Actual trading example explanation of win rate 70% trend-following signal Aizen3

Actual chart image

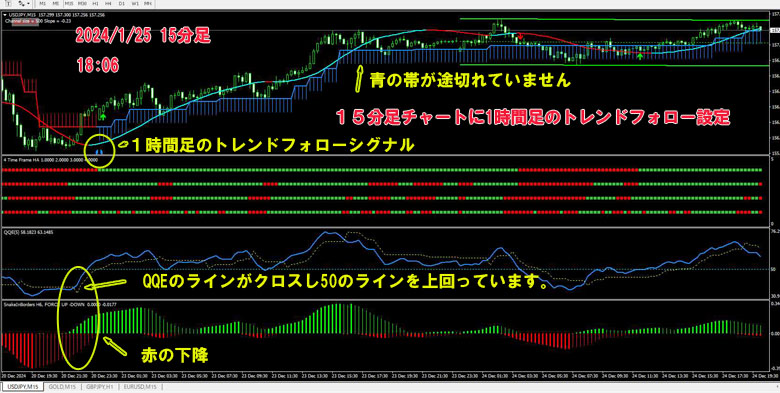

The chart above is a 5-minute chart. (USD/JPY m5)

It is also possible with a 1-minute chart at basic.

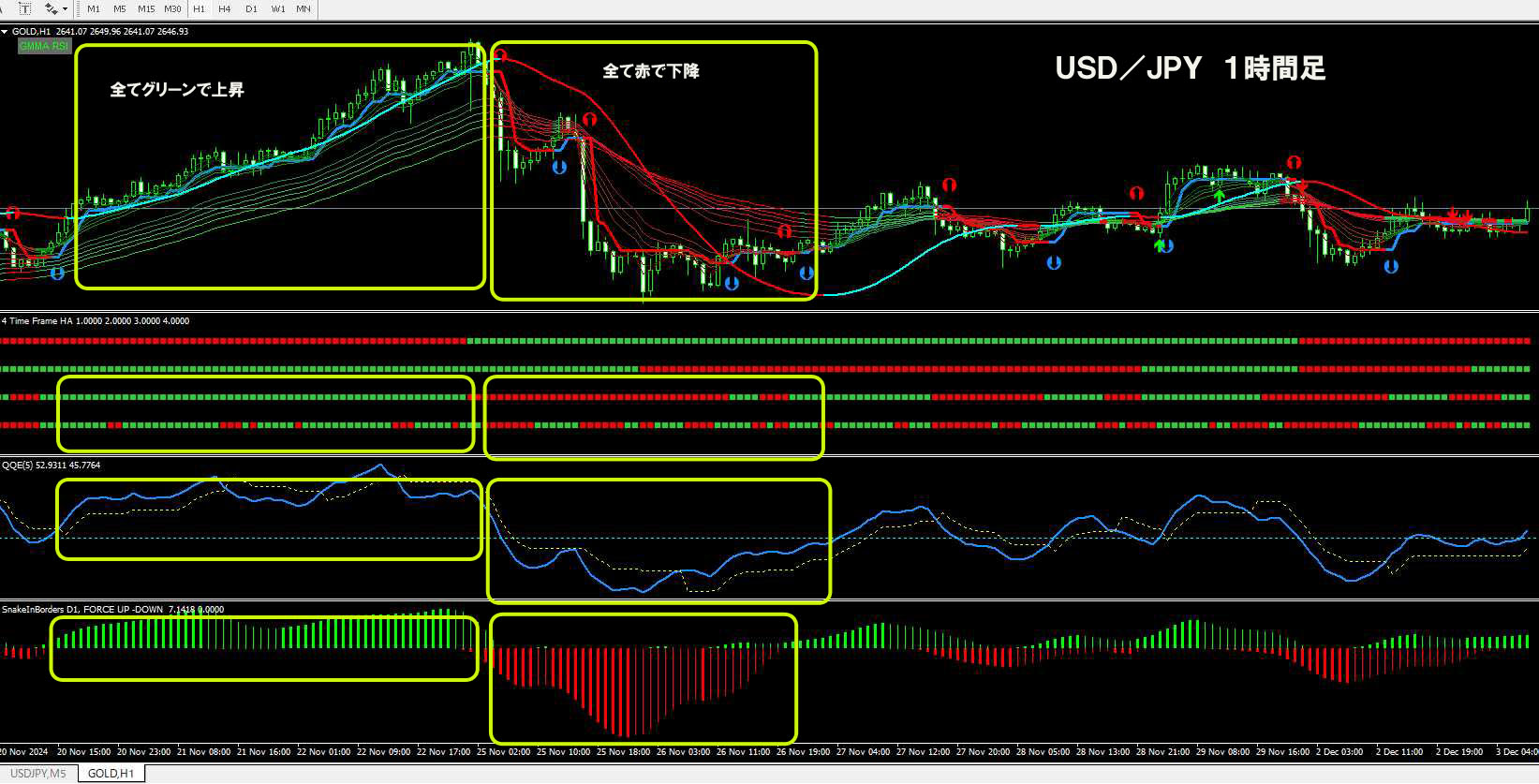

Below I have posted the same time frame on a 1-hour chart.

To newly confirm the direction, I have added two indicators.

I think this will allow entries and take-profits with more solid justification.

※ For more details, here! (Product page)

Win rate 70% Trend Following Signal Aizen3

〇 Added indicators

- Slope Line_Aizen

- Snake_Aizen003

These are the two indicators.

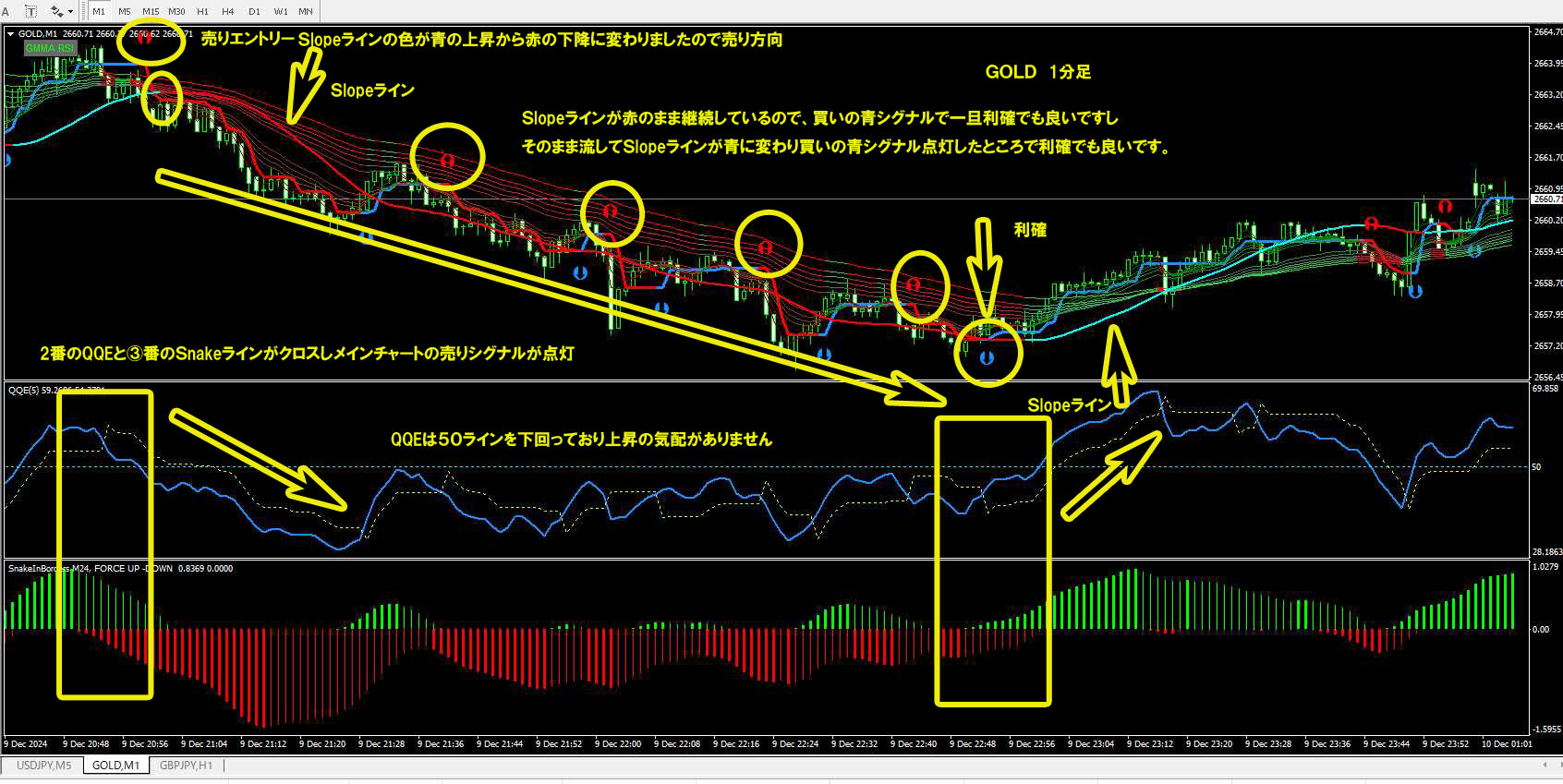

・SlopeLine_Aizen gently draws waves indicating the trend direction on the main chartand shows upward movement in green and downward movement in red.

Green indicates an upward trend.

An uptrend is green, a downtrend is red.

The figure below is the 1-hour chart.

〇 Entry and take profit

The basic main chart signals alone are fine, but on 1-minute or 5-minute charts the candle closes after signal appears, and there is no guarantee of 100% profitability.

However, even if the price moves against you, a reverse signal appears soon, so losses are not large; for some currency pairs, the pip loss may be noticeable.

Therefore the win rate is set at 70%. (I think it will never be 100%.)

The explanations for the indicators included from the start are in the manual, but here I mainly explain how the added indicators help with trading decisions.

・SlopeAbout Line_Aizen

As described on the top 5-minute chart as well, it gently traces a curve across the candles to indicate the trend direction.

Also, green indicates rise, red indicates fall.

When this wave and color agree with the buy/sell signals within the main chart and GMMA, enter and take profit.

Please check both the main chart and the sub-chart and take positions when both align.

※ Note

Even in range markets, a trend reversal detection may trigger buy/sell signals.

The reason for 70% win rate is here.

If a trading signal appears in range and only a small take-profit is possible, the pip value may become negative; as noted earlier, signals do not always follow 100%.

If price moves against you, a reverse signal will appear soon, so cut losses there.

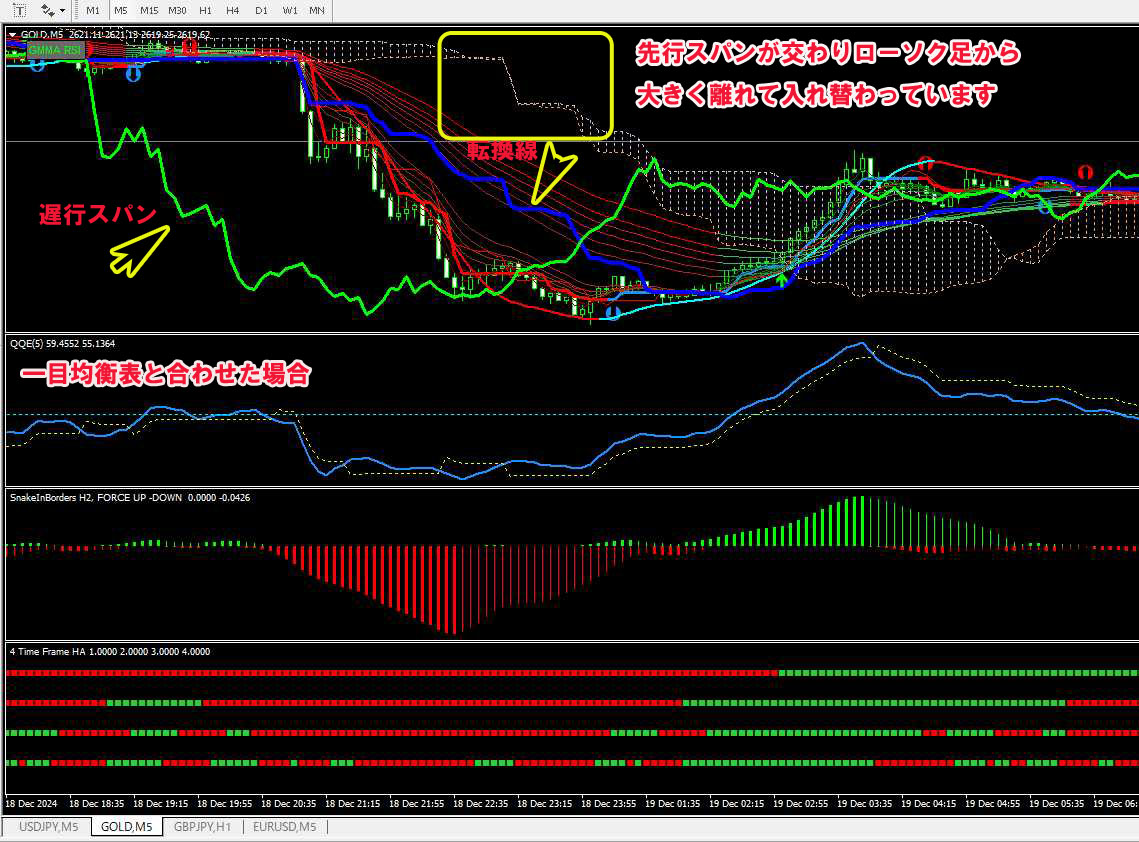

A MACD-like wave appears on the sub-chart.

The candles progress along that curve.

Green indicates rise, but if it moves from the peak toward a downward direction, the green color becomes slightly shadowed.

Red (downward) behaves similarly.

There are overlapping parts, but this area is a complete sideways market, so no trades.

However, since this is about the future, at the initial point you may not know.

※ Countermeasures

On the main chart, use GMMA and (refer to the manual for meaning) buy/sell signals,SlopeLine_Aizen to make a comprehensive judgement.

Most importantly, the color of the four bars on the second level of the sub-chart is crucial.

These four bars represent the time frame of the bottom-most bar when it is wide open.

Green indicates rise, red indicates fall.

What matters most is the timing when the color of that bottom time frame changes, and the color change timing of the next higher time frame up (for example, if the chart is 5-minute, the one above is 15-minute), and then wait for color stability.

Rather than judging only by the bottom current time frame, it is better to enter/take profit after the color of the higher time frame (here, 15-minute) also changes to the same color (rise to fall or vice versa).

If you want to hold longer, wait for the color of the higher time frame (the trend) to change.

Note that the higher time frame will be 30 minutes, so you will be holding a longer position; if you need to be away due to daily wrap or other matters, it is better to avoid long time-frame trades.

It is fine to sweep to a swing trade using the daily time frame, but try to close positions on Fridays as much as possible.

Set a sufficiently deep stop loss (SL).

That's all, simple.

Also, if I notice something, I will write it, and if I think it would be good to use this indicator in combination, I will add it.

As stated in the manual, trading with only the main chart signals is okay, but for me, it is designed to judge from the whole to ensure solid trades.

Thank you very much.