Important Risk Management Lessons from White BearV3 ~ Part 1

This time I would like to introduce the losses from trading of “WhiteBearV3” which has sold over 900 copies cumulatively.I think.

Features of WhiteBearV3 are shown below ↓

http://サラリーマン投資自動売買.com/ea/forex-white-bear-v3/post-689-2/

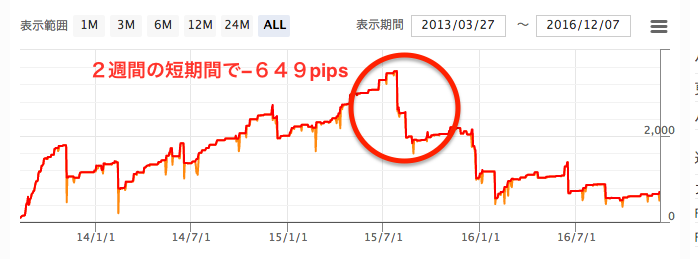

This EA has been in operation since March 2013 and was excellent in 2013 and 2014, but from July 2015 when I started using it I began to incur large losses.

As you can see from forward testing, the operation from July 2015 onward was nothing but unlucky… haha

Reasons

・Greek crisis

・Renminbi issue in China

These two are thought to be the major causes. In times of major economic shocks when the market moves differently from usual, it is necessary to stop the EA.

In particular, scalping has a weakness to market fluctuations, so when you quickly glance at economic news and the market seems likely to move significantly, it is better to stop.

Risk management differs by EA. Especially for V3, be careful with scalping during New York and London hours.

Because the drawdown was so large, it is currently stopped from operating.

Even as of December 2016, performance still seems not favorable…

By the way, the EA price is about 50,000 yen… Even so, when it was performing well, it sold very well.

There were actually people in 2014 who doubled their funds using V3.

Considering that and V3’s past performance, I personally got carried away and increased the lot sizes.

Up until then I had almost never lost, so I didn’t expect this.

The parameters of V3 are

・Limit 7 pips

・Stop 57 pips

・Maximum positions 9

・Do not trade Mondays and Fridays

These are its features.

First of all, since it is a basic scalping EA, the stop is large.

Once you take a drawdown, you must win 8 times (8*7=57 pips) to not lose.

Also the maximum number of positions is 9. Since it is 9, it doesn’t always take 9 positions, but if multiple positions draw down all at once,

57 * number of positions = maximum loss amount

Up to now, V3 rarely had MAX loss (57 pips).

So even if it lost big, it was only about 30 pips (per one position).

This was verified in forward testing before operation.

V3 normally trades during London and New York times, so it tends to have multiple positions and trade aggressively.

Therefore, from its past performance it has achieved a wonderful track record of 345% return over two years (2013 to July 2015).

In other words, V3 could achieve this because it had many trades with a high win rate. Looking back, the drawdown itself was truly remarkable for an EA. (It makes you want to be overly confident, doesn’t it? haha)

On average, the number of positions is about five in the forward test.

Based on V3’s past performance, I set my risk to allow up to 15% of total funds per single trade. (This is quite risky.)

V3 typically holds about five positions, so when all five are in drawdown (57 pips), total funds would be reduced by 15%.

The reason for this is that I never expected all five to draw down at once (57 pips). So I assumed about three out of five would draw down...

Therefore when all five positions draw down (57 pips), it is 5 * 57 = about 280 pips. I assumed 15% of total funds would be lost at this loss.

In July at the start of operation, it continued to generate steady profits as before, so I thought it was reliable.

However, at the end of July and the first week of August, the largest drawdowns to date occurred one after another.

(Loss from the forward test diagram from the center to the right)

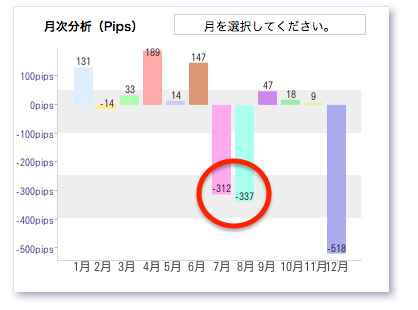

As you can see from the forward test graph above, July and August 2015 were

312 + 337 = -649 pips

of drawdowns occurred...

In a short period, drawdown of 649 pips, a historic loss for V3.

This means a loss of 30% of my account funds.

But after this...

To be continued in the next installment.

PS: The newsletter of professional trader “Rikio Shima” that I also subscribe to is very rich in content, and I was surprised. I knew him from a financial program, but a paid newsletter has a different quality.

By the way, I’m subscribing with a 3-month free trial campaign ↓↓ I’m explaining including excerpts from the newsletter

⇒http://fx-newstart.com/rikio-shima

*Campaign is described at the bottom of the article.

━━━━━━━━━━━━━━━━━━━━━━━━━

My site’s strongest EA ‘Beatrice-07’

━━━━━━━━━━━━━━━━━━━━━━━━━

A site-strong EA that delivers results with long-term operation

Because it is a swing trade, it is less affected by market fluctuations,

and easy to operate EA.

Profitability of 250%, a regular in the top rankings of popular EAs

*Currently available with a limited-time account opening campaign for free

so I definitely recommend it.

⇒http://サラリーマン投資自動売買.com/ea/beatrice-07/post-1365/

━━━━━━━━━━━━━━━━━━━━━━━━━

FX automated trading free newsletter

━━━━━━━━━━━━━━━━━━━━━━━━━

This is my site’s free newsletter. It introduces winning FX automated trading strategies and EA I focus on at that time.

Also now you can get a free FX automated trading strategy report as a gift!

⇒http://サラリーマン投資自動売買.com/landingpage/

━━━━━━━━━━━━━━━━━━━━━━━━━

“Breakout scalping” maintaining win rate over 90% in the long term

━━━━━━━━━━━━━━━━━━━━━━━━━

Since starting operation in November 2014, it has maintained a win rate of over 90% as a scalping EA

There are no flashy profits, but it reliably leaves profits

and is considered a cornerstone trading style

that many would call the golden rule of trading.

It is a regular top-selling EA in the rankings.

EA bestsellers ranking regularly in the top series

http://サラリーマン投資自動売買.com/ea/breakscalsystem/breakscalsystem/

━━━━━━━━━━━━━━━━━━━━━━

Long-term earning EA WhiteBearZ USDJPY

━━━━━━━━━━━━━━━━━━━━━━

Since start of operation, all monthly performance has been positive

This site’s most recommended EA.

(Prices are a bit high…)

⇒http://サラリーマン投資自動売買.com/ea/white-bear-z-usdjpy/post-488/

━━━━━━━━━━━━━━━━━━━━━━

Brokerages offering MT4 during campaigns

━━━━━━━━━━━━━━━━━━━━━━

New account openings receive free automated trading EA

Introducing MT4-compatible brokerages. A must-see!!

⇒http://サラリーマン投資自動売買.com/fx-campaign/fxcampaign/

━━━━━━━━━━━━━━━━━━━━━━

If using VPS, choose ABLENET (AbleNet)

━━━━━━━━━━━━━━━━━━━━━━

A virtual desktop VPS required for automated trading

My top recommended VPS is here

⇒http://サラリーマン投資自動売買.com/mt4-ea/mt4-vps-比較/post-1470/

━━━━━━━━━━━━━━━━━━━━━━

[Recommended] Rikio Shima’s Real-Time Practical Trading

━━━━━━━━━━━━━━━━━━━━━━

The real-time newsletter of a current professional trader I also subscribe to

“Rikio Shima”’s real-time newsletter

You can learn market analysis and trading methods from it

It is innovative and of high quality.

⇒http://fx-newstart.com/rikio-shima