『ATS-11 Ma』 Last week's results ~2024/11/2

Last Week's Results!

(Margin 1,000,000 yen / 0.3 Lots traded)

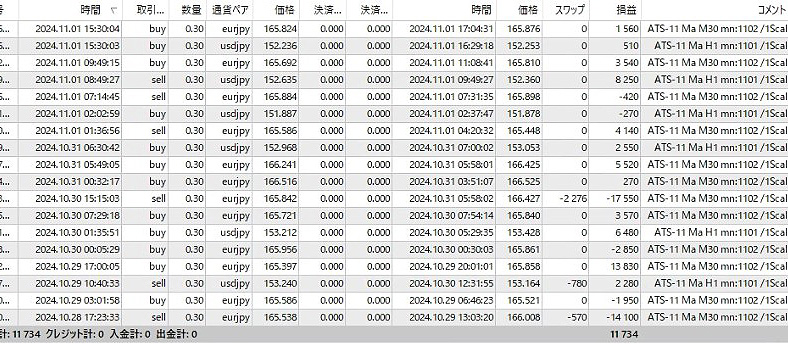

Aggregation period: 2024/10/28~2024/11/2

In one week, an profit of 11,734 yen was made!

Even with a small lot like “0.3 Lots,” you can make this much profit!

Previous'sPlusPlus56,002 yen

Week before last's17,908 yenFollowing that, we have achieved good results!

Here we introduce the actual trades using『ATS-11 Ma』.

There are several trading methods using『ATS-11 Ma』, and we will also explain the timing when we acquired and closed positions with this system.

We will also publish what settings were used.

Last Week's Settings

【October 28】

[Settings Image 1]

[Settings Image 2]

As in the image above, we set『ATS-11 Ma』 on two charts and traded with the above settings.

※ It also includes an automated optimizer search engine, so you can easily find settings that match the current market!

Last Week's Results!

[Trading history image]

[Trading history image / enlarged]

The results are excellent!

In one week, an profit of 11,734 yen was made!

This time, we traded using the pattern introduced later in “2. Scalping Trade (Intermediate).”

Three trading methods are introduced at the end of this article.

Performance up to the week before last!

(Margin 1,000,000 yen / 0.3 lots traded)

Aggregation period: 2024/10/21~2024/10/26 (1 week)

The settings at that time are here

Plus 56,002 yen

[Trading history image]

Aggregation period: 2024/10/14~2024/10/19 (1 week)

The settings at that time are here

Plus 17,908 yen

[Trading history image]

Aggregation period: 2024/09/30~2024/10/12

The settings at that time are here

Plus 85,304 yen

[Trading history image]

Three trading methods

※ Images are reused from the「ATS-12 RSI」version.

The specifications are the same.

1. Beginner: One-shot Trade

【Trading Method 1】 High-win-rate, solid day trading mode too!Acquisition occurs at the first signal, and settlement at the scalping-mode settlement point. A high-win-rate, solid trade is possible.

※ We recommend this method until you get the knack and start winning.

This method trades only once between the start flag and the end flag. The points you can gain are modest, but it is the most reliable among the three. First, set the parameter “ScalMode_Flag” to ON “true.” A scalping-oriented acquisition/settlement point will be displayed on the chart.

① The first flag is the acquisition point.

② Then settle at the scalping settlement point.

③ If an end flag appears while you hold a position, forcibly close it.

At first, after obtaining point ① and when point ② is displayed, it is prudent to close at a plus level quickly.

As you become accustomed, try aiming for the second and third points, and then the subsequent scalping settlement points.

■ About settings: The numbers on the score panel do not need to be as high as the other two methods.

2. Intermediate: Scalping Trade

【Trading Method 2】 Scalping mode!This scalping method involves several trades between the start flag and the end flag. Depending on the case, it can yield the most points among the three methods.

First, set the parameter “ScalMode_Flag” to ON “true.” Scalping acquisition/settlement points will be displayed.

① When the scalping acquisition point is displayed, acquire the position.

② Close the position at the settlement point.

③ Trade several times until the end flag is displayed.

④ If an end flag appears while you hold a position, forcibly close it and wait for the next opportunity.

※ There are two main ways we may acquire within this method.

One is to acquire one position, then wait for the settlement point to close.

The other is to add small lots at each acquisition point and close all at the settlement point, repeating this process.

Either approach can yield results. Until you become proficient, start with small lots and find a method that suits you; that exploration is part of the learning experience.

Once you are comfortable with this method and start harvesting profits, try implementing higher-level settings using related systems. This should yield even greater results.

■ About settings: This method benefits from high-level settings.

Having an auto-detection of high settings via “ATS-11 Ma AutoSearch” and a one-click acquisition via “ATS-11 Ma 1Click” would help you achieve results more efficiently.

3. Intermediate-Advanced: Swing & Day Trading

【Trading Method 3】 Basic Swing/Day Trade

This method is simple: acquire at the start flag and settle at the end flag.

Set the parameter “ScalMode_Flag” to OFF “false” and hide the scalping signals. ① Acquire position at the start flag.

② Settle at the end flag.

Acquisition and settlement are very straightforward, but the settings are actually very important.

If you trade steadily according to the signals, you will get the exact results shown on the score panel.

Also, the profit/loss per trade tends to be the largest with this method.

In short, this method is simple yet requires the highest level of settings.

■ About settings: This method requires the highest level of settings. We recommend having the included “ATS-11 Ma AutoSearch.”

This post corresponds to the following table's■section.

Using RSI to trade in line with the current trend, we would like to share a portion of data extracted from『ATS』.

We will revisit how to read and use this data at the end!

(Paid version) |

(All 8 sessions) (Free) |

(Free) |

(Free) |

||

| ATS-12 RSI | [From here] |

Publicly Available for Free! [From here] |

to access! [From here] |

Continuing Strong [From here] |

|

| ATS-13 RCI | [From here] |

Publicly Available for Free! 【From here】 |

to access! [From here] |

and won! [From here] |

|

| ATS-11 Ma | [From here] |

Start planned! |

[From here] |

|