Even with simple interest, 200% annual yield?! Ultra scalping with a 3-pip stop loss!『Grand-Edelweiss EURUSD』

Explosive system trading using a V-System with high-frequency trading and compounding!

『Grand-Edelweiss EURUSD』

【Grand-Edelweiss Overview】

Currency Pair: [EUR/USD]

Trading Style: [Scalping]

Maximum number of positions: 1 (when using the V-System, if the maximum lot size is exceeded, orders will be split).

Timeframe Used: M1

Maximum Stop Loss: 3

Other: The maximum number of lots is set to 10, but this varies by broker. (Since this is a required field, it is set to 10 to match OANDA TY3OJ1k). You can select any lot size from the broker's minimum to maximum.

Notably,the stop loss is 3 pips!!

It's a level where a small move will trigger a stop loss.

Because the stop loss is extremely tight, the win rate is below 50%, but the balance between TP and SL is important, so,

Let's analyze performance from backtests.

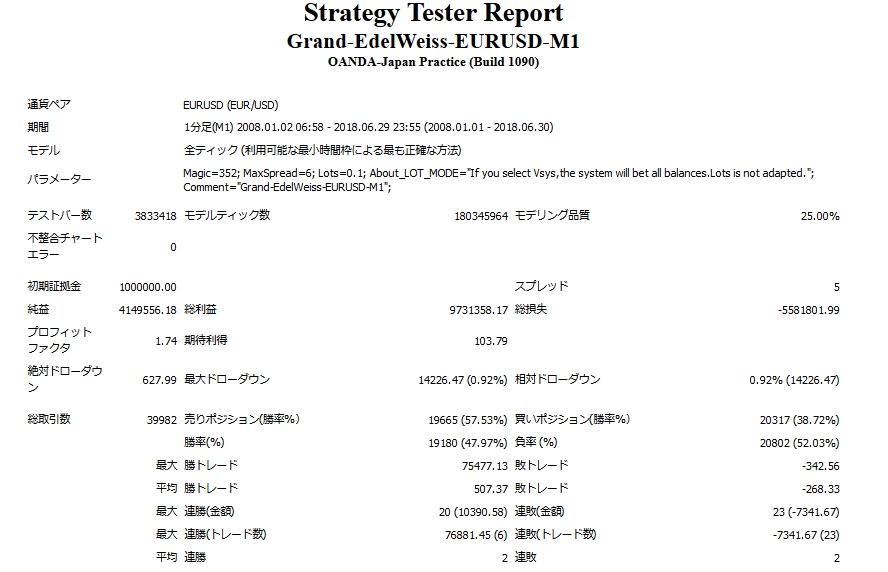

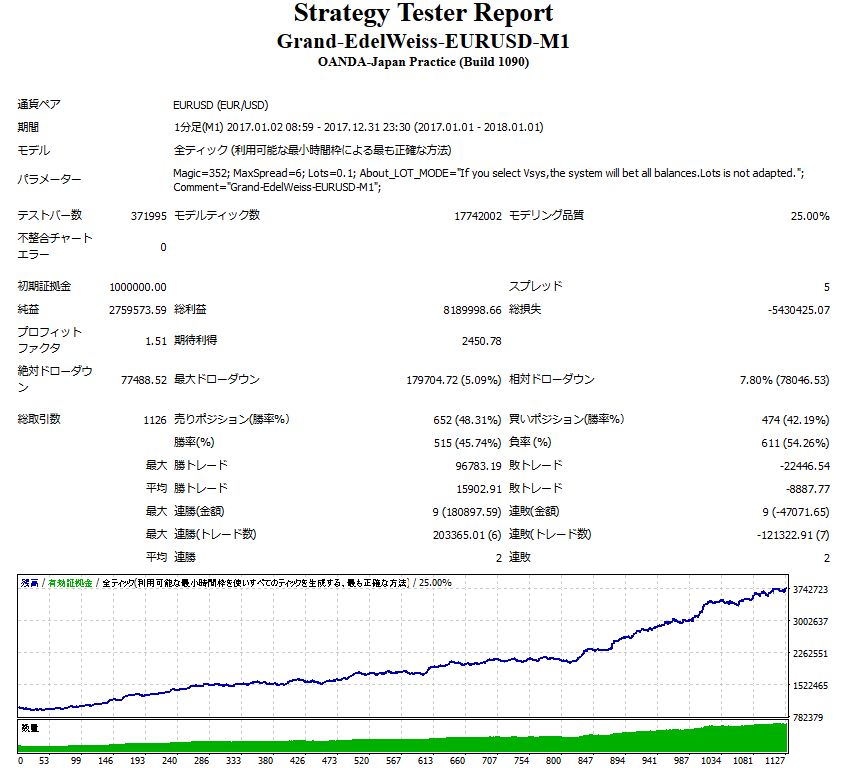

【Backtest Analysis】

2008.01.01-2018.06.30

Spread 0.5 pips

0.1 lot fixed

Net profit +4,140,000 JPY

Maximum drawdown -14,226 JPY

Total trades: 39,982 (annual average 3,500)

Win rate: 47.9%

Average gain per trade: 507 JPY

Average loss per trade: -268 JPY

That’s how it turned out.

The maximum drawdown per 0.1 lot is as small as 15,000 yen, and the maximum loss is -342 yen, 3 pips!!

It’s a fairly stringent design. It depends on the trading account, but if you choose a broker with tight spreads and high fill rate,

it should reliably accumulate profits.

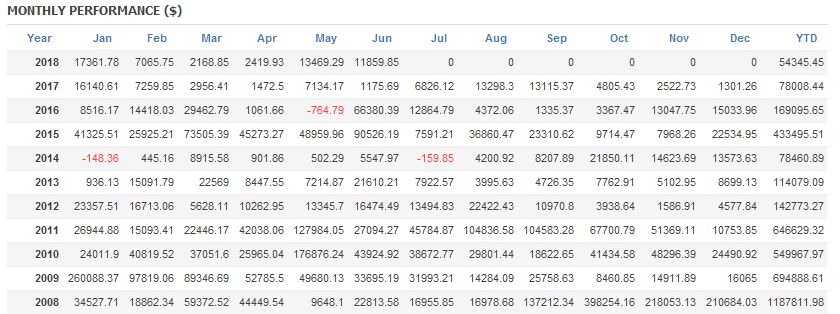

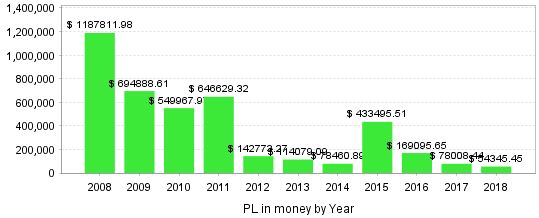

【Monthly & Annual P/L】

There are few negative months on a monthly basis.

This is because there are many trades and the balance between stop-loss pips and take-profit pips allows profits to accumulate gradually.

Looking at yearly results, profits are higher before 2011 (and there are more trades), suggesting that it tends to perform better in volatile markets.

In the last five years, the average gain per 0.1 lot is 150,000 yen.

Recommended margin per 0.1 lot is,

(5.1) + (1.5 × 2) = 8.1万円

Thus.

Because the maximum drawdown is low, the required margin is also low, so in the last five years the annual average return is just under 200%..

Even in the leanest years, profits of 70,000–80,000 yen are produced, so the annual return is close to 100%.

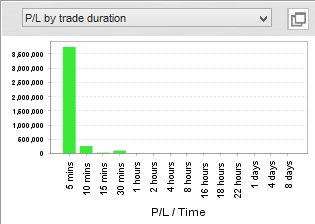

【Holding Time to Settlement】

Holding time is within one hour, a short-term battle.

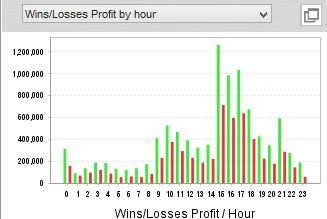

【Trading Hours】

Trading operates 24 hours a day.

Now, although Grand-Edelweiss can yield high profits with simple interest, in forward testing it is operated with compounding in a V-System.

◆What annual return can be expected with the compounding V-System?

In the V-System, about 90% of the account funds are used to hold positions.

For a 1,000,000-yen account, the initial lot is 1.74 lots. That’s quite scary lol.

As a result of compounding with the V-System for the year 2017,

the balance grew from 1,000,000 to 2,750,000 yen, a 3.7x increase.

The relative drawdown is 7.8%, so using 90% of funds to hold positions is theoretically fine.

I think it would be good to further adjust what fraction of the account funds to use and other tuning,

but in terms of capital efficiency, it would likely be the most efficient way to operate.

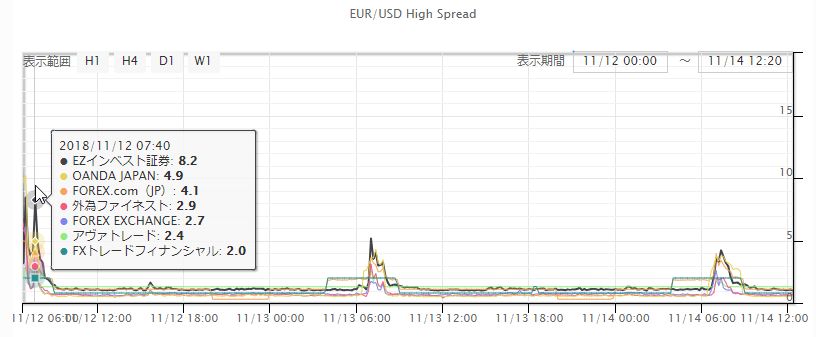

◆Operational Considerations

Since the maximum stop loss is 3 pips, please operate on accounts with tight spreads and high fill rates.

Because it’s EURUSD, many brokers offer spreads under 1 pip, but since this is a 24-hour EA,

please carefully consider spread widening during early-morning rollover and manage it well.

Be cautious of spread widening on Monday gaps.

It might be wise to pause trading in the mornings.

First, I’d like to see whether we can achieve 500,000 yen in profit over a 3-month forward period!