"ATS-12 RSI" Last week's results ~ 2024/11/9

Last week's results announcement!

(Trading with 1,000,000 yen margin / 0.3 Lots)

Aggregation period: 2024/11/4–11/9

In one week, Profit of 17,337 yen was made!

Even with a small lot of 0.3 Lots, we are generating a lot of profit every week!

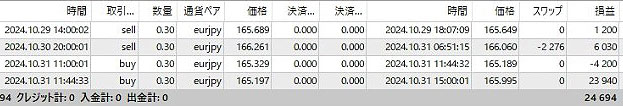

Plus24,694 yen(2024/10/28~11/2)

Plus3,898 yen(2024/10/21~10/26)

Plus62,374 yen(2024/10/14~10/19)

Plus76,852 yen(2024/10/7~10/12)

We continue to achieve excellent results!

Here we will introduce actual trades using the 'ATS-12 RSI'.

There are several trading methods using 'ATS-12 RSI', and we will explain when we entered and exited using this system. We will also share what settings we adopted.

Last week's settings

【November 4】

[Settings image 1]

[Settings image 2]

[Settings image 3]

As shown in the above three charts, we set and traded with 'ATS-12 RSI' using the above settings.

※ An optimizer search engine that automatically extracts optimization data is included, so you can easily find settings that fit the current market!

Last week's results!

[Trading history image]

[Trading history image / partial zoom]

The results are spectacular!

In one week, profit of 17,337 yen was made!

This time we tried trading with the '2. Scalp Trades (Intermediate)' introduced later!

For now, this time as well, a fantastic result! Profit continues!

The three trading methods are introduced at the end of this article.

Results up to before that!

(Trading with 1,000,000 yen margin / 0.3 lots)

Aggregation period: 2024/10/28~11/2 (1 week)

Settings at that time are here

+24,694 yen

[Trading history image]

Aggregation period: 2024/10/21~2024/10/26 (1 week)

Settings at that time are here

+3,898 yen

Aggregation period: 2024/10/14~2024/10/19 (1 week)

Settings at that time are here

+62,374 yen

[Trading history image]

Aggregation period: 2024/10/07~2024/10/12 (1 week)

Settings at that time are here

+76,852 yen

[Trading history image]

Three trading methods

1. Beginner: One-shot Trade

【Trading Method 1】 A high-win-rate, solid day-trade mode too!Entries are taken at the first signal, exits at the scalping mode exit point. A high-win-rate, solid trade is possible.

※ We recommend this method until you get the hang of it and start winning.

This method trades only once between the start flag and the end flag. The points gained are modest, but it has the highest win rate among the three methods and is reliable. First, set the parameter 'ScalMode_Flag' to ON 'true'. The chart will display scalping-oriented entry/exit points.

① The first flag is the entry point.

② Then exit at the scalping exit point.

③ If an end flag appears while holding a position, forcibly exit then.

At first, after entering at ①, when the ② point is displayed, it is more prudent to exit at a positive stage.

As you become accustomed, try aiming for the 2nd, 3rd, and subsequent scalping exit points.

■ About settings: The values on the score panel do not need to be as high as the other two methods.

2. Intermediate: Scalping Trade

【Trading Method 2】 Scalping mode!This method is a scalping approach that makes several trades between the start flag and end flag. Depending on the case, it can yield the most points among the three methods.

First, set the parameter 'ScalMode_Flag' to ON 'true'. Scalping entry/exit points will be displayed.

① When the scalping entry point is displayed, enter the position.

② Exit the position at the exit point.

③ Trade several times until the end flag is displayed.

④ If an end flag appears while holding a position, forcibly exit and wait for the next opportunity.

※ There are two main ways we handle entries among this method.

One: after entering one position, wait for the exit point to occur.

Another: use extremely small lots, add positions at each entry point, exit at the exit points all at once, and repeat.

Either approach can yield results. Until you get used to it, start with small lots and find a method that suits you; discovering what works for you is part of the fun.

Once you are comfortable with this method and able to generate profit, try implementing it with higher settings using related systems. This should yield even greater results.

■ About settings: This method requires higher-level settings.

Having ATS-12 RSI AutoSearch to automatically detect high settings and ATS-12 RSI 1Click for one-click entry will help you achieve results efficiently.

3. Intermediate-Advanced: Swing & Day Trade

【Trading Method 3】 Basic Swing/Day Trade

This method is a simple approach where you enter at the start flag and exit at the end flag.

Set the parameter 'ScalMode_Flag' to OFF 'false' and hide scalping signals. ① Enter position at the start flag.

② Exit at the end flag.

Entries and exits are very simple, but the settings are actually very important.

Trading exactly as the signals yields results equal to the numbers on the score panel.

Also, the profit or loss per trade tends to be the largest with this method.

In other words, this method is simple yet requires the highest level of settings.

■ About settings: This method requires the highest level of settings. It is recommended to have the included ATS-12 RSI AutoSearch.

This post is about the portion in the following table.■RSI-based data extracted from ATS to match the current trend will be introduced here.

We will revisit how to read and use this data at the end!

(Paid Version) |

(All 8 sessions) (Free) |

(Free) |

(Free) |

||

| ATS-12 RSI | [From here] |

Free publication! [From here] |

to view! [From here] |

|

|

| ATS-13 RCI | [From here] |

Free publication 【From here】 |

to view [From here] |

and win! [From here] |

|

| ATS-11 Ma | [From here] |

Scheduled! |

[From here] |

Continuing! [From here] |