Six Ways to Reduce Unnecessary Trading #Methods and Mindsets Series

To keep increasing your fundshow to reduce unnecessary losing tradesis important.

This time, I will write my thoughts on this theme.

First, from the premise of the way of thinking,【Understanding situations where you can trade】【Ways to reduce unnecessary trades6 choices】will proceed in this order.

ー

・Premises of thinking

More important than trading itself isnot trading in unnecessary places. It isn’t that funds won’t increase because there are few wins, but because there are times when sequences of losses and emotions lead to large losses. It’s often not that you are not making good trades, butyou waste the increase you have made. Trading isquality over quantity.

Everyone has wins, but funds don’t increase because losses are even more. Even if you increased by 1,000,000 yen, it’s meaningless if you cut 2,000,000 yen. The differences in realized gains or pips aren’t that large for everyone.The difference comes from the number of unnecessary stop-loss trades and stop-loss pips, and whether you have a steady win with sound money management (the boring but steady approach).

The trader’s job is not to enter, but toincrease funds even if you take a break = waiting without doing unnecessary things is part of the job itself. You should consider whether you are gambling for fun with positions or trading to grow assets. Before entering, the choices are not only buy or sell; there are three options,the option to wait that you must not forget.

Rather than forcing trades from various places,you should win smartly only in situations where you have a good chance. Don’t underestimate the market, but when considering an entry, adopt a stance like “I will enter here,” andsomewhat condescendinglylook at it from a superior perspective. Focus only on situations where you have an advantage, and avoid the difficult ones.

ー

【Understanding the situations where you can trade】

Personally,

about 1–2 times a day at mostand there are days with 0 opportunities if none come. So on average it’s about 3–5 times a week. If you set this as a rough guideline, you won’t waste precious opportunities by trading aimlessly.

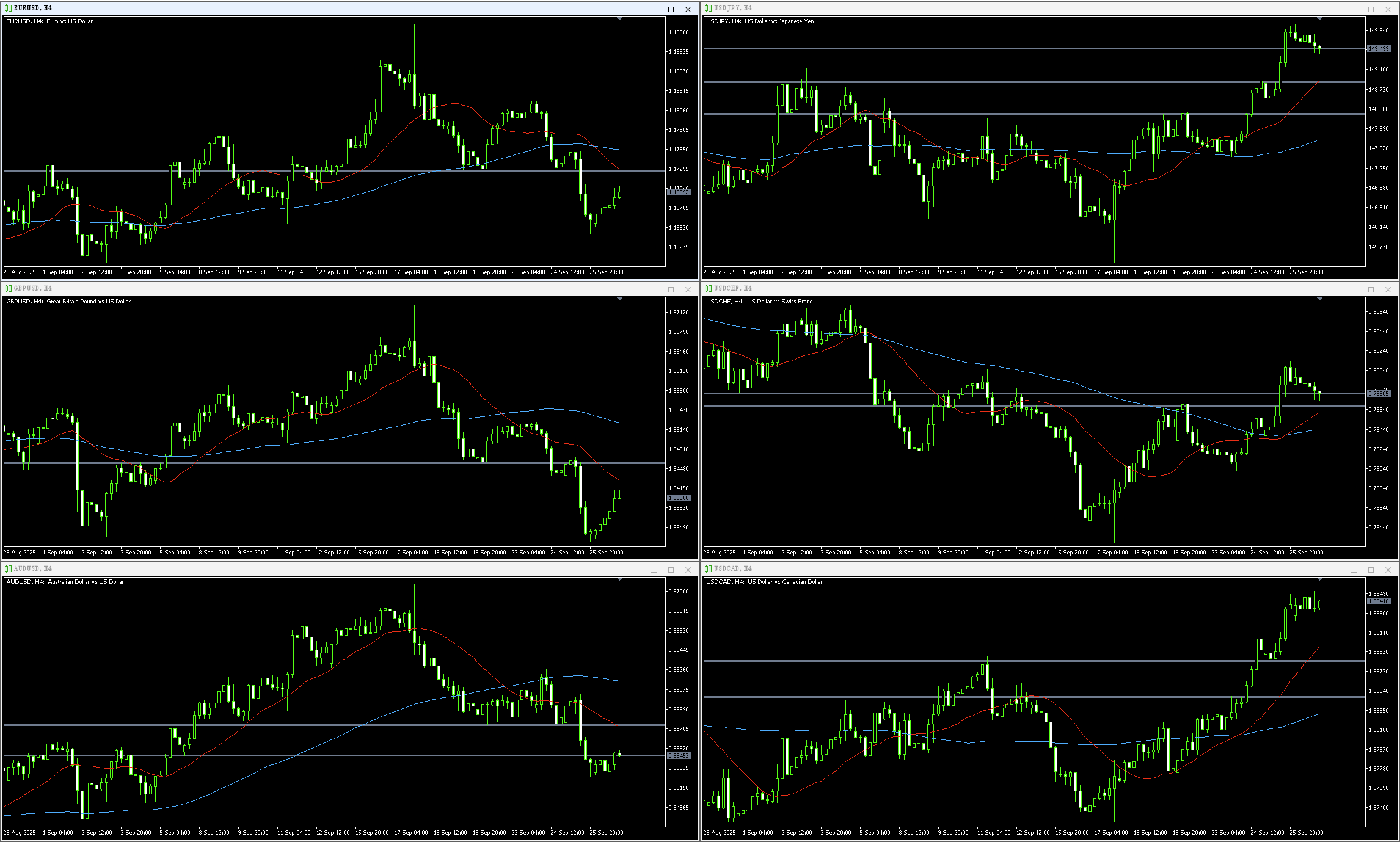

As a premise,there isn’t much price action that reliably extends on the 4-hour or 1-hour charts. Open a 4-hour chart once and look at just one week (6 bars per 4 hours × 5 = 30 bars).

↓

EURUSD, USDJPY

GBPUSD, AUDUSD (4-hour chart)

The right side of the vertical blue line is one week of movement. There are only a few times when the price truly extends, and most of the time it’s ranges or things that you can’t actually enter, which you’ll understand at a glance.

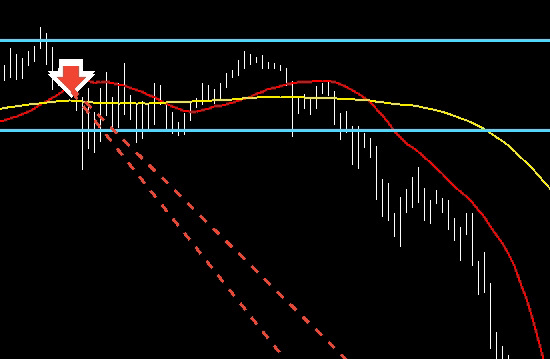

A situation with true edge and actual entry opportunities is

↓