Win with RCI! 3rd time / Free tool distribution in progress!

Win with RCI! Episode 03

[ATS-Base] RSI Training Room

Hello everyone. This is ATS BASE.

For a limited time, we are distributing

the free ATS-navi13RCI.

Have you downloaded it yet?

Since distribution may end without notice,

please download it while you can m(_ _)m

Now, this time, about RCI…

By adjusting the Open (position entry)

how will the trading results change?

Let’s check how it changes.

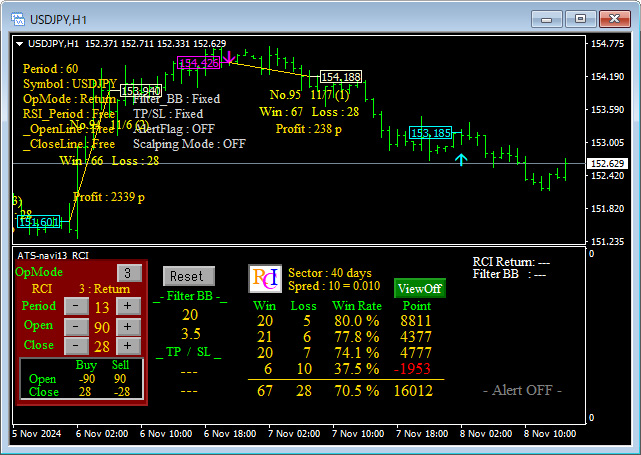

As before, we will use the free version of “ATS-navi13 RCI.”

Now, here is the hidden code for this time.

In the parameters,set the "UserCode"to"258"and try it.

The chart will show the basis for entry…

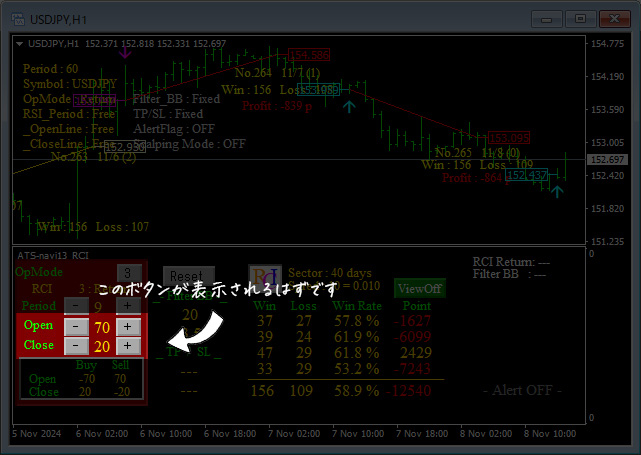

The buttons [+] and [-] to adjust the values for "RCI_OpenLevel" and "RCI_CloseLevel"

will appear, allowing changes to the settings

(^^)

Close is the RCI "exit timing value."

Now then

quickly, using the Open button among these two

change the entry condition!

Regarding Close (exit timing)

we will guide you next time.

For now…

Period (number) remains at the default "9"

and only the entry condition (Open) will be set to "80".

Sell entry: RSI turns downward after rising above "80"

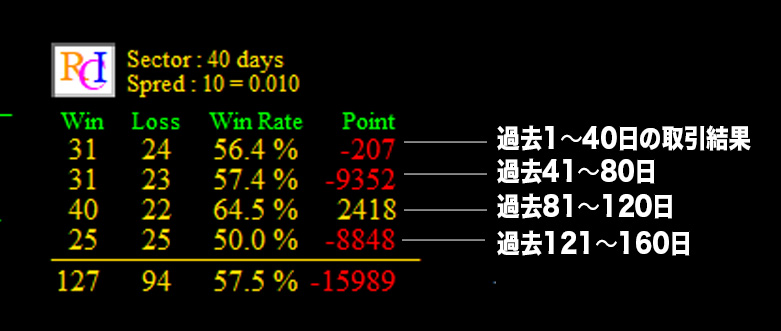

Under this entry condition, the total over 160 days (= 40 days × 4 periods) is -15,989 points, a notably poor performance.

By the way, the way to read the score above is that under the above entry conditions…

This means. Since one Sector is set to 40 days by parameter, 40 days × 4 sectors (periods) = 160 days of trading results.

In the ATS series, just by changing the setting values, you can split the most recent trading results into four periods for easy viewing. This trading result, of course, is backtested.

The advantage of this is,it makes it easier to grasp past trend changes and price movements by period.

For example, in the third period from the top, the third period shows +2,418, while the second period shows -9,352. From these numbers, you can see that this setting did not fit the market trend in the second period and results were not favorable. And in the most recent first period, there is a slight improvement, with -207 points, indicating a trend toward improvement.

Back to the discussion, let's look at other patterns!

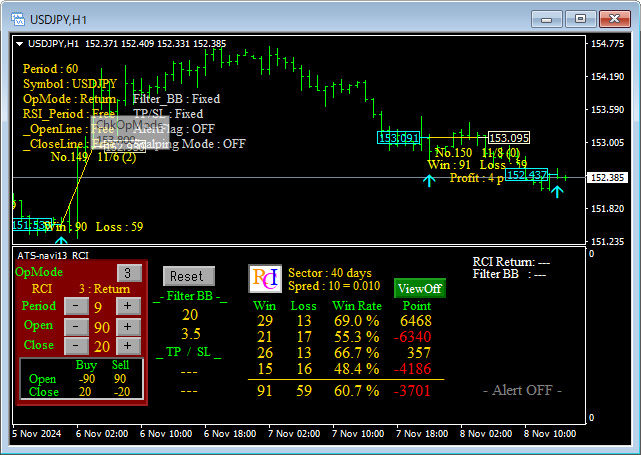

Sell entry: RSI turns upward after rising above "90"

Total: -3,701 points. The negative is decreasing considerably.

This area seems like a potential winning line.

Let's see more!

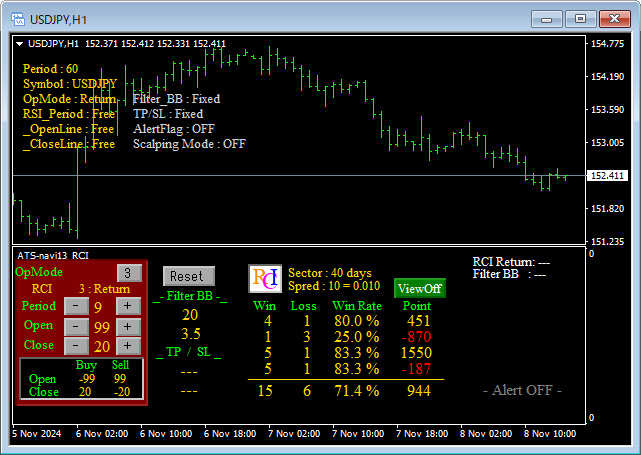

Sell entry: RSI turns upward after rising above "99"

Total became positive!

That said, with "-99" and "99," the number of trades is small, so reliability might be low.

In this way, by adjusting OpenLevel and CloseLevel,

you may discover your own settings that seem to win in trends.

By the way, after tweaking various settings, I found a good configuration like this!

Win rate of 70%, 16,012 points (16.012 yen) gained for the RCI setting.