Translate the below html to English, keep format html, the result is not in markdown code and not break line, convert standard decode before translate: ピラミッディングで優位に取引を! English translation: Trade with an edge through pyramid trading!

What is pyramiding?

FirstpyramidingWhat it is and how it differs from averaging down (nampin)?

Averaging down (nampin)is a lot-sizing method that, for positions already opened, when the price moves against you and you have an unrealized loss, opens additional positions in the same direction to average the entry price and accelerate a break-even or profit.It makes it possible to average the entry price of the positions you hold by adding more in the same direction when price has moved against you.This is the concept of averaging down (nampin).

Nampin martingale adds the martingale method (multiply the size of the new position relative to the previous one; typically 2x) to nampin to push the break-even or profit further, faster.

In contrastpyramidingis about adding further positions in the same direction when the opened positions are already moving in your favor and have become profitableto increase exposure while in profits.This is the idea of pyramiding.

The technique accumulates positions in the favorable direction, which tends to increase the number of positions in profit.

Mental benefits as wellsince the second onward positions are opened only after confirming that the signals generated by the logic match the current market conditions,the win rate increases.

Ultimately, in the exit stage, some positions may incur unrealized losses, but overall it results in profit (though rapid reversals can produce losses as well).

Now, let's test it.

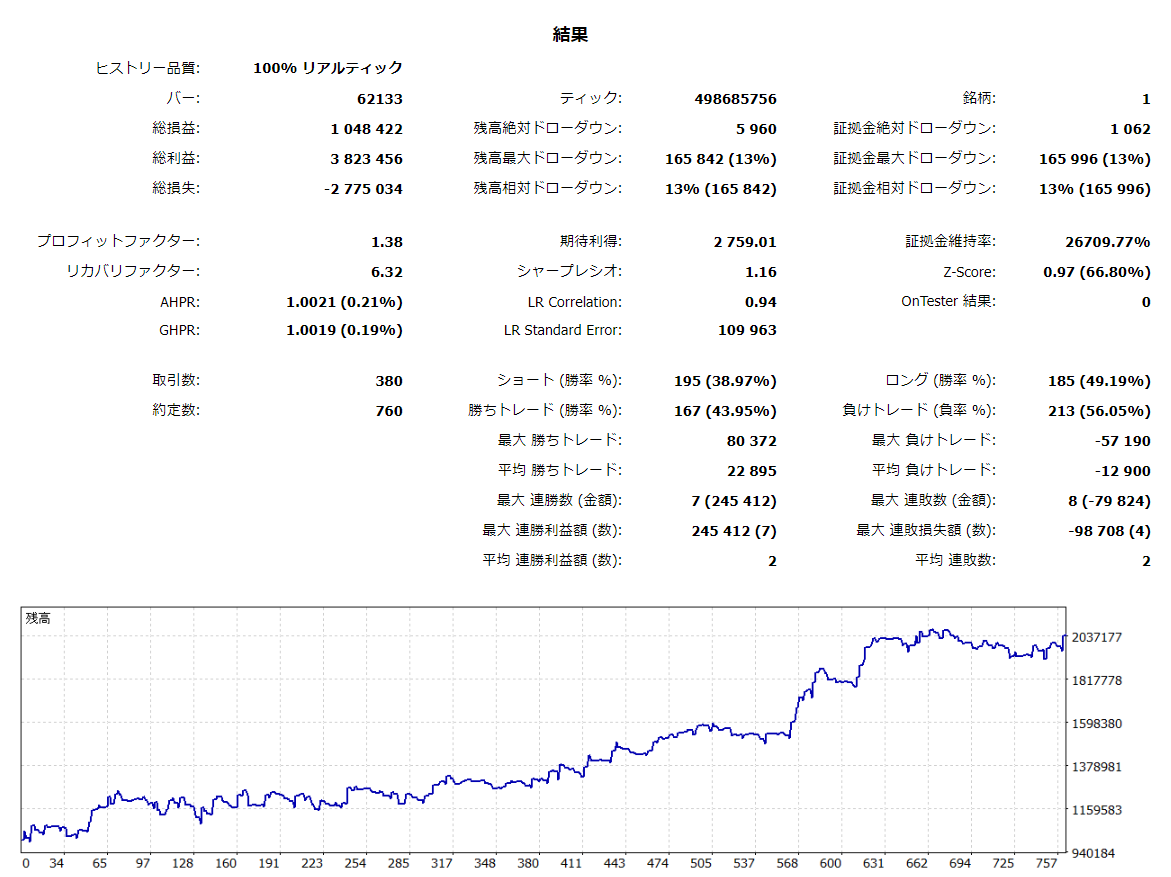

This is a backtest of GBPJPY trend-following swing EA I offer on GoGoJoon calledCloudCross5,a backtest case where pyramiding was not used and only one position was traded.

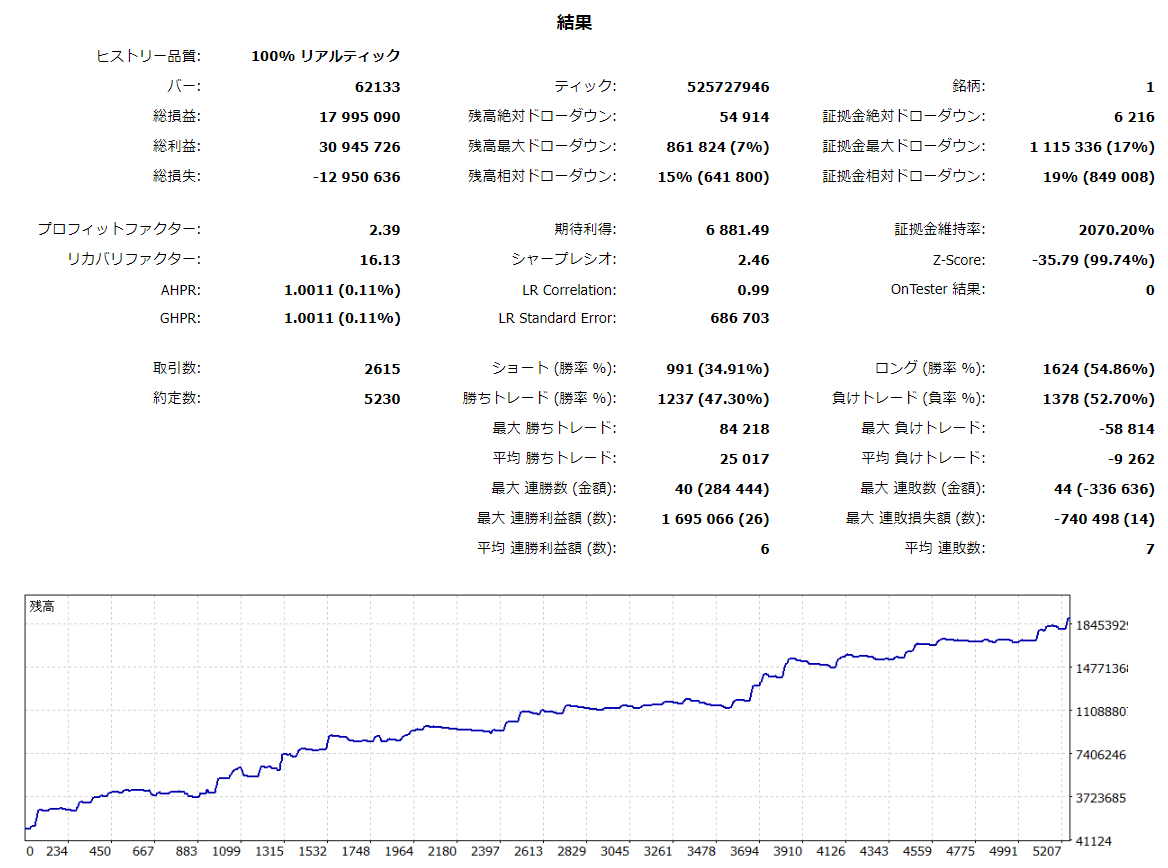

Next isa backtest with pyramiding set to True (On)results.

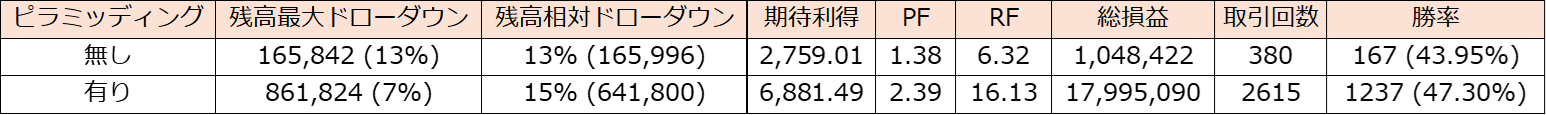

Here is a summary.

With exactly the same logicthe win rate increases, and notablythe expected returnis higher.

It rises to nearly 2.5 times.

In short, risk is reduced.

Although it may seem that moving from a single position to multiple positions increases risk, if pyramiding is applied properly, the win rate improves, the expected return increases, and the recovery factor also rises significantly.

In other words, it means that recovering from a losing trade that should occur happens faster, which reduces the mental risk associated with trading.

Of course,there are matches and mismatches with the logic’s characteristics, so pyramiding must be applied cautiously, but it aligns very well with the type of logic I offer—trend-following, swing, small loss and large gainas a core approach..

CloudCross5is participating in GoGoJoon's campaign until 2024/10/5 and can be purchased at 20% off!

The performance is also strong, so please take a look ♪

× ![]()