If you can win overall while losing skillfully, that’s good #MethodologyAndMindsetSeries

This time, I will summarize as concisely as possible about winning overall.

ー

【How to View Trading Profits】

↓

【It is enough if the capital increases overall】

↓

【Appropriate loss-cut trading is necessary expenses】

↓

【Only capital management cannot fail】

I will write in this order.

ー

【How to View Trading Profits】

Imagine making a profit of 1,000,000 yen per month by repeating trades several times. As is obvious, it is extremely rare to have no losses at all, such as “take profit of 1,000,000 yen, loss cut of 0 yen.” It would be more accurate to think of it as “take profit of 1,500,000 yen, loss cut of 500,000 yen, the remaining 1,000,000 yen is profit,” and just like any ordinary business, subtract necessary expenses from revenue and keep what remains as the sense of profit.Remaining 1,000,000 yen is profit, and it is important to have this sense of profit by thinking of it like that.'The point is that.

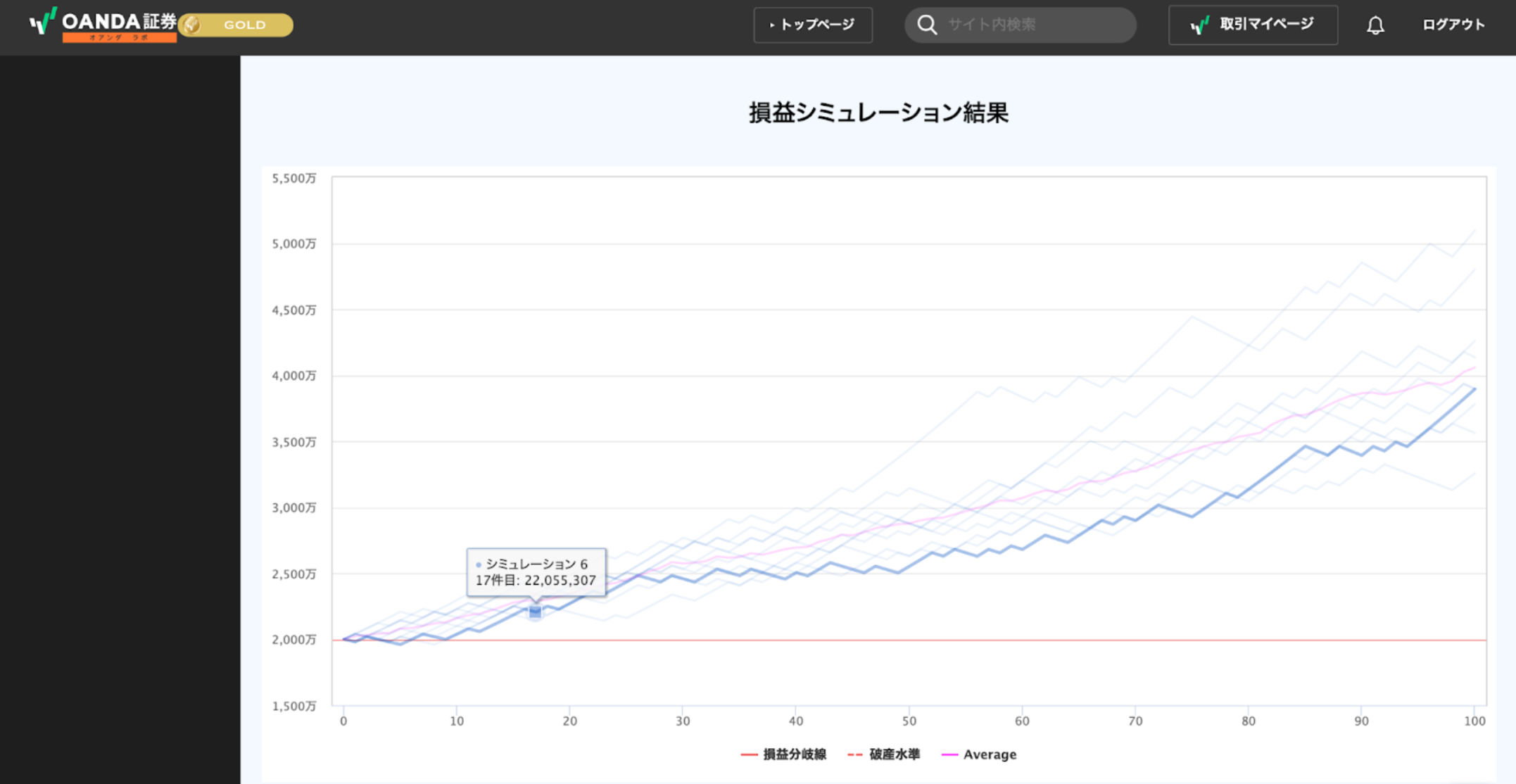

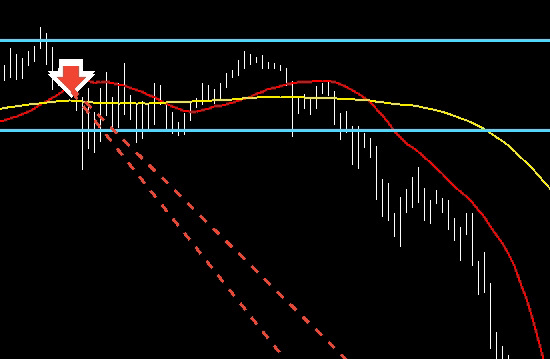

Please look at the blue curve below. It shows the progression of assets increasing by alternating wins and losses.

/

Asset fluctuations do not follow a perfectly rising straight line; although they dip, overall they steadily increase. The steps do not go down but run parallel, closer to the image of climbing stairs. Forcing yourself to win everything makes you emotional and increases unnecessary trades, which reduces your funds.

ー

【It is enough if the capital increases overall】

In the market, it is impossible to answer all questions correctly or to win perfectly on every trade, andwe are not aiming for that in the first place. Even if you trade with a winning pattern that has an edge,

↓