"ATS-13 RCI" Last week's performance ~2024/11/23

Good evening everyone. This is ATS BASE.

In this post, we will weekly introduce trading results based on settings extracted by auto-search for ATS-13 RCI.

Trading results are shared every week.

Last week, at first we had a big win, but

we gradually saw the profits erode a bit (^_^;)

Compared to the large profits from RSI,

it feels a little lonely, but

I think the numbers are solid.

Please take a look now.

Last Week’s Results!

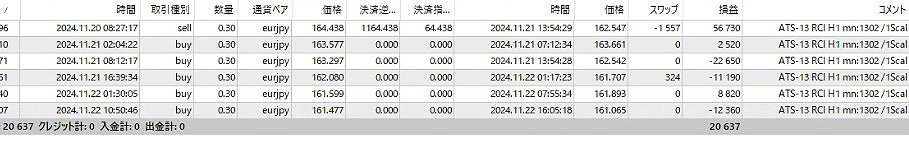

(Trading with margin 1,000,000 JPY / 0.3 Lots)

Period: 2024/11/18–2024/11/23

In one week, a profit of 20,637 JPY was made!

Even with 0.3 lots, weekly profits are recurring!

Results up to last week were

Positive55,370 JPY(11/11-11/16)

Positive15,207 JPY(11/4-11/9)

Positive35,505 JPY(10/28-11/2)

Positive972 JPY(10/21-10/26)

Positive49,746 JPY(2024/10/14~2024/10/19)

Positive14,600 JPY(2024/10/07~2024/10/12)

continues to perform well!

There are several ways to trade using “ATS-13 RCI,” but

I will also explain when to acquire and liquidate using this system.

We will also publish what settings we adopted.

Last Week’s Settings【Nov 18】

[Settings Image 1]

Acquisition and Liquidation Conditions

USDJPY H1

Number of RCI bars is 14

BUY entry (Open): Acquire when RCI turns up after being below -90

BUY exit (Close): Liquidate when RCI turns down after being above 0

--------------------------------------------------------------------

Sell entry (Open): Acquire when RCI turns up after being above 90

Sell exit (Close): Liquidate when RCI turns down after being below 0

Not a great setting, but it seemed interesting, so we adopted it (^ ^)

[Settings Image 2]

Acquisition and Liquidation Conditions

EURJPY H1

Number of RCI bars is 14

BUY entry (Open): Acquire when RCI turns down below -80

BUY exit (Close): Liquidate when RCI turns up above 20

--------------------------------------------------------------------

Sell entry (Open): Acquire when RCI turns up above 80

Sell exit (Close): Liquidate when RCI turns down below 20

This is a good setting, isn’t it♪

[Settings Image 3]

Acquisition and Liquidation Conditions

EURUSD H4

Number of RCI bars is 24

BUY entry condition (Open): Acquire when RCI turns down below -80

BUY exit condition (Close): Liquidate when RCI turns up above 20

--------------------------------------------------------------------

Sell entry condition (Open): Acquire when RCI turns up above 80

Sell exit condition (Close): Liquidate when RCI turns down below 20

Based on these settings, I tried the pattern described in the later “2. Intermediate—Scalping Trade” section!

At ATS, the RCI mode (In, Out, Return), RCI period, Open/Close levels, TP, SL

are combined in hundreds of ways,

and tested by brute force against historical data to automatically extract combinations that win in trends.

Last Week’s Results!

[Trading history image]

[Trading history image / zoomed in]

In one week, a profit of 20,637 JPY was made!

We could have earned a bit more, so we are quite regretful… ( ; ; )

Three trading methods are introduced at the end of this article.

Results up to before that!

(Trading with margin 1,000,000 JPY / 0.3 lots)

Period: 2024/11/11–2024/11/16 (1 week)

Settings at the time here

+55,370 JPY

Period: 2024/11/4–2024/11/9 (1 week)

Settings at the time here

+15,207 JPY

Period: 2024/10/28–2024/11/2 (1 week)

Settings at the time here

+35,505 JPY

Period: 2024/10/21–2024/10/26 (1 week)

Settings at the time here

+972 JPY

Period: 2024/10/14–2024/10/21 (1 week)

Settings at the time here

+49,746 JPY

Period: 2024/10/07–2024/10/12 (1 week)

Settings at the time here

+14,600 JPY

Three trading methods

*Images are reused from the “ATS-12 RSI” version.

The specifications are the same.

1. Beginner: One-shot Trade

【Trading Method 1】 A solid high-win-rate day-trading mode too!Acquisition is at the first signal, liquidation at the scalping mode’s liquidation point. This enables high-win-rate, solid trading.

※ We recommend this method until you get the hang and start winning.

This method trades only once between the start and end flags. It yields fewer points, but is the highest in win rate and most steady among the three. First, set the parameter “ScalMode_Flag” to ON “true.” The chart will display scalping-oriented acquisition and liquidation points.

① The first flag is the acquisition point.

② Then liquidate at the scalping liquidation point.

③ If an end flag appears while holding a position, forcibly liquidate then and wait for the next opportunity.

At first, after acquiring at ①, when the ② point is shown, it is more prudent to liquidate early at a profit.

As you get used to it, aim for the 2nd and 3rd, then the subsequent scalping liquidation points.

■ About settings: The score panel numbers do not need to be as high as the other two methods.

2. Intermediate: Scalping Trade

【Trading Method 2】 Scalping mode!This method is a scalping method that makes a few trades between the start and end flags. In some cases, it can accumulate the most points among the three methods.

First, set the parameter “ScalMode_Flag” to ON “true.” Scalping acquisition and liquidation points will be displayed.

① When scalping acquisition points are displayed, acquire the position.

② Liquidate the position at the liquidation points.

③ Make several trades until the end flag appears.

④ If an end flag appears while holding a position, forcibly liquidate and wait for the next opportunity.

※ In acquisition, we may use two main approaches among us.

One is to acquire one position and wait for the liquidation point.

The other is to add positions in very small lots at each acquisition point and liquidate all at the liquidation point, repeating this cycle.

Either approach can yield results. Until you are used to it, start with small lots and find a method that suits you, which can be enjoyable in itself.

Once you’re accustomed to this method and can profit, practice with higher-level settings using related systems. I believe you can achieve even greater results.

■ About settings: This method benefits from high-level settings.

Using “ATS-13 RCI AutoSearch” to automatically detect high settings and “ATS-13 RCI 1Click” for one-click acquisition would be more efficient for achieving results.

3. Intermediate/Advanced: Swing & Day Trading

【Trading Method 3】 Basic swing and day trading

This method acquires at the start flag and liquidates at the end flag, a simple approach.

Set the parameter “ScalMode_Flag” to OFF “false” and hide scalping signals. ① Acquire position at the start flag.

② Liquidate at the end flag.

Acquisition and liquidation are very simple, but the settings are actually crucial.

If you trade conservatively according to the signals, you will get results matching the score panel values.

Also, this method yields the largest per-trade profit and loss.

In other words, this method is simple yet requires the highest level settings.

■ About settings: This method requires the highest-level settings. We recommend having the included “ATS-13 RCI AutoSearch.”

This post includes the following table’s■section.

Using RSI to trade in line with the current trend, we will introduce a portion of data extracted by “ATS.”

We will explain how to read and use this data at the end again!

(Paid Version) |

(All 8 Sessions) (Free) |

(Free) |

(Free) |

||

| ATS-12 RSI | [From here] |

Publicly available for free! [From here] |

public release! [From here] |

Continuing strong [From here] |

|

| ATS-13 RCI | [From here] |

Publicly available for free! [From here] |

to be released! |

|

|

| ATS-11 Ma | [From here] |

Scheduled to start! |

[From here] |

Performance公開中 [From here] |