"ATS-12 RSI" Last week's performance ~2024/11/30

Good evening, everyone! This is ATS BASE.

Without further ado, we will present RSI performance results!

These are last week's trading results!

Last Week's Results Summary period: 2024/11/25~11/30

(Trading with margin 1,000,000 yen / 0.3 Lots)

In one week, 14,813 yen of profit!

Even with a small lot of "0.3 Lots," you can earn a lot of profit every week!

Here are the results for the past month.

+72,848 yen (2024/11/18~11/23)

+11,144 yen (2024/11/11~11/16)

+17,337 yen (2024/11/4~11/9)

+24,694 yen (2024/10/28~11/2)

+3,898 yen (2024/10/21~10/26)

+62,374 yen (2024/10/14~10/19)

+76,852 yen (2024/10/7~10/12)

Continuing, we have managed to achieve good results!

Here we introduce actual trades using the “ATS-12 RSI.”

There are several methods to trade using the “ATS-12 RSI,” but

we would like to explain at what timings we entered and exited using this system.

We will also publish what settings we used.

Additionally, we will include the specific settings used.

Last Week's RSI Settings【November 25】

[Settings Image 1]

Extracted by ATS-12 RSI Auto Search feature.

Entry/Exit Conditions

USDJPY H1

Number of RSI bars is 15

BUY entry (Open): Enter when RSI rebounds after dropping below 30

BUY exit (Close): Exit when RSI rebounds after rising above 60

--------------------------------------------------------------------

Sell entry (Open): Enter when RSI rebounds after rising above 70

Sell exit (Close): Exit when RSI rebounds after dropping below 40

[Settings Image 2]

Entry/Exit Conditions

EURJPY M30

Number of RSI bars is 12

BUY entry (Open): Enter when RSI rebounds after dropping below 35

BUY exit (Close): Exit when RSI rebounds after rising above 50

--------------------------------------------------------------------

Sell entry (Open): Enter when RSI rebounds after rising above 65

Sell exit (Close): Exit when RSI rebounds after dropping below 50

The win rate for the last 20 days is 83%, and sector up is 5600, which is quite favorable, so we adopted it.

With this setting, we tried trading in “2. Scalping Trade (Intermediate)”!

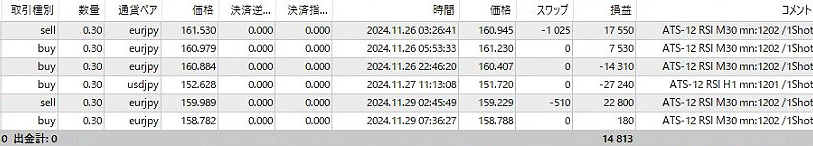

The trades are as follows.

[Trading History Image]

The result is...

In one week, 14,813 yen of profit was made!

Three trading methods are introduced at the end of this article.

ATS-12RSI Results to Date!

(Trading with margin 1,000,000 yen / 0.3 lots)

Summary period: 2024/11/18~11/23 (1 week)

Actual trading data and settings at that time are here

+72,848 yen

Summary period: 2024/11/11~11/16 (1 week)

Actual trading data and settings at that time are here

+11,144 yen

Summary period: 2024/11/4~11/9 (1 week)

Actual trading data and settings at that time are here

+17,337 yen

Summary period: 2024/10/28~11/2 (1 week)

Actual trading data and settings at that time are here

+24,694 yen

Summary period: 2024/10/21~2024/10/26 (1 week)

Actual trading data and settings at that time are here

+3,898 yen

Summary period: 2024/10/14~2024/10/19 (1 week)

Actual trading data and settings at that time are here

+62,374 yen

Summary period: 2024/10/07~2024/10/12 (1 week)

Actual trading data and settings at that time are here

+76,852 yen

Three trading methods

1. Beginner: One-Shot Trade

【Trading Method 1】High-win-rate, reliable day trading mode too!

Enter on the first signal, exit at the scalping mode exit point. A high-win-rate, reliable trade is possible.

Note: We recommend this method until you gain the knack and start winning.

This method trades only once between the start flag and the end flag. The points you can gain are limited, but it is the most reliable with the highest win rate among the three. First, set the parameter “ScalMode_Flag” to ON “true.” A scalping-oriented entry/exit point will be displayed on the chart.

① The first flag is your entry point.

② Then exit at the scalping exit point.

③ If an end flag appears while you hold the position, force-exit.

At first, after entry (①), if the point for (②) is displayed, it's safer to exit at a positive level early.

As you get used to it, try aiming for the second and third points, and then the subsequent scalping exit points.

■ About the settings: The numbers on the score panel do not need to be as high as the other two methods.

2. Intermediate: Scalping Trade

【Trading Method 2】Scalping mode!

This scalping method involves multiple trades between the start and end flags. Depending on the case, it can yield the most points among the three methods.

First, turn on the parameter “ScalMode_Flag” to ON “true.” Scalp entry/exit points will be displayed.

① When the scalping entry point is displayed, enter a position.

② Exit the position at the exit point.

③ Repeat several trades until the end flag appears.

④ If an end flag appears while you hold a position, force-exit and wait for the next opportunity.

Note: There are two major approaches to entries within this method.

One is to hold one position and wait for the exit point.

The other is to add positions in tiny lots at each entry point and fully exit at the exit point, repeating this cycle.

Either approach can yield results. Until you’re comfortable, start with small lots and find the method that suits you best.

Once you become comfortable and start earning profits with this method, implement higher-level settings using related systems. You should be able to achieve even greater results.

■ About the settings: This method requires high-level settings. It is recommended to have the included “ATS-12 RSI AutoSearch.”

3. Intermediate-Advanced: Swing & Day Trade

【Trading Method 3】Basic swing and day trading

This method buys on the start flag and sells on the end flag in a simple manner.

Set the parameter “ScalMode_Flag” to OFF “false” and hide scalping signals. ① Enter a position at the start flag.

② Exit at the end flag.

Entry/exit is very simple, but the settings themselves are very important.

Trading exactly as the signals yields a score panel value that matches the results.

Also, the profit/loss per trade tends to be the largest with this method.

In other words, this method is simple yet requires the highest level of settings.

■ About the settings: This method requires the highest-level settings. It is recommended to have the included “ATS-12 RSI AutoSearch.”

This post continues in the following table’s■section.

Using RSI to trade in alignment with the current trend, we will share some of the data extracted from ‘ATS’.

We will reintroduce how to read and use this data at the end!

(Paid Version) |

(All 8 sessions) (Free) |

(Free) |

(Free) |

||

| ATS-12 RSI | [From here] |

Free to view! [From here] |

View here [From here] |

|

|

| ATS-13 RCI | [From here] |

Free to view 【From here】 |

View here [From here] |

I won with it! [From here] |

|

| ATS-11 Ma | [From here] |

Planned start! |

[From here] |

Continuing! [From here] |