Win with RSI! 4th round / Free tool distribution in progress!

Win with RSI! Episode 04

[ATS-Base] RSI Training Room

In this fourth installment, following the RSI acquisition line we established last time, let’s think about the exit line as well!

Before that,… Have you already downloaded the ATS trial version? If you haven’t, you can download it from here, so please do so soon!

The exit line is defined as follows by the regulations.

Sell exit: When RSI falls below 35

Deciding when to exit is also very important. Let’s vary the RSI setting line that serves as the exit criterion!

There should surely be an optimal exit timing for the current market!

Here,This time’s hidden codewill be shown!

That said, the acquisition line and the exit line are a set, so the code to set is the same as last time.

For the parameter“UserCode”set to“369”and try it.

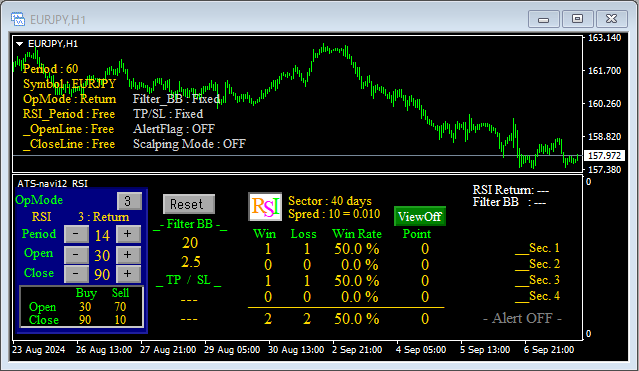

On the chart, you’ll see a [+] and [-] button to change the settings for the reference values of the acquisition “RSI_OpenLine” and “RSI_CloseLine”.

----------------------------------------------------------------------------------------------------

This time it’s the exit timing, isn’t it?

Then, quickly, use the [+], [-] buttons to vary the acquisition conditions!

First, keep the Period (count) at the default “14”,

First, from the acquisition condition (Open), five patterns: “90”, “80”, “70”, “60”, and “50”.

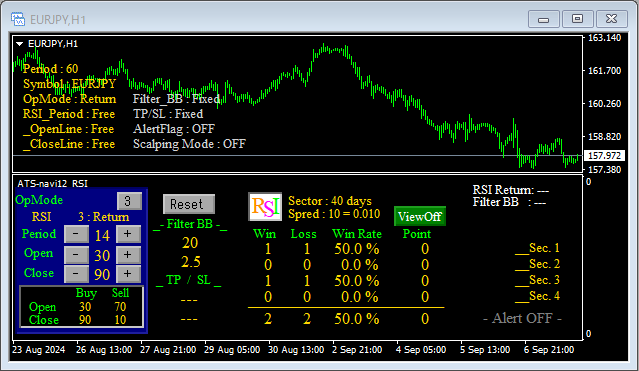

Acquisition Condition (Open) “90”

Sell exit: RSI falls below “10”

Surely, with “Buy exit = RSI/90, Sell exit = RSI/10”, there is a sense of being overextended. Trade frequency is low.Overnarrowness occurs, doesn’t it.

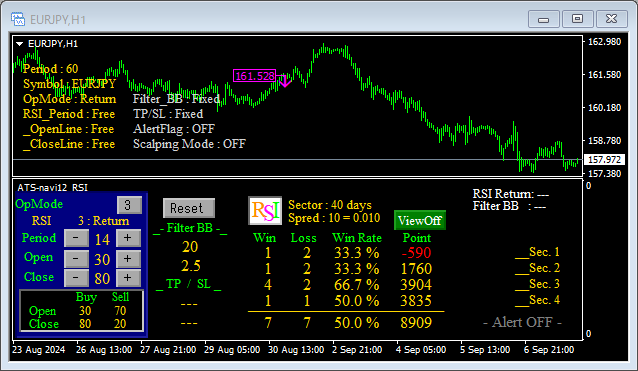

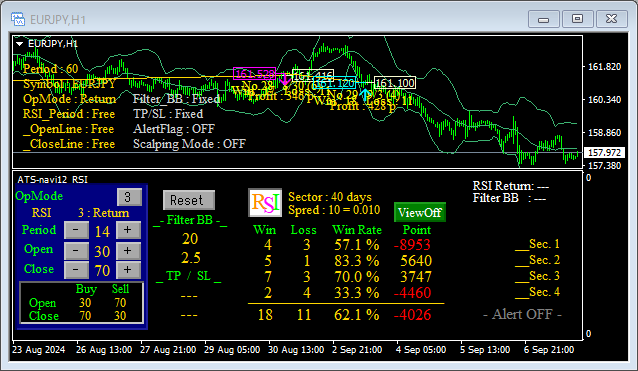

Acquisition Condition (Open) “80”

Sell exit: RSI falls below “20”

Trade frequency increases significantly, and total points becomegreatly positive.

In this currency pair’s current market, these exit lines might be appropriate!

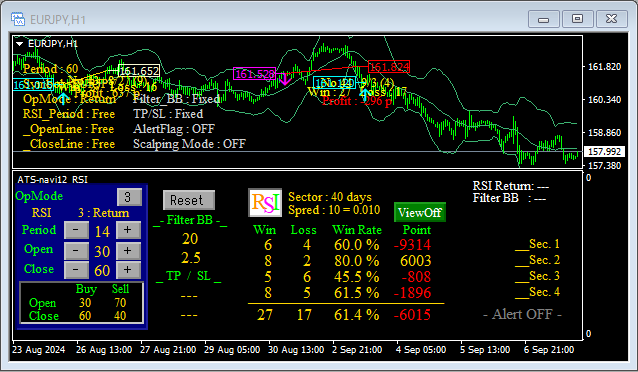

Acquisition Condition (Open) “70”

Sell exit: RSI falls below “30”

Not so good in this market.

Sometimes you profit, sometimes you incur losses…

Acquisition Condition (Open) “60”

Sell exit: RSI falls below “40”

This may not be very good either.

Especially the most recent period (Sec.1) is deeply negative, which isn’t good.

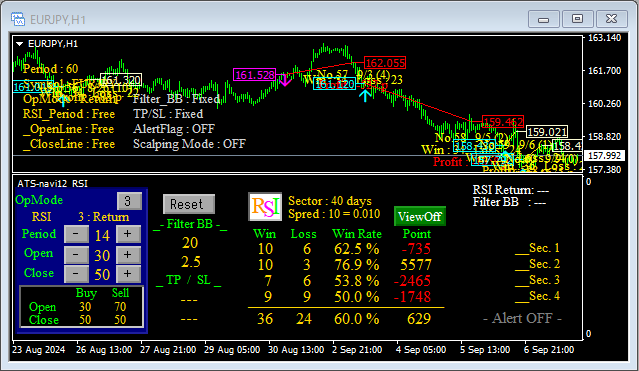

Acquisition Condition (Open) “50”

Sell exit: RSI falls below “50”

Total number of trades is “60”).

With a spread deduction of “600” points, it’s barely positive.

As you can see,exit timing is also very important.

Different currency pairs have different characteristics, and the market is always changing.

Using trading methods that fit the current situation, and finding the optimal settings, that is likely the optimization needed to keep winning.

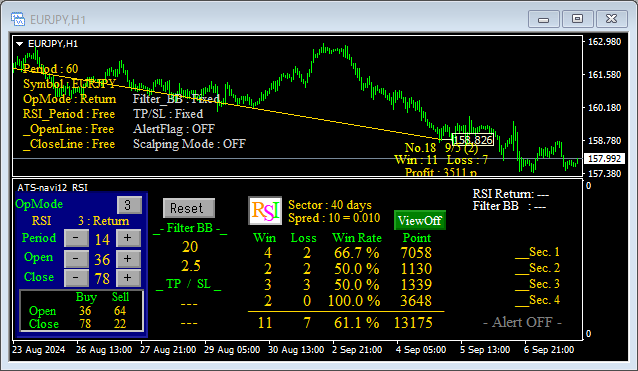

By the way, when I experimented with various acquisition and exit lines, something like this came up!

Wow!Over 10,000 points in 4 iterations.

I also want to try other currency pairs and timeframes!