"ATS-12 RSI" Last week's results ~2024/11/23

Good evening, everyone! This is ATS BASE.

Last week, RSI performance was quite good!

Some of you may have felt it firsthand

perhaps?

Here are the trading results from last week!

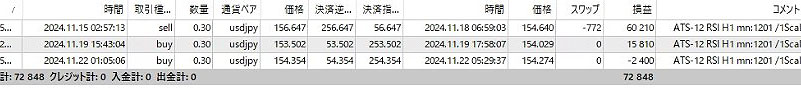

Last Week's Results Data collection period: 2024/11/18~11/23

(Trading with 1,000,000 yen in margin / 0.3 Lots)

In one week,82,848 yen of profit!

Even with a small lot of 0.3 Lots, profits come in every week!

This is the performance for the last month.

+11,144 yen (2024/11/11~11/16)

+17,337 yen (2024/11/4~11/9)

+24,694 yen (2024/10/28~11/2)

+3,898 yen (2024/10/21~10/26)

+62,374 yen (2024/10/14~10/19)

+76,852 yen (2024/10/7~10/12)

And we continue to achieve good results!

Here we will introduce actual trades using the 『ATS-12 RSI』.

There are several trading methods using the 『ATS-12 RSI』, but

we would like to explain when we entered and exited using this system.

We will also publish what settings we used.

Last Week's RSI Settings【November 18】

[Settings Image 1]

Extracted with ATS-12RSI AutoSearch function.

We adopted this setting because the performance in the most recent ~80 days is very good.

With ATS AutoSearch, you can easily find settings that suit the current market!

Acquisition and Exit Conditions

USDJPY H1

Number of RSI candles is 12

BUY entry (Open): Enter when RSI dips below 30 and reverses

BUY exit (Close): Exit when RSI rises above 65 and reverses

--------------------------------------------------------------------

Sell entry (Open): Enter when RSI rises above 70 and reverses

Sell exit (Close): Exit when RSI drops below 35 and reverses

With these settings, I traded in “2. Scalping Trade (Intermediate)”!

Now, the results from last week!

[Trading history image]

[Trading history image / partial zoom]

The results are...

In one week,82,848 yen in profit!

A substantial profit, indeed (^_^)

By the way

We also did swing trades and others,

and all of them yielded good results.

The current market may be RSI-hot!

Three trading methods are introduced at the end of this article.

ATS-12RSI Results to Date

(Trading with 1,000,000 yen margin / 0.3 lots)

Data collection period: 2024/11/11~11/16 (1 week)

Actual trading data and settings from that time are here

+11,144 yen

Data collection period: 2024/11/4~11/9 (1 week)

Actual trading data and settings from that time are here

+17,337 yen

Data collection period: 2024/10/28~11/2 (1 week)

Actual trading data and settings from that time are here

+24,694 yen

Data collection period: 2024/10/21~2024/10/26 (1 week)

Actual trading data and settings from that time are here

+3,898 yen

Data collection period: 2024/10/14~2024/10/19 (1 week)

Actual trading data and settings from that time are here

+62,374 yen

Data collection period: 2024/10/07~2024/10/12 (1 week)

Actual trading data and settings from that time are here

+76,852 yen

Three trading methods

1. Beginner: One-Shot Trade

【Trading Method 1】A highly reliable day-trading mode with high win rate as well

Enter on the first signal, exit at the scalping-mode exit point. A high-win, reliable trade is possible.

We recommend this method until you master the basics and start winning consistently.

This method trades only once between the start and end flags. The points you can gain are modest, but it has the highest win rate among the three and is the most solid method. First, set the parameter “ScalMode_Flag” to ON “true.” The chart will display scalping-oriented entry/exit points.

① The first flag is the entry point.

② Then exit at the scalping exit point.

③ If an end flag appears while holding a position, forcibly exit then.

At first, after acquiring at ①, when the ② point is shown, it is safer to exit while in positive territory.

As you gain familiarity, aim for the 2nd and 3rd points and the subsequent scalping exits.

■ About the settings: The values on the score panel do not need to be as high as in the other two methods.

2. Intermediate: Scalping Trade

【Trading Method 2】Scalping Mode!

This scalping method trades several times between the start and end flags. Depending on the case, it can yield the most points among the three methods.

First, set the parameter “ScalMode_Flag” to ON “true.” The scalping entry/exit points will be displayed.

① When the scalping entry point is displayed, enter a position.

② Exit the position at the exit point.

③ Trade several times until the end flag is displayed.

④ If an end flag appears while holding a position, forcibly close and wait for the next opportunity.

※ Regarding entries, we may use two main approaches among this method.

One is to enter one position and wait for the exit point to occur.

The other is to add positions at each entry point with very small lots and exit fully at the exit points, repeating this process.

Either approach can yield results. Until you get used to it, start with small lots and find the method that suits you.

As you become proficient and able to gain profits with this method, try higher-quality settings using related systems. This should yield even greater results.

■ About the settings: This method requires high-quality settings. It is recommended to have the accompanying “ATS-12 RSI AutoSearch.”

It would be efficient to have “ATS-12 RSI AutoSearch” to automatically detect high settings and “ATS-12 RSI 1Click” for one-click entries.

3. Intermediate/Advanced: Swing & Day Trade

【Trading Method 3】Basic swing and day trading

This method buys on the start flag and exits on the end flag, a simple approach.

Set parameter “ScalMode_Flag” to OFF “false” and hide scalping signals. 1) Enter a position at the start flag.

② Exit at the end flag.

The acquisition and exit are simple, but the settings are actually very important.

Following the signals faithfully yields a score panel value that matches the results exactly.

Also, the profit and loss per trade tends to be the largest with this method.

In short, this method is simple yet requires the highest-level settings.

■ About the settings: This method requires the highest-level settings. We recommend including the “ATS-12 RSI AutoSearch.”

This post focuses on the part of the table below.■that portion.

Using RSI, we would like to share some of the data extracted from ATS to align with current trends.

We will again introduce how to read and use this data at the end!

(Paid version) |

(8 sessions total) (Free) |

(Free) |

(Free) |

||

| ATS-12 RSI | [From here] |

Now publicly available for free! [From here] |

[From here] |

|

|

| ATS-13 RCI | [From here] |

Free publicly available 【From here】 |

[From here] 【From here】 |

I won with it! [From here] |

|

| ATS-11 Ma | [From here] |

Starting soon! |

【From here】 [From here] |

Continuing! [From here] |