Win with RSI! 6th edition / Free tools distribution in progress!

Win with RSI! Episode 06

[ATS-Base] RSI Training Room

Hello everyone! In episode 6, let's think about acquisition restrictions!

By the way, have you already downloaded the ATS trial version? If you haven't, you can download it from here, so do so soon!

Right after sudden market changes, you would want to refrain from taking positions.

Therefore, we will set a filter on the acquisition criteria.

This time, the filter role will use Bollinger Bands.

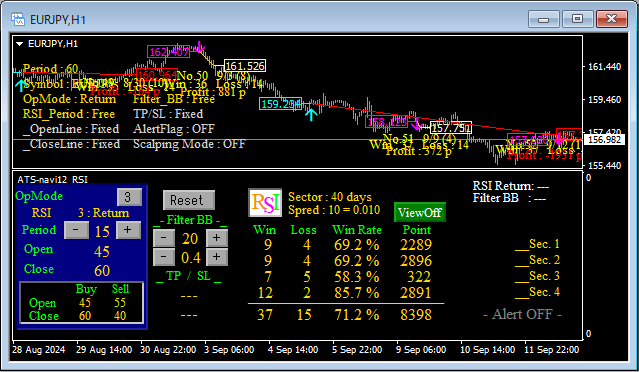

The default settings are as follows.

BB = 20 / 2.5

This setting means that positions are not acquired outside the range defined by Period = 20 (periods) and Deviation = 2.5.

Now, let's quickly look at an example!

In the boxed area on the chart, there was a sudden price movement.

Moreover,within 30 minutes by more than 3 yenas well!

When there is such rapid movement, future developments are hard to read and the spread may widen, potentially forcing an unfavorable trade.

In such cases, it is safer not to trade forcibly.

However, if you do not set a filter, other acquisition criteria may come together and you could end up taking a position as shown in the diagram.

So let's set the filter!

We set Bollinger Bands with “Period = 20 (periods)” and “Deviation = 2.5” to act as a filter.

Then!We were able to eliminate it cleanlyand avoid acquisition after sharp price movements!

We could prevent acquisitions immediately after rapid price moves!

As shown in the figure, immediately after sharp price movements, you can prevent acquisitions outside Bollinger Bands!

Narrowing the filter BB settings can achieve similar results!

In total,you have more than +8 yenprofit!

Please try various settings!

You might find even better conditions!

Now, as usual, here is the hidden code!

The parameter for this session's“UserCode”is“1258”.

A [+] [-] button will appear to change the Filter BB.