Win with RSI! Second time / Free tool distribution ongoing!

Win with RSI! Episode 02

[ATS-Base] RSI Training Room

In this second session, we will actually use “ATS” to verify RSI. We are currently distributing “ATS RSI navi” for free, so please take this opportunity to download it.

First, install MT4 and set RSI, which is configured as “Period = 14” (i.e., 14 bars).

This “14” is a setting value that can accommodate many markets, so it is set as the default value.

However, currencies also have their own characteristics, and is this value truly optimal for all timeframes?

Also, in a constantly changing market, is this value always the best?

So this time, let's verify from that angle!

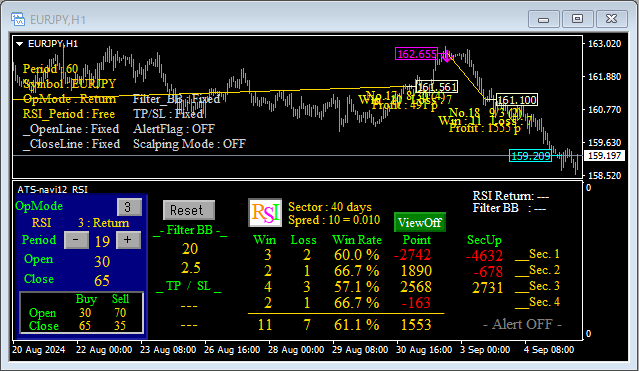

Trading conditions [Fixed conditions]

-------------------------■ Chart

USDJPY

H1

■ Trading conditions

Buy entry: when RSI dips below 30 and reverses

Buy exit: when RSI rises above 65

Sell entry: when RSI rises above 70 and reverses

Sell exit: when RSI falls below 35

■ Filter (entry)

Only enter when the Bollinger Band is inside the range of Period = 20 (bars) and Deviation = 2.5

■ Summary

40 days × 4 sectors (terms) = 160 days

■ Other

Spread: 10 (0.01 = 1 pip)

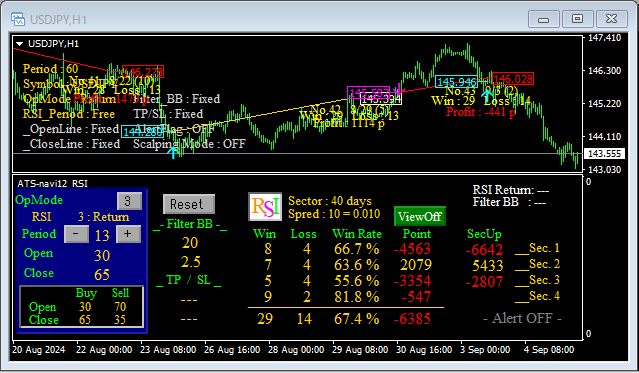

First, start with the standard value of “14 bars”…

■ Period = 14

And the surrounding “13 bars” and “15 bars”…

■ Period = 13

■ Period = 15

On USDJPY H1, with these trading conditions, it seems unlikely to win, but what I want to focus on here is that simply changing the Period (bars) byjust 1 makes the result change.

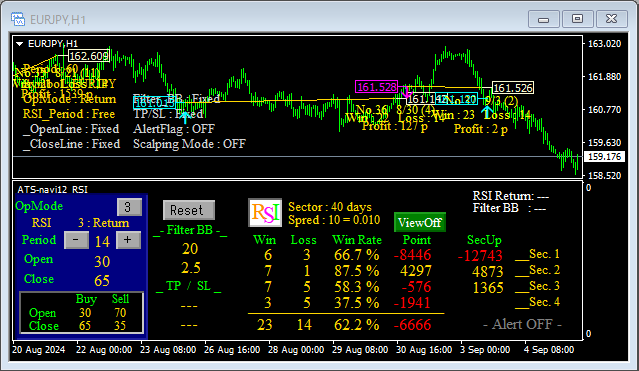

Now, let's try it on EURJPY H1 as well. Likewise, start from the standard value of “14 bars”…

■ Period = 14

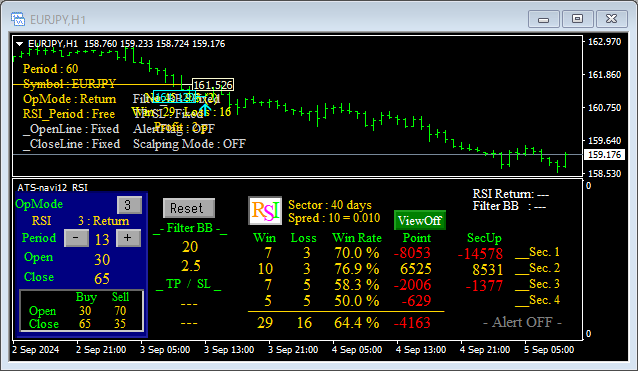

And likewise, the surrounding “13 bars” and “15 bars”…

■ Period = 13

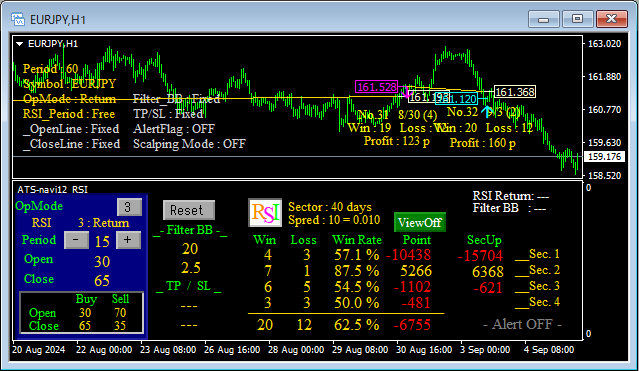

■ Period = 15

Here you notice that a value shorter than the standard 14 bars, namely“13 bars” yields better results this time.

Furthermore, by changing many other things, I also found things like this!

Even after subtracting the spread, the total across all periods adds up to“1,553 points ( = 1.53 yen) profit”

Additionally, by varying other conditions, there may be even better trading conditions!

If you can find trading conditions that are positive not only for the entire period but also for each timeframe, there is a lot of value in trying them out.

By adjusting this setting value to suit the situation, and trading under conditions that always match the current state, you can obviously win.

We will continue to pursue trading methods that fit currency pair characteristics, timeframes, and current market conditions, with optimal settings.