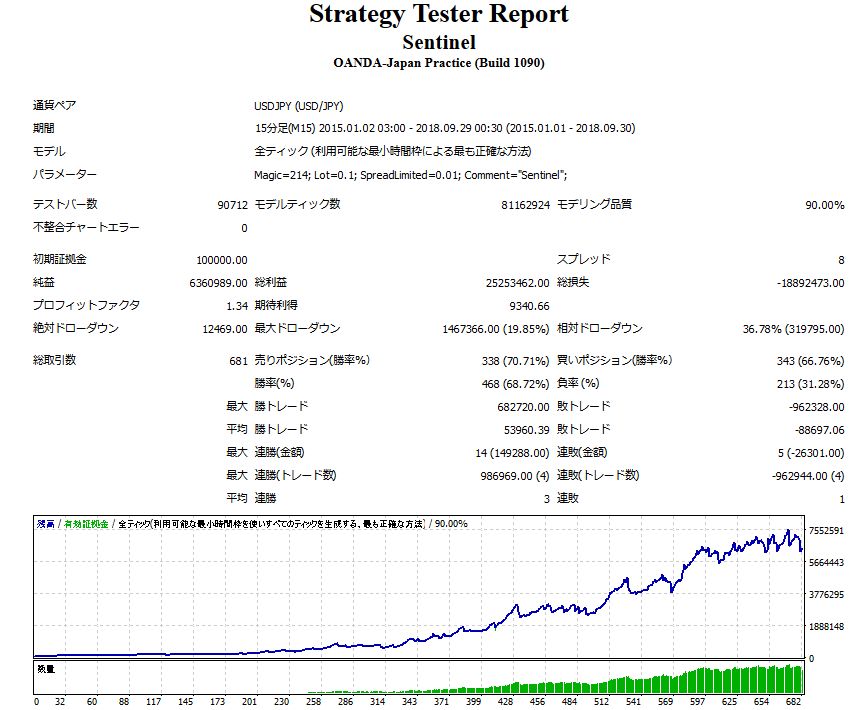

Starting from 100,000 yen, a high-leverage single-position EA! 'Sentinel'

【Sentinel Overview】

Currency pair: [USD/JPY]

Trading style: [Scalping]

Maximum number of positions: 1 (If orders exceed the broker's maximum lot size, multiple positions will be opened)

Maximum lot size: 1000; Others: user-configurable; Auto-management when Eighty Mode is used

Timeframe used: M15

Maximum stop loss: 80 pips

One-month forward test yields 55 pips, and with compounding in Eighty Mode the return is +8%.

■Backtest analysis from multiple perspectives!

Backtest results under various conditions are listed on the official sales page,

Let's focus on 0.1-lot simple-returns operation and Eighty Mode operation.

【In Simple-Interest Operation】

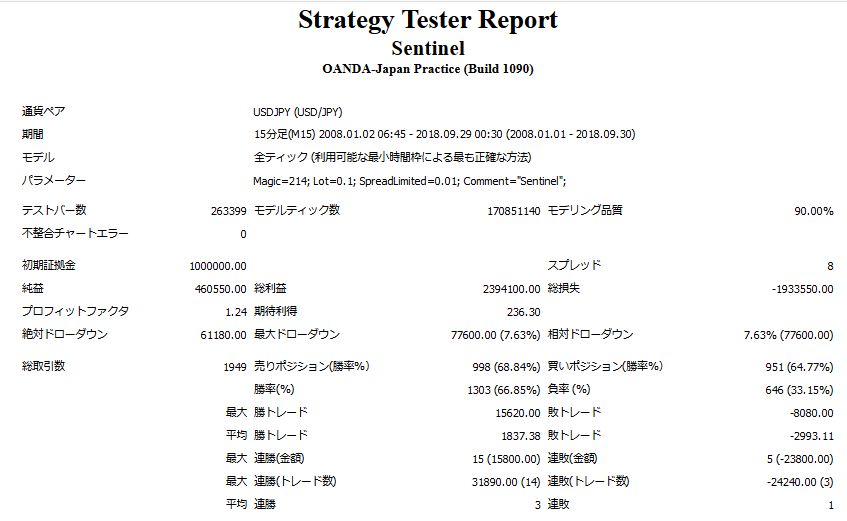

2008.01.01-2018.09.30

Spread: 0.8

0.1-lot fixed

Net profit: +¥460,000 (4,600 pips)

Maximum drawdown: ¥77,000

Win rate: 67%

Total trades: 1,949 (annual average 180)

This was the result. In ten and a half years of backtesting,

Average annual profit per 0.1 lot is about ¥43,000 (430 pips).

Recommended margin is

4.5 + (7.7×2) = 19.9 (ten thousand yen) → ¥199,000

Approximately ¥200,000 per 0.1 lotIt can be operated with those settings.

With a maximum drawdown of 50%, the expected average annual return is 21%.It will be.

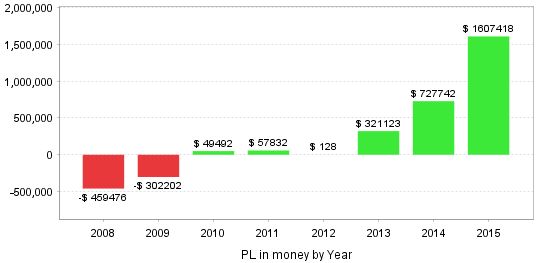

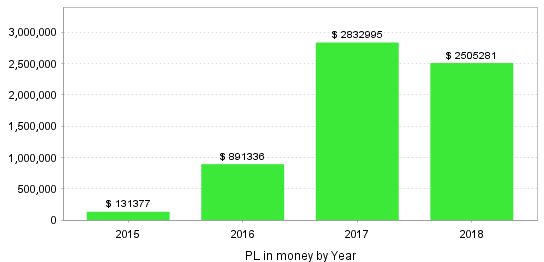

【Monthly and Annual P/L】

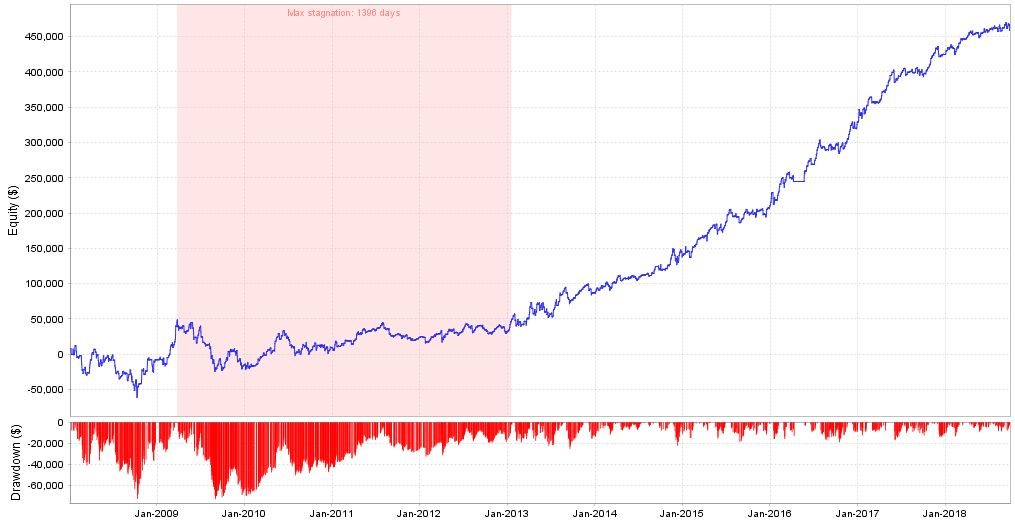

In 2009 and 2010 the maximum drawdown is ¥70,000, but in other years it stays within ¥30,000.

Looking monthly, 2008 and 2009 were slightly negative. Since then it has been stable, with some years exceeding 1,000 pips per year.

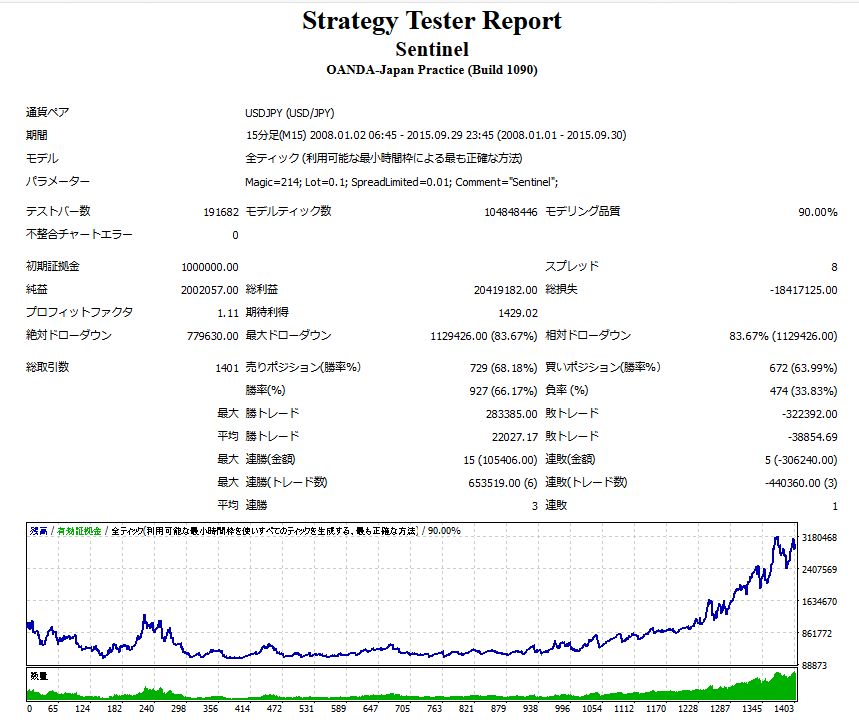

■What is Eighty Mode

The standout feature of Sentinel is the compounding setting called Eighty Mode, in an account with 25x leverage,

This mode uses 80% of the account equity to maintain positions.

For example, if the account funds are ¥1,000,000, ¥800,000 is used to hold positions, roughly 1.5 lots.

When operating in Eighty Mode, the relative drawdown has been around 30% since 2010.

【Even in years with poor performance, it will surely become positive after a few years!】

In 2008 and 2009, even simple-interest operations yielded negative results, so with compounding the losses would be even greater,

I know, but what would happen if you continued operating as is?

I backtested Eighty Mode including 2008!

From a near-death state with a relative drawdown of 83% (account balance around ¥200,000) to a miraculous recovery!

From 2013 onward, profits grew exponentially.

Since 2008 and 2009 were irregular markets, if the next roughly five years of market conditions continue,

Eighty Mode is expected to become a very powerful trading style.

It is also possible to operate with fixed lots to control risk, however,

I would definitely like to try running one EA per account.

Even starting with ¥100,000, it has increased by +6,000% over the last three and a half years.

From ¥100,000 to ¥6,400,000

In one year: +130%; in the second year: +450% YoY; in the third year: +240% YoY.

Whether it grows as backtested, forward tests are exciting for this EA!