Forward achieved a 100% return in one year! "White Phoenix" is back on sale!

Achieved over 100% return in one year of forward testing!

Low deviation from backtests with traditional trading

White Phoenix is back on sale!

【White Phoenix Overview】

Currency pair:[USD/JPY]

Trading styles:[Day Trade][Swing Trade]

Maximum number of positions: 9

Used time frame:M15

Maximum stop loss:100(100 pips per position)

Take profit:350( per position 350 pips)

Due to the seller's busy schedule, sales were suspended from March 2018, but

After one year of forward operation, sales have resumed after a six-month hiatus!

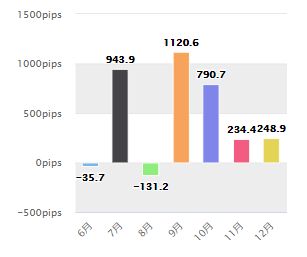

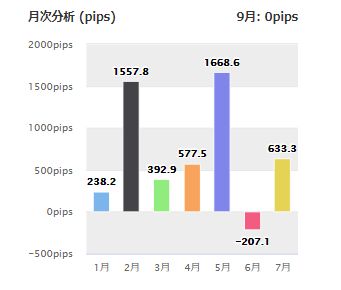

【Forward Results】

In 2017, gained +3169 pips in just under 7 months!

In 2018, forward measurement was stopped in July, but

in seven months, +4858 pips were earned!

During the period, earnings with 0.1 lot were 800,000 yen!

The maximum drawdown during the period was under 200,000 yen, making the risk-return ratio very favorable.

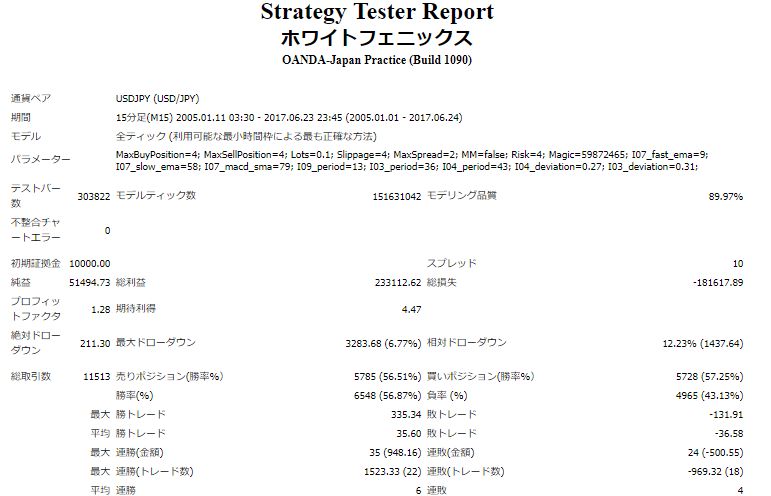

【Backtest Analysis】

From the backtest, let's look at the recommended margin and expected annual return

2005.01.11-2017.06.23

Spread 1.0

0.1 lot fixed

Net profit: +$51,494 (Annual average: $4,477)

Maximum drawdown: -$3,283

Win rate: 56.8%

Total trades: 11,513 (Annual average 1,000)

Thus. The recommended margin at 25x leverage is,

(4.5*9)+(36*2)=117万円

Approximately 1.2 million yen can be operated with 0.1 lots.

Average expected annual return is about 40%ほど。

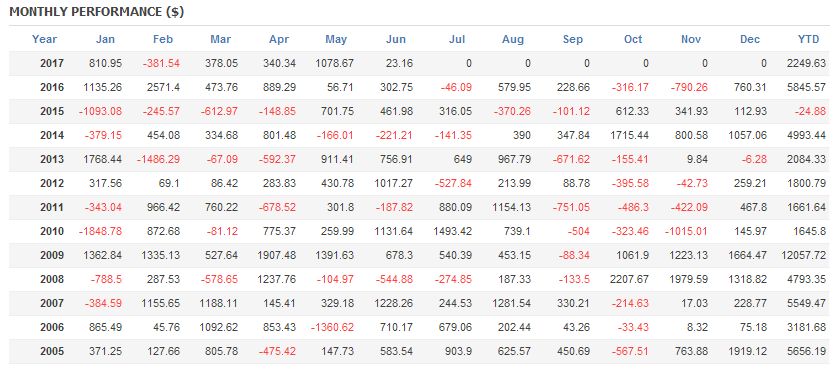

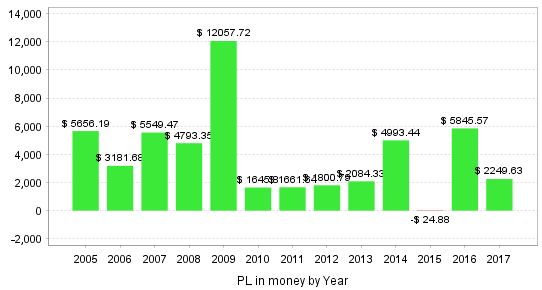

【Monthly/Yearly Backtest Profit and Loss】

Usually, September and October don't perform as well.

By year, 2009 stands out, while 2015 was slightly negative.

From late 2017 to late 2018, profits amount to about 800,000 yen, so in terms of backtests

the results are better than the expected annual return.

There is forward performance as well, with an expected annual return of over 40% and solid profitability

“White Phoenix,”

Don’t miss the opportunity to purchase as it’s back on sale ♪

(Due to a long sales stop, forward operation was temporarily halted in July 2017, but

with the resumption of sales, forward operation has also resumed)