Compare the 'YURAGI' series of one-position high-frequency scalping for rare currencies!

【YURAGI EURGBP Overview】

Currency pair: [EUR/GBP]

Trading style: [Scalping] [Day trading]

Maximum number of positions: 1

Timeframe used: M15

Maximum stop loss: 100 (modifiable)

■ Overview

YuragiThis is Yuragi's EURGBP version.

It is a day-trading EA that enters by capturing market fluctuations.

Although it operates with a single position, it has a high entry frequency, repeatedly taking profits and stopping losses to steadily accumulate profits over the long term.

We optimized a reliable, high-quality core logic that works well on other currency pairs so that EURGBP achieves its maximum performance.

Note: Compared with other currency pairs, EURGBP's PF isn't bad, but its number of trades is low and the asset curve is gradual, so the selling price is set lower.

■ Entry Time

It enters from 2:00–7:00 JST (1:00–6:00 during daylight saving time).

■ Recommended Broker(s)

To achieve maximum performance, we recommend ECN brokers with an average spread of 1.5 pips or less.

The maximum spread at which this EA can profit is 3 pips (exceeding 3 pips is challenging).

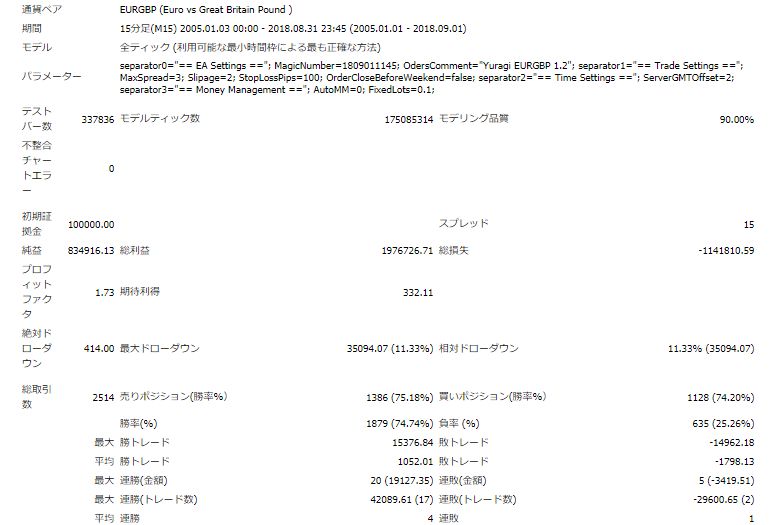

【Backtest Analysis】

2005.01.03-2018.08.31

Spread 1.5

0.1 lot fixed

Net profit +834,916 JPY

Maximum drawdown 35,094 JPY

Total trades: 2514 (annual average 200)

Win rate 74%

Average gain: 1,052 JPY

Average loss: -1,798 JPY

This is the result.

The maximum drawdown per 0.1 lot is in the 30,000-yen range, and because it is a one-position EA, the required margin is low, so

the profitability is high.

Compared with other YURAGI series, it trades less frequently, so the price is lower, but

still, at around 200 trades per year, it is by no means a low trading frequency.

Also, the gain-to-loss ratio is 1:1.7 and the win rate is over 70%, making it stable.

Designed not to experience extreme losses throughout the year.

Recommended margin for EURGBP is 64,000 yen per 0.1 lot (as of 112 JPY per USD), so

(6.4)+(3.5*2)=13.4(万円)

This is the figure.

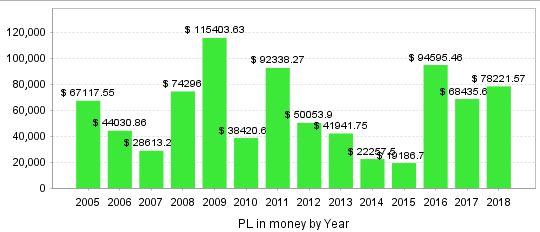

【Annual Profit by Year】

Looking at by year, the most recent three years show stable, high profits!

(2018年は8月までのバックテストとなります)

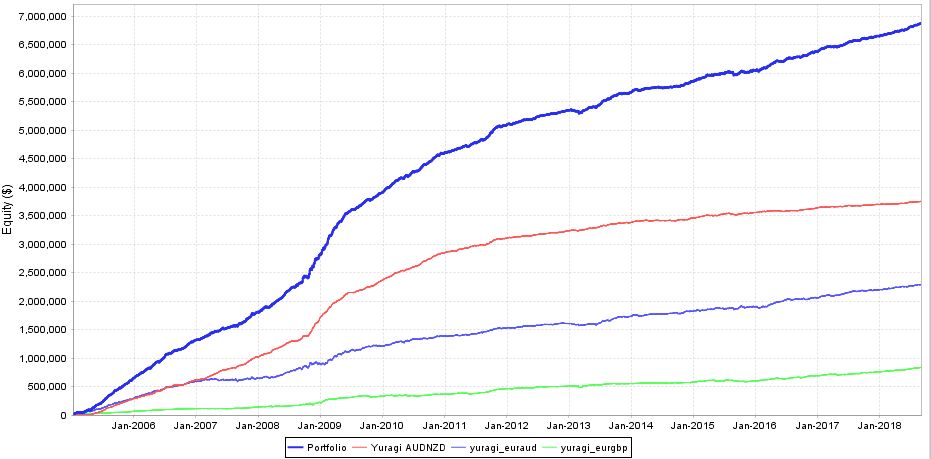

Even with this, the profit margin is good, but I compared with other YURAGI series to see how they compare.

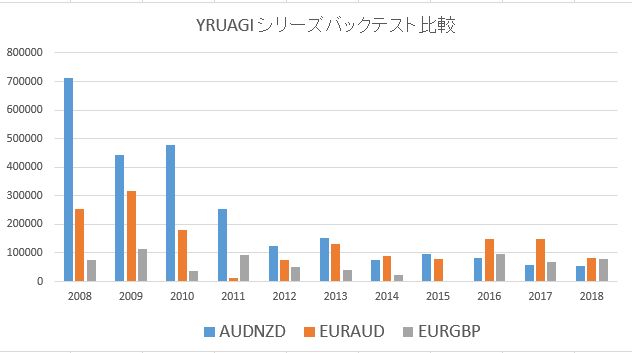

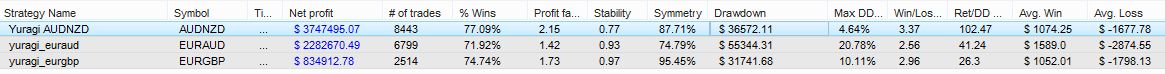

■ Compare annual profits and specs across the YURAGI series!

In terms of profit, AUDNZD is by far the best.

If we look year-by-year...

Profit from AUDNZD and the AUD-related EURAUD was outstanding up to 2010, and since then it has been stable.

It's wonderful that none of the EAs run negative over any year.Indeed.

【Specification Comparison】

At present, forwards for AUDNZD and EURAUD are underperforming, so EURGBP was introduced, but

Looking at the specs, AUDNZD trades more frequently and has a PF above 2, so it is the most recommended.

As you watch forward results, you can choose a product that fits your trading style, or add it to your portfolio!

Related Articles:

With one-position, high-frequency trading, minimum annual return over 50%! ‘YURAGI AUDNZD’

https://fx-on.com/navi/detail/?id=7181

EURGBP trading around 200 times per year is

10,000 JPY

Yuragi AUDNZD

Pips gained before 2010 are phenomenal.

In the last five years, you can aim for 500–1500 pips per year.

AUDNZD at around 600 trades per year

13,800 JPY

Yuragi EURAUD

In the most recent five years, the gained pips are the most. Annual trades around 500 per year.

EURAUD

13,800 JPY

(Please modify this section for buyers)