My method for creating a stable, good EA is as follows

“Smart Choice for FX Automated Trading (EA)”

I’ll briefly introduce the method I use to create a stable, good EA.

1. Overview

What I pay attention to when creating an EA is to use a simple, easy-to-understand logic,

utilize Excel's analysis tools, and perform pseudo-forward testing.

I will explain that flow.

2. Development Flow

① Consider the logic.

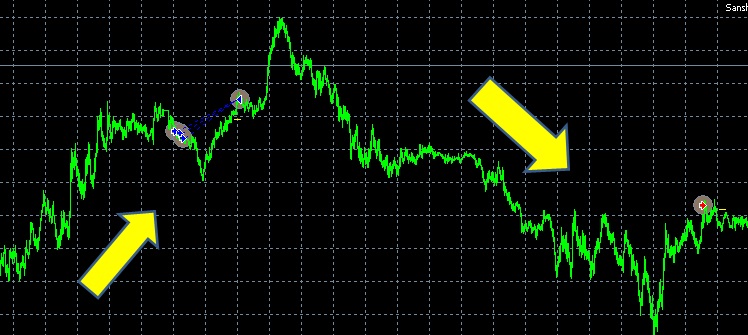

■ On higher timeframes, confirm the direction and strength of the trend. The arrows in the figure show the trend direction.

■ When the oscillator-type technical indicators reverse from the trend direction, enter,

and when the trend direction is established, trigger a trailing stop to extend profits.

② Move the data into Excel, and after examining hundreds of technical indicators and filters for correlations,

use VBA to determine the optimal values.

③ Return to MT4, create the EA based on the optimal values from step ②, and again use the strategy tester to

optimize. The optimization uses only the first 10 years out of the past 12 years.

④ Use the optimized EA to conduct pseudo-forward testing on the remaining 2 years.

If the pseudo-forward test results are not favorable, go back to step ① or ②.

2. Real forward results of “Yamagi Suimei”

That is all.