS-11 MA might be the answer.

ATS11Ma Past Trading Results

(Trading with 1,000,000 yen margin / 0.3 lots)

Period: 2024/11/25~11/30 (1 week)

Plus 114,524 yen

Trading details article here

Period: 2024/11/18~11/23 (1 week)

Plus 32,610 yen

Trading details article here

Period: 2024/11/11~11/16 (1 week)

Plus 32,730 yen

Trading details article here

Period: 2024/11/4~11/9 (1 week)

Plus 63,763 yen

Trading details article here

Period: 2024/10/28~11/2 (1 week)

Plus 11,734 yen

Trading details article here

Period: 2024/10/21~11/26 (1 week)

Plus 56,002 yen

Trading details article here

Period: 2024/10/14~11/19 (1 week)

Plus 17,908 yen

Trading details article here

Plus 85,304 yen

Trading details article here

Three trading methods

*The images are reused from the ATS-12 RSI version.

The specifications are the same.

1. Beginner: One-shot trade

【Trading Method 1】High-win-rate solid day trading mode too!Acquisition occurs at the first signal, and closing occurs at the scalper mode closing point. A high-probability solid trade is possible.

※ We recommend this method until you get the hang of it and start winning.

This method trades once between the start flag and end flag. The points gained are modest, but it has the highest win rate among the three and is the most reliable. First, set the parameter “ScalMode_Flag” to ON “true.” A scalping-appropriate acquisition/closing point will be displayed on the chart.

① The first flag is the acquisition point.

② Then close at the scalping closing point.

③ If an end flag appears while holding a position, forcibly close.

At first, after obtaining point ①, if point ② is displayed, it's safer to close while in the plus stage.

As you become accustomed, aim for the second and third points, and then the subsequent scalping closing points.

■ About the settings: The score panel values do not need to be as high as the other two methods.

2. Intermediate: Scalping trade

【Trading Method 2】Scalping mode!This scalping method trades a few times between the start and end flags. Depending on the case, it can yield the most points among the three methods.

First, set the parameter “ScalMode_Flag” to ON “true.” Scalping acquisition/closing points will be displayed.

① When the scalping acquisition point is displayed, acquire the position.

② Close the position at the closing point.

③ Trade several times until the end flag is displayed.

④ If an end flag appears while holding a position, forcibly close and wait for the next opportunity.

※ There are two main approaches to acquisitions among us.

One is to acquire one position and wait for the closing point.

The other is to add positions in tiny lots at each acquisition point and close everything at the closing point, repeating the process.

Either approach can yield results. Until you get used to it, start with small lots and find the method that suits you, which can be enjoyable too.

When you become comfortable with this method and start to realize profits, try applying it with higher-level settings using related systems. It should yield even greater results.

■ About the settings: This method benefits from high-level settings. It is recommended to have the accompanying ATS-11 Ma AutoSearch.

Setting that can find winning configurations automatically: ATS-11 Ma AutoSearch

3. Intermediate-advanced: Swing & Day trading

【Trading Method 3】Basic swing and day trading

This method acquires at the start flag and closes at the end flag in a simple way.

Set the parameter “ScalMode_Flag” to OFF “false,” and hide scalping signs. ① Acquire position at the start flag.

② Close at the end flag.

Acquisition and closing are simple, but the settings themselves are very important.

If you trade according to the signs, you will see results that match the score panel values exactly.

Also, this method yields the largest profit or loss per trade.

In short, this method is simple in concept, yet demands the highest-level settings.

■ About the settings: This method requires the highest-level settings. We recommend having the included ATS-11 Ma AutoSearch.

The strongest signal tool to find profitable MA-cross settingsATS-11Ma is here

This post focuses on the following table’s■section.

Using RSI, we will introduce some data extracted from ATS to trade in line with the current trend.

We will revisit how to read and use this data at the end!

(Paid version) |

(All 8 sessions) (Free) |

(Free) |

(Free) |

||

| ATS-12 RSI | [From here] |

Free to public! [From here] |

公開中! [From here] |

Continuing strong [From here] |

|

| ATS-13 RCI | [From here] |

Free to public! 【Here】 |

公開中! [From here] |

We won with it! [From here] |

|

| ATS-11 Ma | [From here] |

Please look forward to it! |

[From here] |

|